Assessing AMD (NVDA): Is CES 2026 AI Optimism Already Priced Into the Valuation?

Advanced Micro Devices (AMD) is back in the spotlight after its shares climbed on expectations heading into the CES 2026 keynote, where CEO Lisa Su is poised to showcase fresh AI and data center advances.

See our latest analysis for Advanced Micro Devices.

That latest pop comes on top of a strong run. The stock posted a roughly 9.7% 90 day share price return and a powerful 78.3% one year total shareholder return, suggesting momentum is still building as AI expectations rise.

If AMD's AI story has your attention, this is also a good moment to explore other potential winners among high growth tech and AI stocks that could benefit from the same structural tailwinds.

Yet with AMD trading near record highs, but still at a sizable discount to bullish analyst targets, the key question now is whether investors are underestimating its AI runway or if the market has already priced in that future growth.

Most Popular Narrative: 17.2% Undervalued

At a last close of $223.47 versus a narrative fair value near $270, the story frames AMD as still having meaningful upside from here.

AMD has evolved into a formidable player in AI and enterprise compute, propelled by leadership in CPUs (EPYC) and a growing presence in GPUs (Instinct MI series). With solid revenue and earnings growth, strong analyst upgrades, and a valuation that still looks reasonable compared to peers, AMD offers a balanced play on AI infrastructure growth.

Want to see what justifies that richer price tag? This narrative leans on accelerating earnings power, structurally higher margins, and a bold long range profit roadmap.

Result: Fair Value of $270.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stiff GPU competition from Nvidia and ongoing export controls on advanced AI chips to China could quickly challenge AMD’s bullish valuation story.

Find out about the key risks to this Advanced Micro Devices narrative.

Another View: Rich Multiples Signal Less Obvious Value

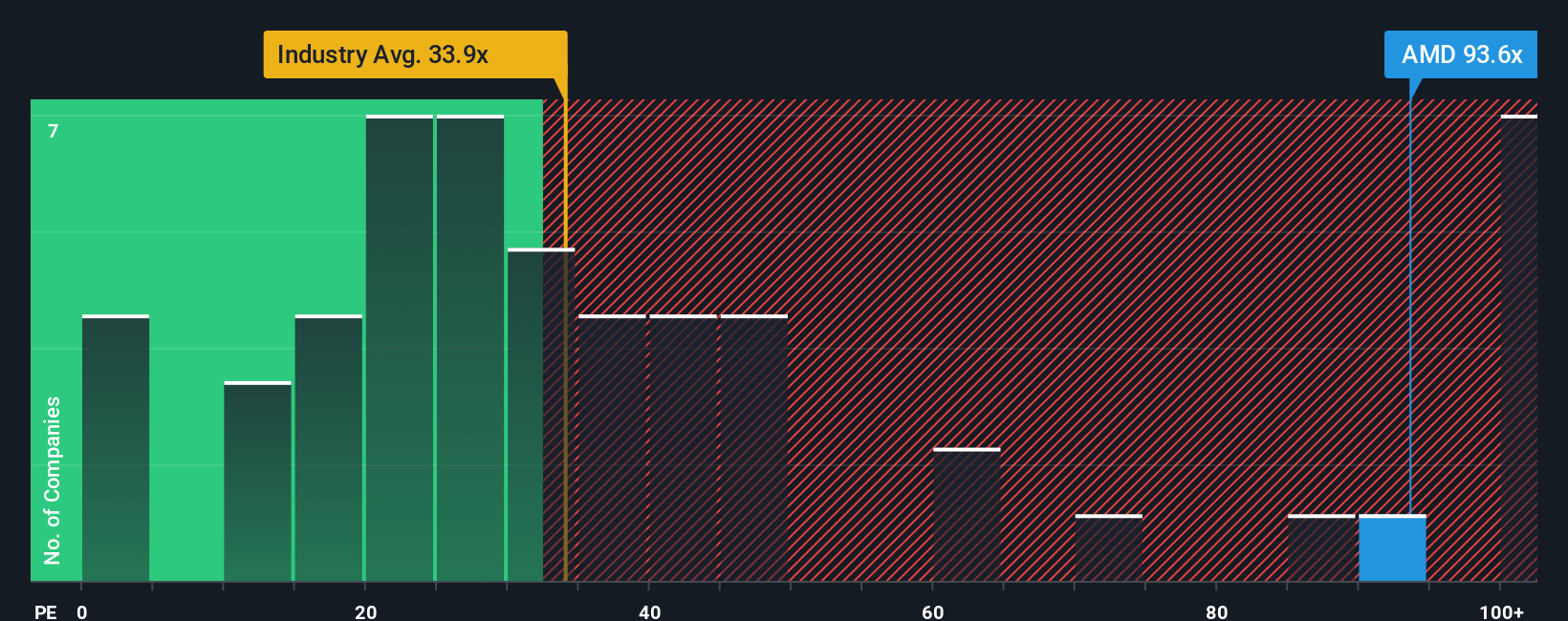

While the narrative fair value suggests upside, AMD’s current price implies a price to earnings ratio of 116.2 times. This is well above both its fair ratio of 64.7 times and the US semiconductor average of 37.3 times, as well as a 60.5 times peer average, raising clear valuation risk questions.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Advanced Micro Devices Narrative

If the story so far does not fully align with your view, dive into the numbers yourself and build a custom narrative in minutes, Do it your way.

A great starting point for your Advanced Micro Devices research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, set yourself up for the next opportunity by scanning focused stock idea lists powered by real fundamentals and forward looking metrics on Simply Wall St.

- Capture fast moving opportunities by scanning these 3571 penny stocks with strong financials that could help turn small positions into meaningful portfolio drivers.

- Position your portfolio at the heart of innovation with these 25 AI penny stocks that are aligned with long term demand for intelligent software and infrastructure.

- Review these 875 undervalued stocks based on cash flows to explore companies where cash flows suggest potential value that the market may be overlooking.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報