Goldman Sachs (GS) Valuation Check as Shares Jump Before Key Q4 Earnings Event

Goldman Sachs Group (GS) just popped about 4% in after hours trading as investors gear up for its January 15 fourth quarter earnings, treating the stock as a quick read on Wall Street risk appetite.

See our latest analysis for Goldman Sachs Group.

That 4.02% one day share price return, lifting Goldman Sachs to $914.34, builds on a firm 30 day share price return of about 7% and a powerful 12 month total shareholder return of roughly 61%. This signals that momentum has been steadily rebuilding as investors price in stronger deal activity and capital markets revenue.

If you want to see what else could benefit from a healthier deal and risk environment, this is a good moment to scout fast growing stocks with high insider ownership.

With the shares already above the average analyst target and riding a 61% one year total return, the key question now is simple: is Goldman still a mispriced compounder, or are markets already baking in the next leg of growth?

Most Popular Narrative: 12% Overvalued

With Goldman Sachs closing at $914.34 against a most-followed fair value of about $813, the narrative frames today’s price as running ahead of fundamentals.

Record growth and momentum in Asset and Wealth Management, including strong fee based net inflows for 30 consecutive quarters and rising demand for alternative assets from high net worth and institutional clients, are shifting the revenue mix toward less volatile, high margin streams supporting higher and more durable net margins.

Curious how steady, fee driven growth can still justify a premium valuation for a cyclical deal maker? The narrative leans on rising margins, richer multiples, and disciplined capital returns. Want to see exactly how those moving parts convert into today’s fair value line?

Result: Fair Value of $813 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent geopolitical volatility and tougher capital rules could quickly compress advisory revenues and margins, challenging assumptions underpinning today’s premium valuation.

Find out about the key risks to this Goldman Sachs Group narrative.

Another View: Multiples Paint a Cooler Picture

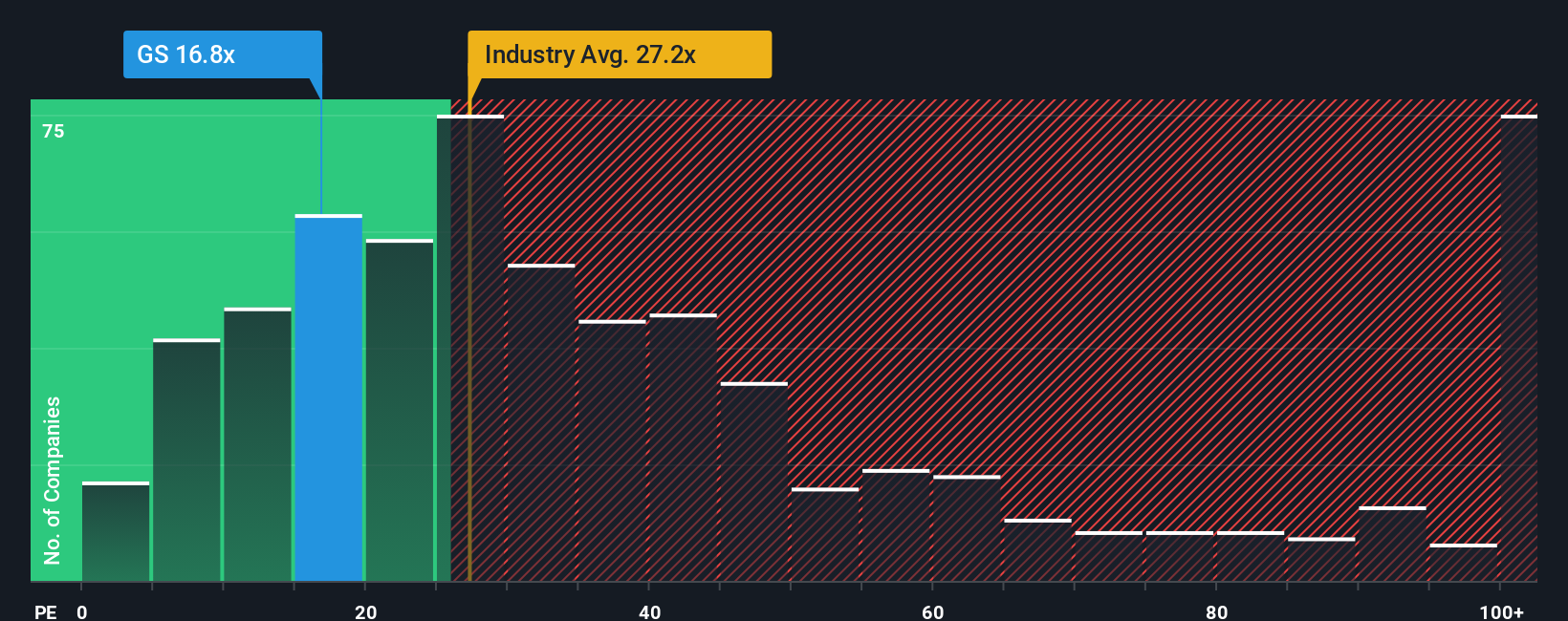

While the narrative flags Goldman as about 12% overvalued versus its $813 fair value line, the earnings multiple tells a softer story. At 18.2 times earnings, the stock trades below both the US market at 19 times and the Capital Markets industry at 25.6 times, and even under its 19.6 times fair ratio. This suggests less froth than the headline overvaluation implies and raises the question of whether this relative discount could cushion downside if sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Goldman Sachs Group Narrative

If you see the story differently or simply prefer digging into the numbers yourself, you can build a fresh narrative in minutes: Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Goldman Sachs Group.

Looking for more investment ideas?

Smart investors never stop searching for the next opportunity, and the Simply Wall Street Screener can surface stocks you might regret missing if momentum accelerates from here.

- Capture potential market mispricings by reviewing these 875 undervalued stocks based on cash flows that strong cash flow analysis suggests could be trading below their intrinsic worth.

- Capitalize on the AI boom by scanning these 25 AI penny stocks at the forefront of automation, data intelligence, and transformative software platforms.

- Strengthen your passive income strategy by targeting these 14 dividend stocks with yields > 3% that balance meaningful yields with underlying business quality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報