Warner Bros. Discovery (WBD): Revisiting Valuation After a Powerful Share Price Turnaround

Warner Bros. Discovery (WBD) has quietly shifted from a turnaround story to a stock that is actually working, with shares up roughly 9% over the past month and nearly 50% in the past 3 months.

See our latest analysis for Warner Bros. Discovery.

That recent strength builds on a powerful turnaround, with a 90 day share price return of 49.42% feeding into a 1 year total shareholder return of 169.73%. This suggests momentum is firmly back on Warner Bros. Discovery’s side.

If you want to see what else is catching a bid in media and beyond, this could be a good moment to scout fast growing stocks with high insider ownership.

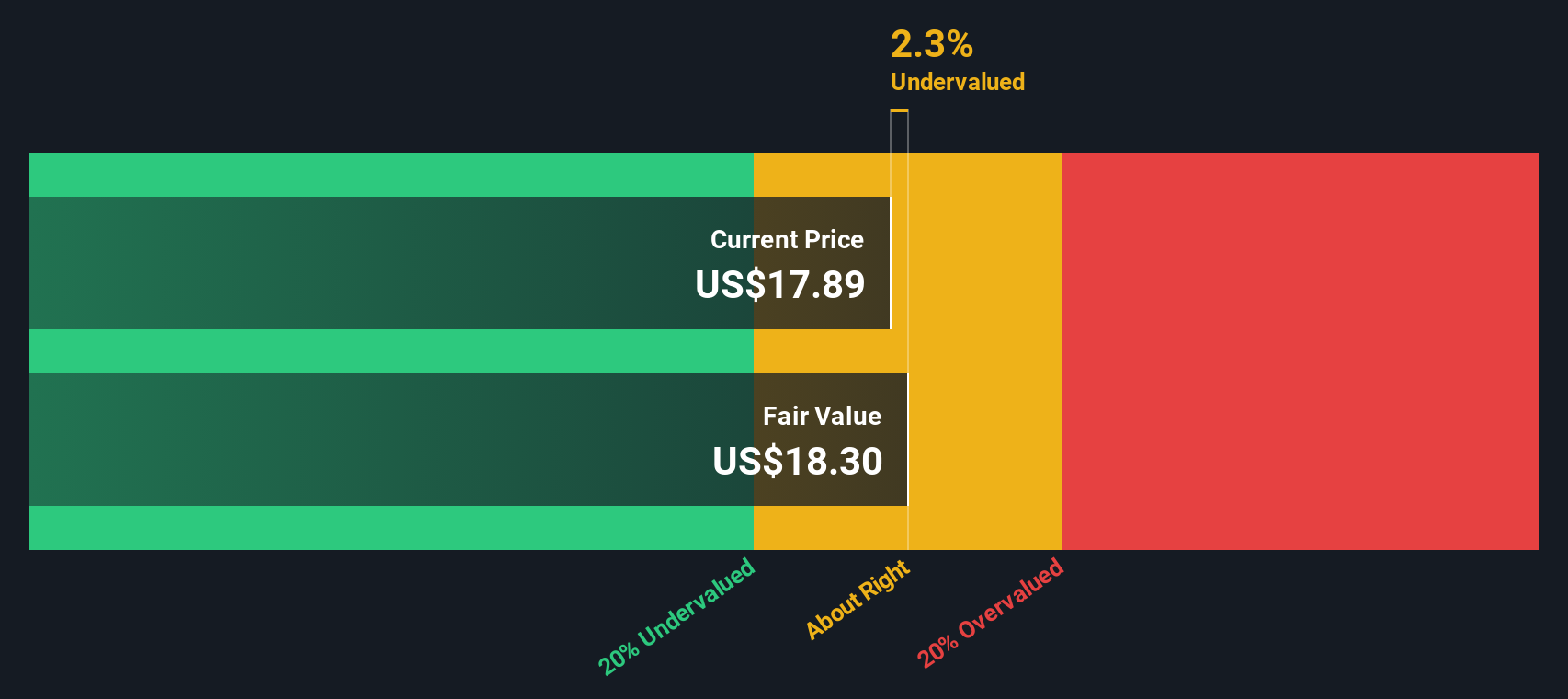

Yet with Warner Bros. Discovery now trading slightly above the average analyst price target but still showing a modest intrinsic value discount, investors face a key question: Is there still a buying opportunity, or is future growth already priced in?

Most Popular Narrative: 18.3% Overvalued

Compared with Warner Bros. Discovery's last close at $28.51, the most widely followed narrative pins fair value notably lower, setting up a tension between market optimism and modeled fundamentals.

Ongoing cost discipline, debt reduction, and anticipated net benefits from sports rights repricing (e.g., NBA contract roll off) are expected to materially increase free cash flow and margins, improving earnings resilience and the company's ability to invest in high growth initiatives longer term.

Curious how a slower revenue path can still support a richer valuation case, even with thinner margins and a stretched earnings multiple baked in? The growth math behind this fair value might surprise you.

Result: Fair Value of $24.10 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, that upside case could quickly unravel if franchise fatigue sets in or international streaming growth falls short of expectations.

Find out about the key risks to this Warner Bros. Discovery narrative.

Another Lens on Valuation

Our DCF model actually points the other way, with Warner Bros. Discovery trading about 3.7% below its estimated fair value of $29.60. That implies a small margin of safety rather than excess. Which signal should investors trust as deal headlines keep shifting the story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Warner Bros. Discovery for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Warner Bros. Discovery Narrative

If you see the story differently and want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Warner Bros. Discovery research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential winner by scanning targeted stock shortlists on Simply Wall Street that most investors never even think to check.

- Strengthen your portfolio’s foundation by targeting reliable income from these 14 dividend stocks with yields > 3% that can keep paying you through good markets and bad.

- Ride the next wave of intelligent automation by focusing on companies at the forefront of these 25 AI penny stocks transforming how entire industries operate.

- Position yourself early in a frontier theme by reviewing these 80 cryptocurrency and blockchain stocks shaping the next generation of digital infrastructure and financial rails.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報