Is MINISO’s Warsaw Flagship Accelerating Its IP-led Destination Brand Strategy for MINISO Group Holding (MNSO)?

- MINISO Group Holding Limited has already opened its first Polish flagship store at Warsaw’s Zlote Tarasy mall, a more than 1,000-square-metre, carnival-themed space featuring beauty, home essentials, and IP collectible toys with over 60% of products tied to brands like Disney and Sanrio.

- The store’s immersive design and heavy emphasis on exclusive, globally recognised IP collections, such as Zootopia and Hello Kitty Pop Star, underline MINISO’s push to become a destination brand for young, trend-focused European shoppers.

- Next, we’ll examine how this Warsaw flagship, with its strong focus on IP-driven collectibles, may influence MINISO’s broader investment narrative.

We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

MINISO Group Holding Investment Narrative Recap

To own MINISO, you need to believe its global rollout of larger, experience-led stores and IP-heavy ranges can support sustained revenue and earnings growth without eroding margins. The Warsaw flagship strengthens the near term catalyst around IP-driven, higher value sales, but it also heightens the key risk of rising operating and labor costs if these big-format stores do not deliver enough productivity.

Against this backdrop, MINISO’s ongoing share repurchase program, which has retired 14,575,804 shares for about HK$468.89 million under the August 2024 plan, is particularly relevant. It reinforces the existing catalyst of capital returns supported by cash generation, but also raises the bar for managing cost inflation as the company scales directly operated overseas flagships like Warsaw.

Yet while the Warsaw opening looks exciting, investors should be aware that rising selling and labor costs could...

Read the full narrative on MINISO Group Holding (it's free!)

MINISO Group Holding's narrative projects CN¥31.7 billion revenue and CN¥4.9 billion earnings by 2028. This requires 19.4% yearly revenue growth and a CN¥2.5 billion earnings increase from CN¥2.4 billion today.

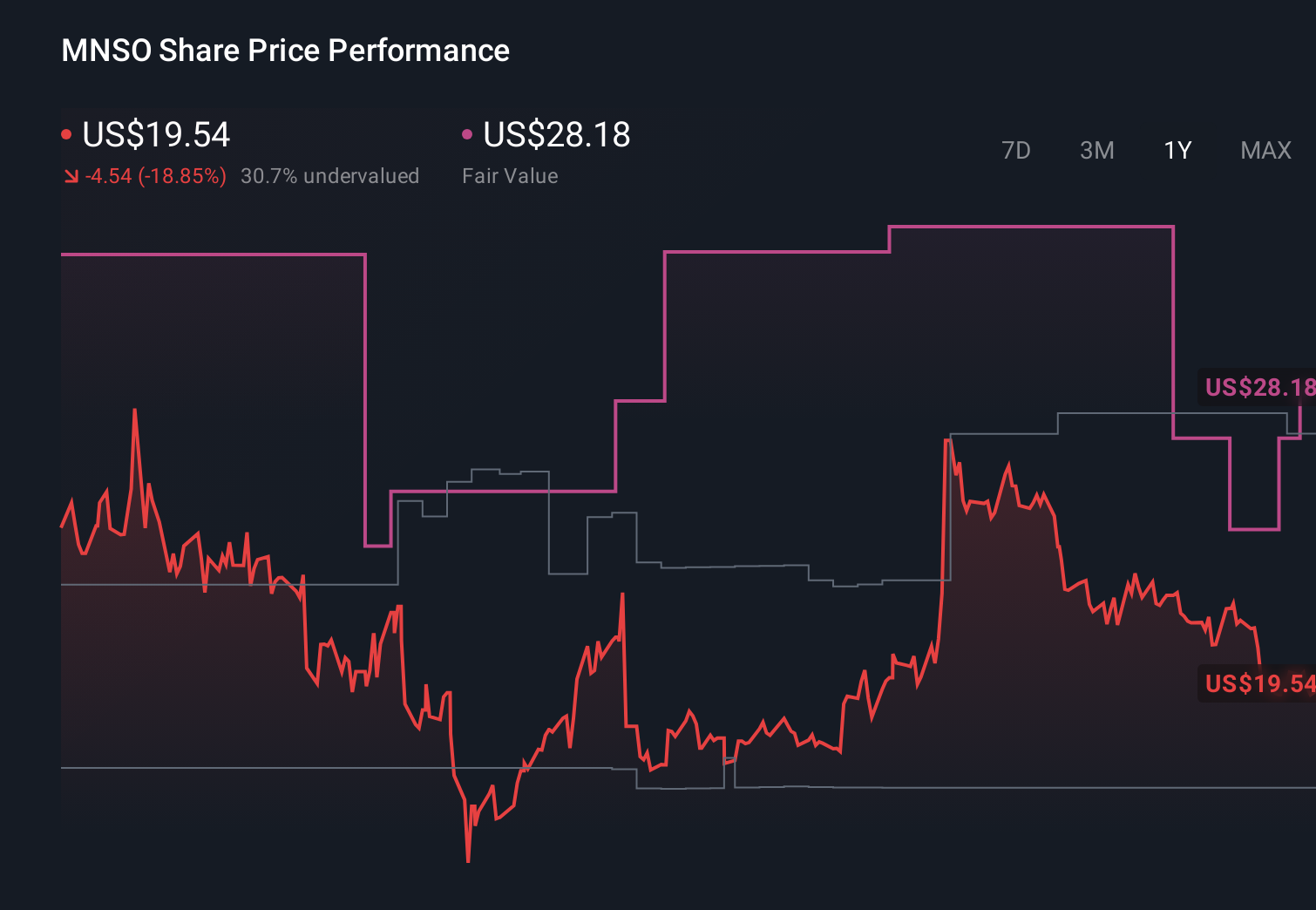

Uncover how MINISO Group Holding's forecasts yield a $26.87 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Seven members of the Simply Wall St Community value MINISO between US$23.00 and US$44.06 per share, highlighting very different expectations. Set against this spread, the company’s push into large, IP-focused European flagships puts even more focus on whether cost discipline can protect margins over time.

Explore 7 other fair value estimates on MINISO Group Holding - why the stock might be worth over 2x more than the current price!

Build Your Own MINISO Group Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MINISO Group Holding research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MINISO Group Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MINISO Group Holding's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 29 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報