3 Asian Stocks Estimated To Be Trading At Discounts Of Up To 49.8%

As we enter 2026, Asian markets are navigating a complex landscape marked by mixed performances across major indices, with Japan's stock markets recently experiencing declines and China's manufacturing sector showing modest improvement. In this environment, identifying undervalued stocks can offer potential opportunities for investors looking to capitalize on market inefficiencies; such stocks may be trading at significant discounts relative to their intrinsic value, providing a compelling case for those seeking growth in the region.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Visional (TSE:4194) | ¥10010.00 | ¥19857.16 | 49.6% |

| Takara Bio (TSE:4974) | ¥795.00 | ¥1579.26 | 49.7% |

| NEXON Games (KOSDAQ:A225570) | ₩12430.00 | ₩24607.01 | 49.5% |

| Mobvista (SEHK:1860) | HK$15.70 | HK$30.74 | 48.9% |

| Meitu (SEHK:1357) | HK$7.43 | HK$14.80 | 49.8% |

| Kuraray (TSE:3405) | ¥1587.00 | ¥3161.55 | 49.8% |

| Daiichi Sankyo Company (TSE:4568) | ¥3348.00 | ¥6544.37 | 48.8% |

| CURVES HOLDINGS (TSE:7085) | ¥801.00 | ¥1583.43 | 49.4% |

| Andes Technology (TWSE:6533) | NT$242.00 | NT$482.55 | 49.8% |

| Aidma Holdings (TSE:7373) | ¥3160.00 | ¥6305.80 | 49.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Meitu (SEHK:1357)

Overview: Meitu, Inc. is an investment holding company that develops and provides photo, video, and design products with AI capabilities in Mainland China and internationally; it has a market cap of HK$33.93 billion.

Operations: The company's revenue is primarily derived from its Internet Business segment, which generated CN¥3.54 billion.

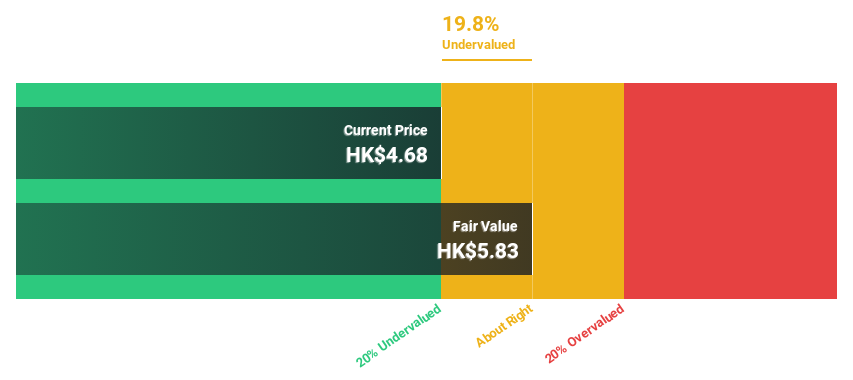

Estimated Discount To Fair Value: 49.8%

Meitu is trading at HK$7.43, significantly below its estimated fair value of HK$14.8, suggesting it may be undervalued based on cash flows. The company's earnings grew by 97.9% last year and are forecast to grow over 21% annually, outpacing the Hong Kong market's growth rate of 11.9%. Revenue is projected to increase by 20.3% per year, also surpassing market expectations, though future return on equity might remain lower than desired at 18.6%.

- Upon reviewing our latest growth report, Meitu's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Meitu.

Kingdee International Software Group (SEHK:268)

Overview: Kingdee International Software Group Company Limited is an investment holding company that operates in the enterprise resource planning sector, with a market cap of approximately HK$50.22 billion.

Operations: The company generates revenue from its enterprise resource planning business, with total revenue segments amounting to CN¥null million.

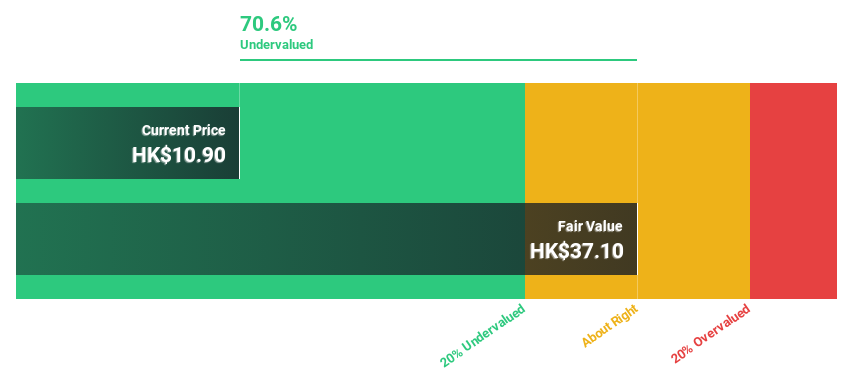

Estimated Discount To Fair Value: 28.9%

Kingdee International Software Group is trading at HK$14.15, below its estimated fair value of HK$19.9, highlighting potential undervaluation based on cash flows. Analysts agree that the stock price could rise by 33.7%. While earnings are expected to grow 39.12% annually and become profitable in three years, revenue growth at 14.5% per year may not meet high expectations, and return on equity is forecasted to be low at 6%.

