Taking Stock of Santander (BME:SAN): Valuation Check After DZ Bank Downgrade and New U.S. TMT Alliance

Banco Santander (BME:SAN) just drew mixed headlines, with DZ Bank shifting its view to Hold while Santander CIB unveiled a new U.S. equity research alliance with MoffettNathanson focused on Technology, Media, and Telecom.

See our latest analysis for Banco Santander.

Those moves come as the stock has been quietly grinding higher, with a 30 day share price return of 8.1 percent and a standout 1 year total shareholder return of roughly 139 percent. This suggests momentum is still building as investors reassess Santander's growth profile and risk.

If this kind of strategic shift has you thinking more broadly about financial innovation, it could be a good moment to explore fast growing stocks with high insider ownership as potential next ideas.

Yet with the shares now trading slightly above DZ Bank's target and the bank still showing solid growth and an apparent intrinsic discount, the key question is whether this rally leaves upside on the table or already fully prices in future gains.

Most Popular Narrative: 7.5% Overvalued

With Banco Santander last closing at €10.25 against a narrative fair value of €9.53, the spotlight shifts to how future earnings and margins are expected to evolve.

The analysts have a consensus price target of €7.997 for Banco Santander based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €9.5, and the most bearish reporting a price target of just €5.8.

Want to see how modest revenue growth, easing margins, and a richer future earnings multiple still combine into that fair value? The narrative’s core assumptions may surprise you.

Result: Fair Value of €9.53 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering regulatory and litigation risks, along with intense competition from fintech players, could pressure margins and undermine the current valuation narrative.

Find out about the key risks to this Banco Santander narrative.

Another Angle On Value

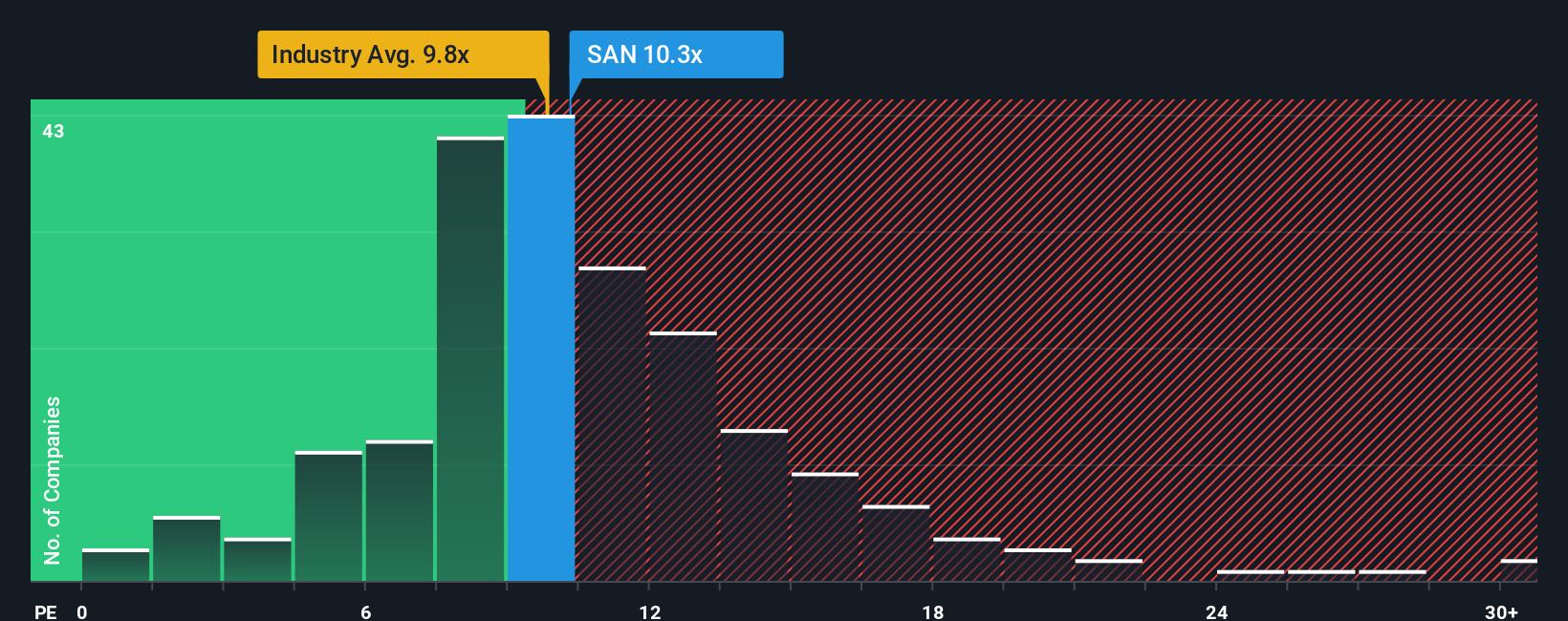

On our numbers, Banco Santander looks around 18 percent undervalued using earnings, trading on 11.8 times versus a fair ratio of 13.2 times. That is only slightly richer than European banks at 11.1 times. This raises the question of whether the market is still underpricing its progress.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Banco Santander for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Banco Santander Narrative

If you see things differently, or want to dive into the numbers yourself, you can build a personalized view in just minutes with Do it your way.

A great starting point for your Banco Santander research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking For Your Next Investment Move?

Do not stop with just one bank; sharpen your edge and uncover fresh opportunities with targeted stock ideas tailored to your strategy on Simply Wall Street.

- Secure potentially resilient income streams by reviewing these 14 dividend stocks with yields > 3% featuring businesses that prioritize consistent shareholder payouts.

- Position yourself ahead of structural shifts in medicine and diagnostics by scanning these 29 healthcare AI stocks shaping tomorrow's healthcare breakthroughs.

- Capitalize on emerging digital finance trends by assessing these 80 cryptocurrency and blockchain stocks pushing boundaries in blockchain infrastructure and crypto enabled services.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報