Assessing OGE Energy (OGE)'s Valuation as Investors Revisit This Quiet Utility Performer

Why OGE Energy is on investors radar

OGE Energy (OGE) has quietly outperformed over the past year, and that track record is drawing fresh attention as investors scan utilities for income, stability, and reasonable growth.

See our latest analysis for OGE Energy.

That steady, mid single digit 1 year total shareholder return, alongside a 5 year total shareholder return above 60 percent, suggests investors are slowly warming to OGE Energy as earnings growth and perceived risk both trend in its favor around the 42.88 dollar share price.

If OGE’s profile has you thinking about what else might be quietly reshaping portfolios, it could be a good time to explore fast growing stocks with high insider ownership.

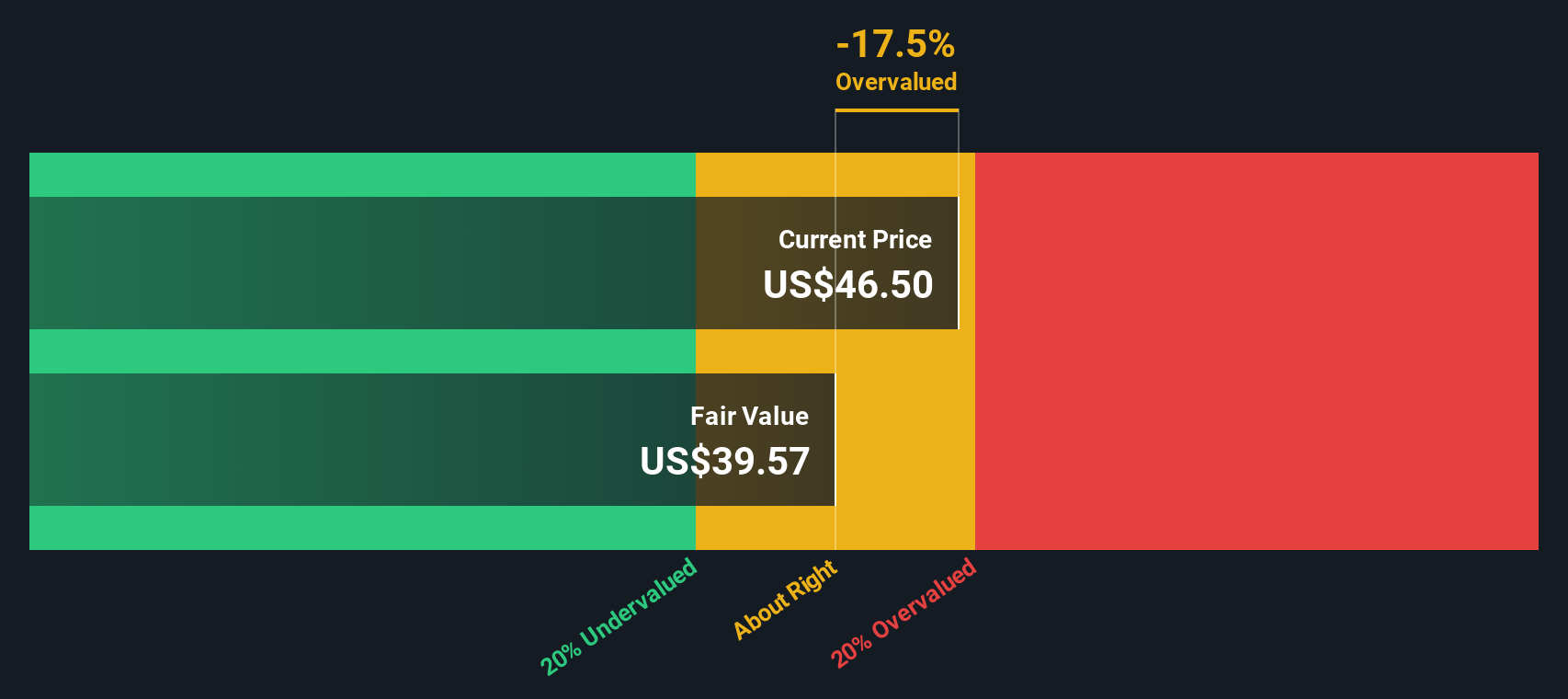

With the shares trading just below analyst targets but above some intrinsic value estimates, the key question now is whether OGE Energy is quietly undervalued, or if the market has already priced in its next leg of growth.

Most Popular Narrative: 8.9% Undervalued

With the narrative fair value sitting at 47.05 dollars against a 42.88 dollar close, the story leans toward upside built on measured utility style growth.

Ongoing and planned investments in generation capacity and transmission infrastructure, with legislative and regulatory support (e.g., CWIP and PISA mechanisms), enable accelerated asset deployment with minimized lag in rate recovery, supporting consistent future earnings and improved return on equity.

Want to see what is really powering that valuation gap? This narrative pins its case on steady growth, rising margins, and a richer future earnings multiple. Curious how those moving parts add up to the fair value target? Dive in to uncover the specific revenue, profit, and valuation assumptions behind this call.

Result: Fair Value of $47.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, softer industrial demand and heavier reliance on gas projects could pressure margins and derail the steady growth path supporting that upside case.

Find out about the key risks to this OGE Energy narrative.

Another View: Cash Flow Paints A Tougher Picture

While the narrative suggests around 8.9 percent upside, our DCF model tells a different story, putting fair value closer to 38.37 dollars versus the 42.88 dollar share price. This implies OGE might actually be overvalued. Which lens you trust more likely depends on how confident you are in those long range growth assumptions.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out OGE Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own OGE Energy Narrative

If you see the numbers differently and would rather test your own thesis, you can build a complete narrative in just a few minutes: Do it your way.

A great starting point for your OGE Energy research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you move on, lock in an edge by using the Simply Wall Street Screener to uncover focused opportunities that most investors are still overlooking.

- Target reliable income streams by reviewing these 14 dividend stocks with yields > 3% that aim to balance yield with business quality and resilience.

- Tap into structural growth by scanning these 25 AI penny stocks positioned to benefit from accelerating demand for intelligent automation and data driven solutions.

- Position ahead of the crowd by monitoring these 80 cryptocurrency and blockchain stocks building real businesses around digital assets, infrastructure, and blockchain adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報