Karrie International Holdings And 2 Other Asian Penny Stocks To Watch

As the Asian markets navigate a landscape of mixed economic signals and geopolitical tensions, investors are increasingly exploring diverse opportunities across various sectors. Penny stocks, often associated with smaller or newer companies, continue to capture attention due to their potential for growth at lower price points. Despite the term being somewhat outdated, these stocks can offer significant upside when backed by strong financials and sound fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.145 | SGD61.07M | ✅ 2 ⚠️ 4 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.46 | HK$903.04M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.60 | THB1.09B | ✅ 3 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.55 | HK$2.12B | ✅ 4 ⚠️ 1 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.102 | SGD53.4M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.45 | SGD13.58B | ✅ 5 ⚠️ 1 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.81 | HK$21.27B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$137.01M | ✅ 2 ⚠️ 5 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.52 | HK$52.47B | ✅ 4 ⚠️ 2 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.91 | NZ$244.72M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 959 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Karrie International Holdings (SEHK:1050)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Karrie International Holdings Limited is an investment holding company that manufactures and sells metal, plastic, and electronic products across Hong Kong, Japan, Mainland China, Asia, North America, and Western Europe with a market cap of HK$5.15 billion.

Operations: The company's revenue is derived from its operations in manufacturing and selling metal, plastic, and electronic products across diverse regions including Hong Kong, Japan, Mainland China, Asia, North America, and Western Europe.

Market Cap: HK$5.15B

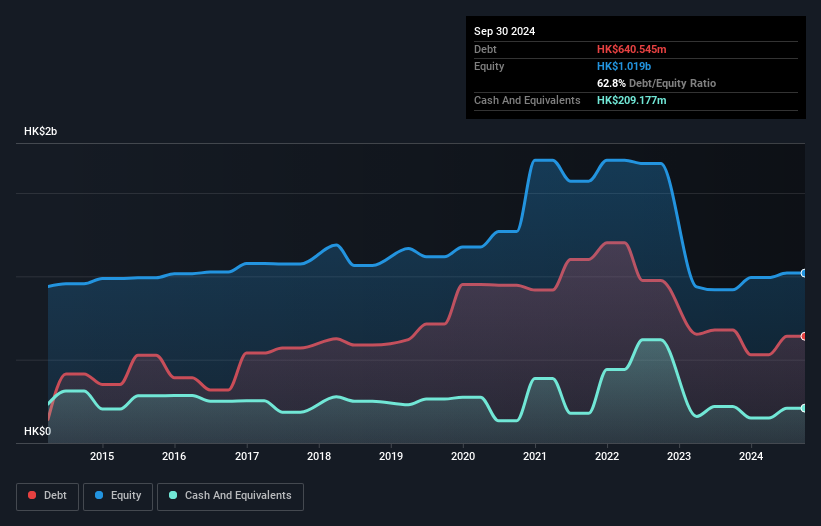

Karrie International Holdings has shown a stable financial position with short-term assets exceeding liabilities, and its debt is well covered by operating cash flow. However, the company faces challenges such as declining earnings over the past five years and a high net debt to equity ratio of 42.6%. Recent events include a decrease in interim dividends and a private placement raising HK$150 million through convertible bonds, which may impact future share capital. The board and management are experienced, providing some stability amid fluctuating profit margins and earnings growth that trails industry averages.

- Get an in-depth perspective on Karrie International Holdings' performance by reading our balance sheet health report here.

- Gain insights into Karrie International Holdings' past trends and performance with our report on the company's historical track record.

Fu Shou Yuan International Group (SEHK:1448)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fu Shou Yuan International Group Limited, with a market cap of HK$6.50 billion, operates in the People's Republic of China providing burial and funeral services through its subsidiaries.

Operations: The company's revenue is primarily derived from burial services, which generated CN¥1.28 billion, followed by funeral services at CN¥276.98 million and other services contributing CN¥37 million.

Market Cap: HK$6.5B

Fu Shou Yuan International Group, despite its HK$6.50 billion market cap, is currently unprofitable with losses increasing by 12% annually over the past five years. The company has no debt, which simplifies financial management and reduces risk. Its short-term assets of CN¥2.8 billion comfortably cover both short-term and long-term liabilities, suggesting a solid liquidity position. Recent board appointments bring extensive experience in finance and law, potentially strengthening governance and strategic direction. While earnings are projected to grow significantly at 69% per year, the current dividend yield of 19.36% lacks coverage by earnings or free cash flow.

- Take a closer look at Fu Shou Yuan International Group's potential here in our financial health report.

- Assess Fu Shou Yuan International Group's future earnings estimates with our detailed growth reports.

Tian Tu Capital (SEHK:1973)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Tian Tu Capital Co., Ltd. is a private equity and venture capital firm that invests in small and medium-sized companies across various stages of development, with a market cap of HK$2.46 billion.

Operations: The company generates revenue primarily from its asset management segment, which contributed CN¥198.78 million.

Market Cap: HK$2.46B

Tian Tu Capital, with a market cap of HK$2.46 billion, faces challenges as it remains unprofitable and has seen losses grow by 58.2% annually over the past five years. Despite this, its debt management shows improvement with a reduced debt-to-equity ratio from 37.1% to 12.4%, and cash reserves exceed total debt, indicating financial resilience. Short-term assets of CN¥1.6 billion surpass short-term liabilities of CN¥717.4 million, reflecting strong liquidity; however, long-term liabilities remain uncovered by short-term assets. Recent amendments to its Articles of Association may impact governance structures moving forward.

- Dive into the specifics of Tian Tu Capital here with our thorough balance sheet health report.

- Learn about Tian Tu Capital's historical performance here.

Seize The Opportunity

- Click this link to deep-dive into the 959 companies within our Asian Penny Stocks screener.

- Searching for a Fresh Perspective? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報