Suburban Propane Partners (SPH): Valuation Check After $350 Million Debt Refinancing and 2027 Notes Redemption

Suburban Propane Partners (SPH) just refinanced a big chunk of its balance sheet, closing a $350 million offering of 6.5% senior notes due 2035 to take out its 2027 notes.

See our latest analysis for Suburban Propane Partners.

At a share price of $18.69, Suburban Propane Partners has seen modest near term share price softness but still delivered an 11.34% total shareholder return over the past year. This suggests that the refinancing is being viewed as a gradual, balance sheet de risk rather than a dramatic catalyst.

If this kind of steady, income focused story appeals to you, it could be a good moment to see what else is out there via fast growing stocks with high insider ownership.

With the balance sheet slowly improving and long term returns already strong, is Suburban Propane Partners quietly trading at a discount to its true cash flow power, or has the market already priced in its future growth?

Most Popular Narrative: 9.9% Overvalued

Suburban Propane Partners last closed at $18.69, slightly above the most followed narrative fair value of $17, setting up a mild tension between market and model.

In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.8x on those 2028 earnings, down from 12.4x today. This future PE is lower than the current PE for the US Gas Utilities industry at 17.6x.

Curious how flat top line expectations, rising profit margins and a deliberately lower future earnings multiple can still support today’s price tag? The narrative spells out the maths behind that balancing act, and it may not be what you expect from a slow growth utility name.

Result: Fair Value of $17 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this narrative depends on volatile propane demand and policy sensitive renewable credits, where warmer winters or weaker incentives could quickly undermine earnings assumptions.

Find out about the key risks to this Suburban Propane Partners narrative.

Another View: Multiples Point to Deep Value

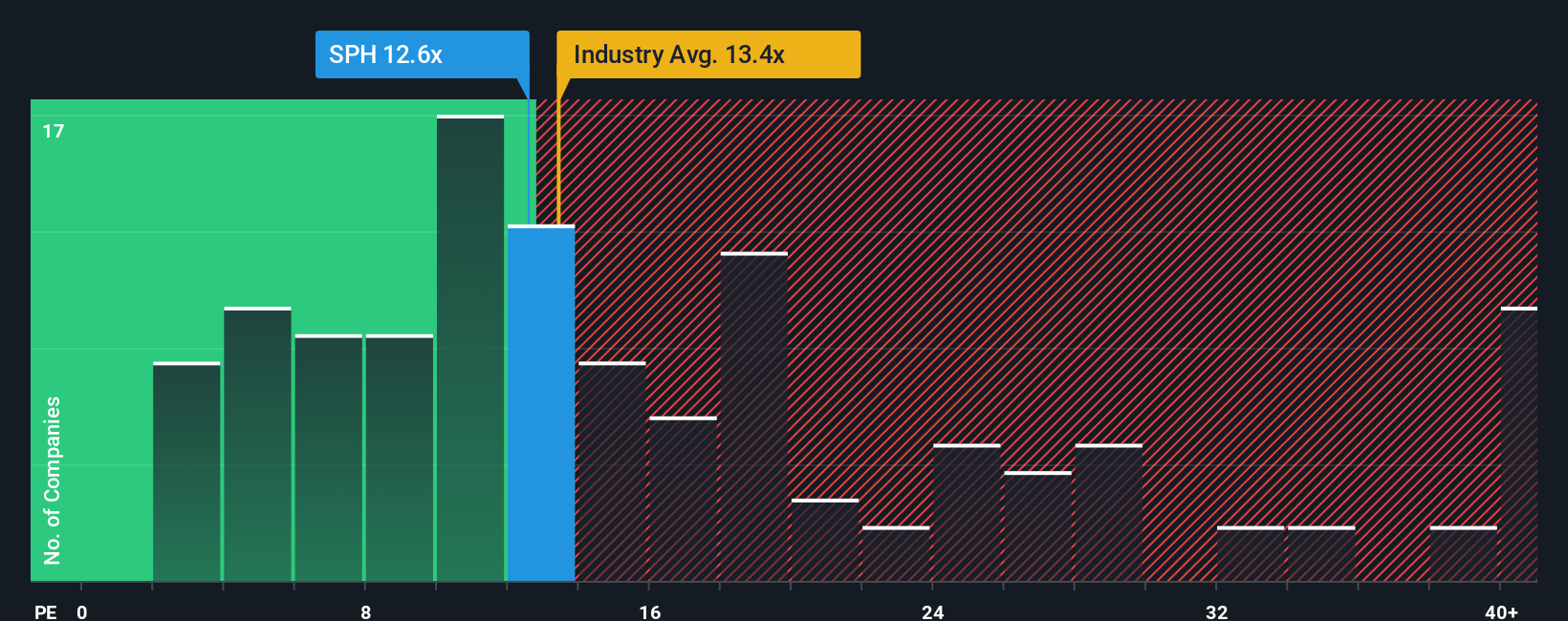

While the narrative framework pegs Suburban Propane Partners at 9.9% overvalued, its current P/E of 11.6x sits well below both peers at 16.5x and a fair ratio of 15.8x. If earnings hold up, is the market overly discounting its risks or quietly offering a value entry point?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Suburban Propane Partners Narrative

If you see things differently or would rather dig through the numbers yourself, you can shape a fresh perspective in just minutes by using Do it your way.

A great starting point for your Suburban Propane Partners research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, you may want to explore new opportunities on Simply Wall Street’s screener so you are not left watching others capture potential upside.

- Target reliable income by reviewing these 14 dividend stocks with yields > 3% that can help anchor your portfolio with cash returns.

- Explore rapid innovation by assessing these 25 AI penny stocks shaping the next wave of intelligent products and services.

- Identify possible re rating opportunities by focusing on these 875 undervalued stocks based on cash flows where prices may trail underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報