- The growth report we've compiled suggests that Kingdee International Software Group's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Kingdee International Software Group's balance sheet health report.

ASMPT (SEHK:522)

Overview: ASMPT Limited is an investment holding company involved in the design, manufacture, and marketing of machines, tools, and materials for the semiconductor and electronics assembly industries globally, with a market cap of approximately HK$33.92 billion.

Operations: The company's revenue is derived from two main segments: Semiconductor Solutions, contributing HK$7.86 billion, and Surface Mount Technology (SMT) Solutions, accounting for HK$5.73 billion.

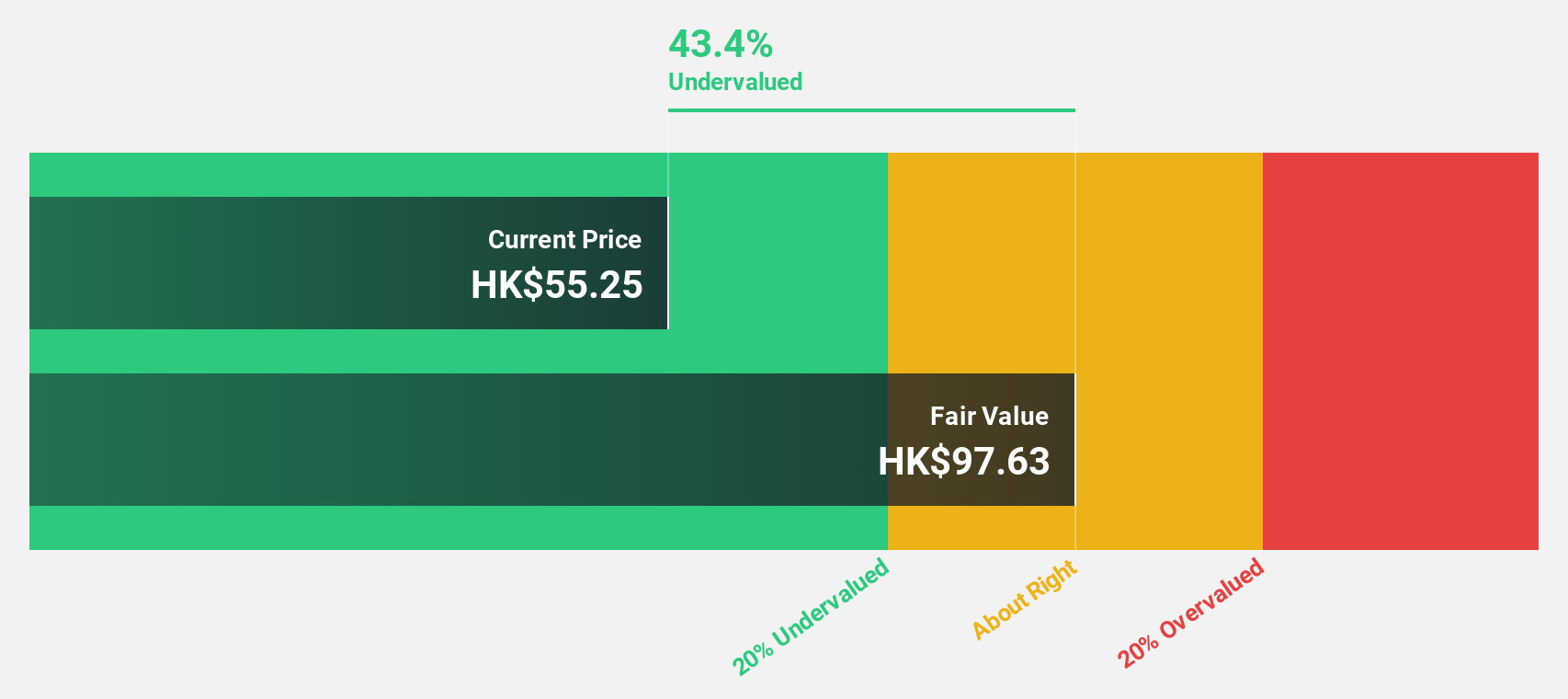

Estimated Discount To Fair Value: 30.4%

ASMPT is trading at HK$81.2, significantly below its estimated fair value of HK$116.7, suggesting it may be undervalued based on cash flows. Despite recent losses and a net loss of HKD 269.88 million in Q3 2025, the company expects revenue growth between US$470 million and US$530 million for Q4 2025, surpassing market consensus. Analysts forecast a return to profitability within three years with earnings projected to grow annually by a substantial margin.

- The analysis detailed in our ASMPT growth report hints at robust future financial performance.

- Dive into the specifics of ASMPT here with our thorough financial health report.

Make It Happen

- Gain an insight into the universe of 262 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報