Neurocrine Biosciences (NBIX) Valuation Check After KINECT DCP Phase 3 Trial Failure

Neurocrine Biosciences (NBIX) is back in focus after the company reported that its pivotal Phase 3 KINECT DCP trial of valbenazine in dyskinetic cerebral palsy failed to hit primary and key secondary efficacy endpoints.

See our latest analysis for Neurocrine Biosciences.

The KINECT DCP setback has added pressure to a stock that was already drifting lower in recent weeks, with a 30 day share price return of minus 9.59 percent. However, the roughly flat 90 day share price return and a 1 year total shareholder return of 1.81 percent suggest momentum is cooling rather than collapsing as investors reassess pipeline risk against a still profitable commercial base.

If this kind of binary trial outcome has you rethinking concentration risk, it might be a good time to scan other healthcare stocks that balance innovation with more diversified pipelines.

With shares still profitable and trading at a sizable discount to analyst targets despite the trial miss, is Neurocrine quietly slipping into undervalued territory, or is the market simply discounting more modest long term growth ahead?

Most Popular Narrative Narrative: 42.6% Undervalued

Compared with the last close at $140.60, the most followed narrative implies a markedly higher fair value, framing the recent pullback as potential mispricing.

PipelineCrenessity@CRENESSITY Capsule 50/100 MG $766.66 packaging 50 MG 60u $45,999.60 packaging 100 MG 30u. Starts at approximately $21,338.71 USD for a monthly supply Ingrezza@Ingrezza (valbenazine) As of July 2025, the average pharmacy acquisition cost for Ingrezza capsules in the U.S. is approximately:

• $274.54 per capsule for the 60 mg and 80 mg strengths

• $250.16 per capsule for the 40 mg strength Other Products: Tetrabenazine Tablet 12.5 MG $62.52 Austedo Tablet 6 MG $100.06 Austedo XR Tablet 6 MG $100.06 Xenazine Tablet 12.5 MG $227.88 Assumptions Risks

According to kapirey, this valuation hinges on premium pricing power, ambitious revenue expansion, and a rich future earnings multiple more often seen in high growth leaders. Curious which precise growth runway, margin profile, and profit multiple combine to justify such a steep gap to today’s price?

Result: Fair Value of $244.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upbeat case could unravel if pricing pressure on Ingrezza intensifies or further pipeline disappointments undermine confidence in long term growth.

Find out about the key risks to this Neurocrine Biosciences narrative.

Another Angle on Valuation

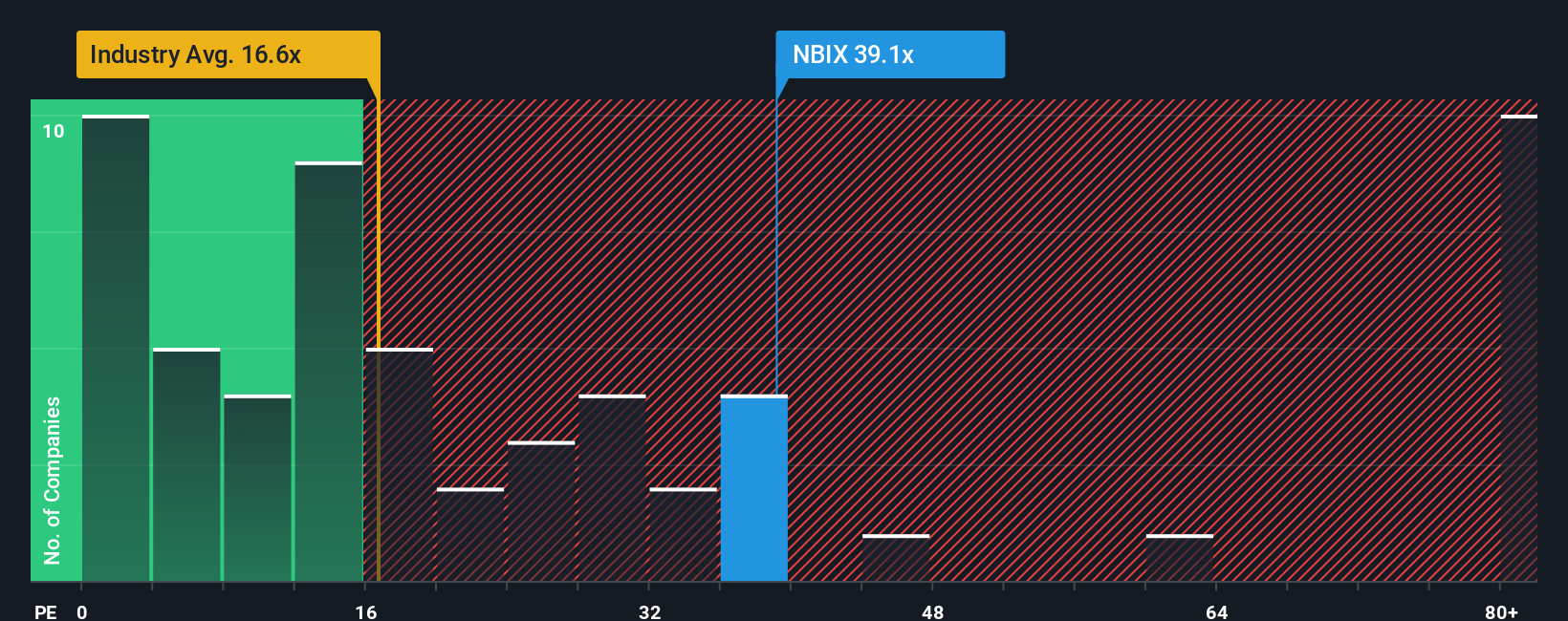

On earnings metrics, the story looks very different. Neurocrine trades on a 32.8x price to earnings ratio versus 21.1x for the US biotech sector, 18.2x for peers, and a 24x fair ratio our models point to. That premium suggests investors risk paying up for execution that may already be priced in.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Neurocrine Biosciences Narrative

If you see the numbers differently or prefer to test your own assumptions, you can build a complete view in just minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Neurocrine Biosciences.

Ready for more investment ideas?

Before you move on, put your research to work by using the Simply Wall St Screener to uncover fresh, data driven opportunities tailored to your strategy.

- Capture potential mispricings by targeting companies trading below their estimated cash flow value through these 875 undervalued stocks based on cash flows and sharpen your watchlist with conviction.

- Tap into the next wave of innovation by filtering for emerging innovators in artificial intelligence using these 25 AI penny stocks before the crowd fully catches on.

- Lock in steadier income streams by focusing on dependable payers with strong yields via these 14 dividend stocks with yields > 3% and strengthen the foundation of your portfolio.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報