Vertiv Holdings (VRT): Revisiting Valuation After Analyst Upgrades and Growing S&P 500 Inclusion Speculation

Vertiv Holdings Co (VRT) is back in the spotlight after a wave of analyst upgrades, led by Barclays, pushed the stock up around 9% and rekindled talk of a potential S&P 500 inclusion in early 2026.

See our latest analysis for Vertiv Holdings Co.

The move comes after a choppy few weeks when Vertiv’s 30 day share price return of negative 7.09% briefly cooled sentiment, even as the 1 year total shareholder return of 39.94% and three year total shareholder return above 1,000% underline that momentum is still very much intact.

If today’s AI infrastructure story has you thinking bigger, this could be a good moment to explore other potential winners among high growth tech and AI stocks.

With the stock up sharply, trading only modestly below bullish analyst targets and already reflecting years of rapid AI driven growth, the key question now is simple: is Vertiv still mispriced, or is the market already discounting its next leg higher?

Most Popular Narrative Narrative: 10.8% Undervalued

With Vertiv last closing at $175.61 against a narrative fair value just under $200, the storyline leans bullish and hinges on powerful AI infrastructure tailwinds.

Operational and supply chain challenges, including costs tied to tariff transitions and rapid scaling, are expected by management to be largely resolved by the end of 2025. This is anticipated to support management's long-term operating margin targets (25% by 2029) and stronger future earnings growth as scale benefits are fully realized.

Curious how sustained double digit growth, rising margins, and a premium future multiple all fit together? Want to see the exact assumptions behind that gap?

Result: Fair Value of $196.83 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent supply chain disruptions or hyperscale customers shifting in house could compress Vertiv’s margins and derail the bullish earnings narrative.

Find out about the key risks to this Vertiv Holdings Co narrative.

Another Lens On Vertiv's Valuation

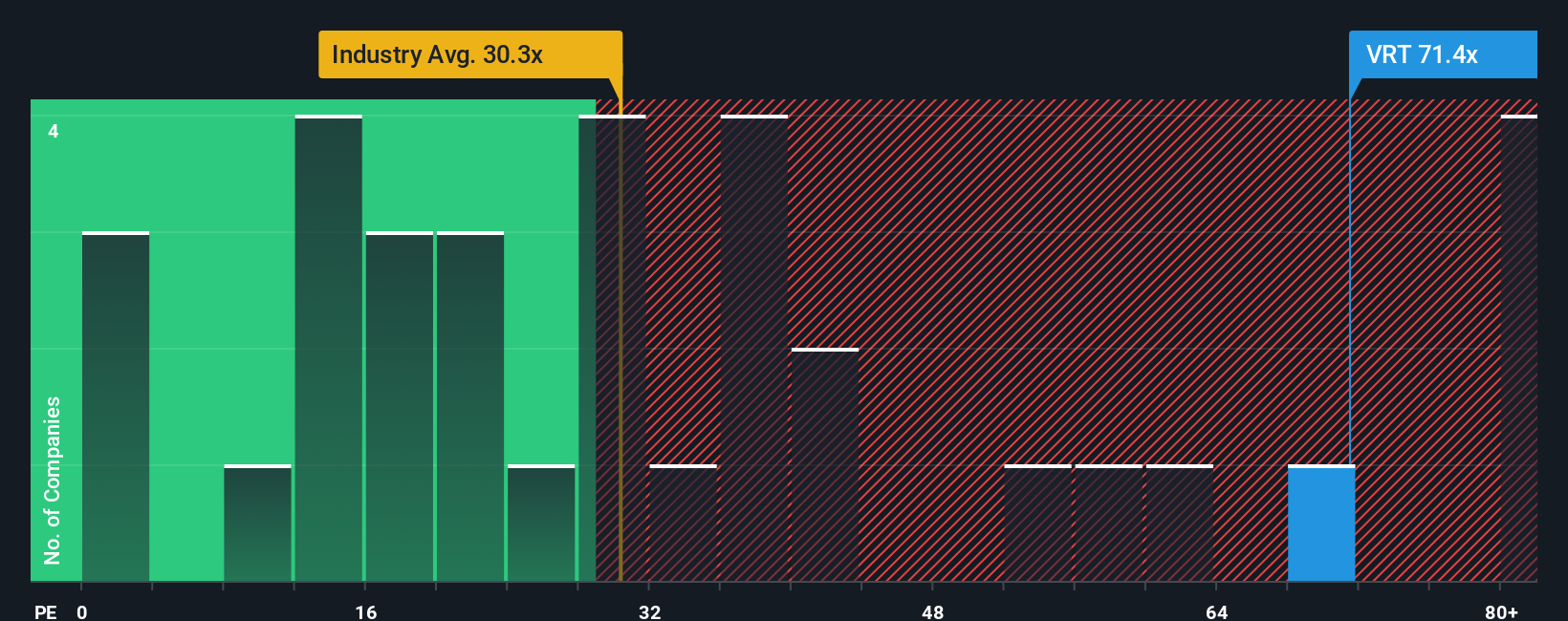

On earnings, Vertiv looks stretched. The stock trades on a price to earnings ratio of 64.9 times, versus 30.5 times for the US Electrical industry, 37.6 times for peers, and a fair ratio of 53 times that the market could drift back toward.

If sentiment cools or growth expectations reset, that gap leaves less room for execution hiccups and more scope for a valuation derating, even if the long term AI story plays out. How much premium are you willing to pay for perfection?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Vertiv Holdings Co Narrative

If you see Vertiv differently or want to test your own assumptions against the numbers, you can build a complete view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vertiv Holdings Co.

Ready for more high conviction ideas?

Before the next big move leaves you watching from the sidelines, use the Simply Wall St Screener to uncover focused opportunities that match your strategy and risk profile.

- Lock onto potential mispriced quality by targeting companies that look cheap on future cash flows using these 875 undervalued stocks based on cash flows and upgrade the way you hunt for value.

- Position yourself early in the next wave of innovation by scanning these 25 AI penny stocks packed with strong growth stories and powerful long term demand tailwinds.

- Strengthen your income game by zeroing in on these 14 dividend stocks with yields > 3% that can help turn market volatility into a steady stream of potential cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報