Does Pinterest’s Valuation Reflect Its 63% Five Year Share Price Slide?

- If you are wondering whether Pinterest is quietly setting up for a comeback or still a value trap, you are not alone. This is exactly the kind of stock where valuation really matters.

- The share price is at $26.56, up 1.6% over the last week, roughly flat year to date at 0.0%, but still down 14.2% over 1 year and a steep 63.0% over 5 years. This tells you sentiment has been on a long, bumpy ride.

- Recently, investors have been refocusing on user engagement trends, new ad formats and Pinterest's push into more actionable shopping features. All of these factors can shift expectations for long term growth. At the same time, changing views on the broader ad market and competition from other social platforms help explain why the stock can swing as perceptions of risk and opportunity evolve.

- Despite that mixed history, Pinterest currently scores a 6/6 valuation check, suggesting it screens as undervalued across all our key metrics. Next, we will unpack what different valuation approaches say about that signal and hint at an even better way to judge fair value by the end of the article.

Find out why Pinterest's -14.2% return over the last year is lagging behind its peers.

Approach 1: Pinterest Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and then discounting them back to today in $ terms. For Pinterest, the model starts with last twelve months free cash flow of about $1.13 billion, then layers on analyst forecasts and longer term extrapolations.

Analysts expect free cash flow to rise to around $1.40 billion by 2026 and $1.83 billion by 2028, with Simply Wall St extending those projections further, reaching roughly $2.00 billion by 2030. These cash flows are discounted using a 2 Stage Free Cash Flow to Equity approach, which values a higher growth period first and a steadier phase thereafter.

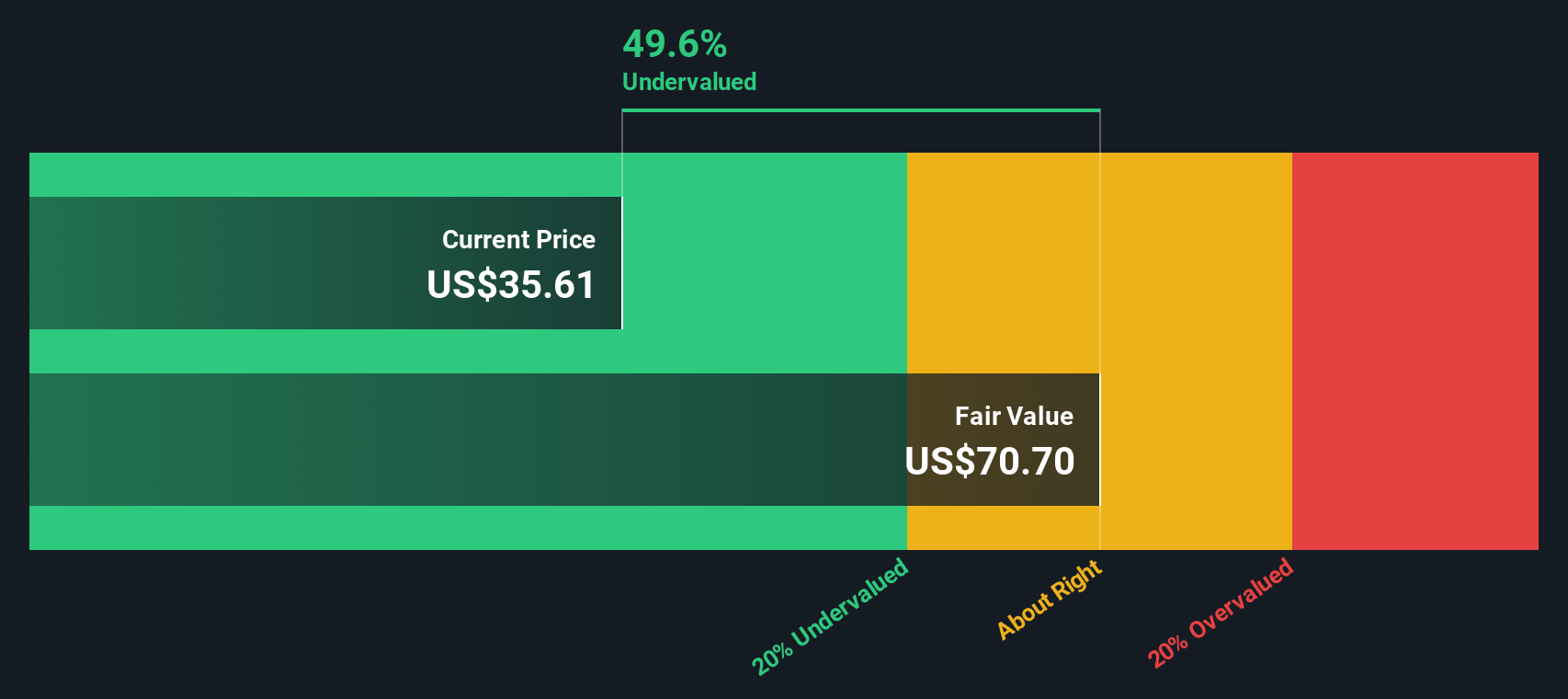

On this basis, the intrinsic value for Pinterest comes out at about $52.13 per share, compared with a current price near $26.56. That implies the shares trade at roughly a 49.1% discount to the DCF estimate, indicating the market is pricing in materially weaker prospects than the cash flow model suggests.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Pinterest is undervalued by 49.1%. Track this in your watchlist or portfolio, or discover 875 more undervalued stocks based on cash flows.

Approach 2: Pinterest Price vs Earnings

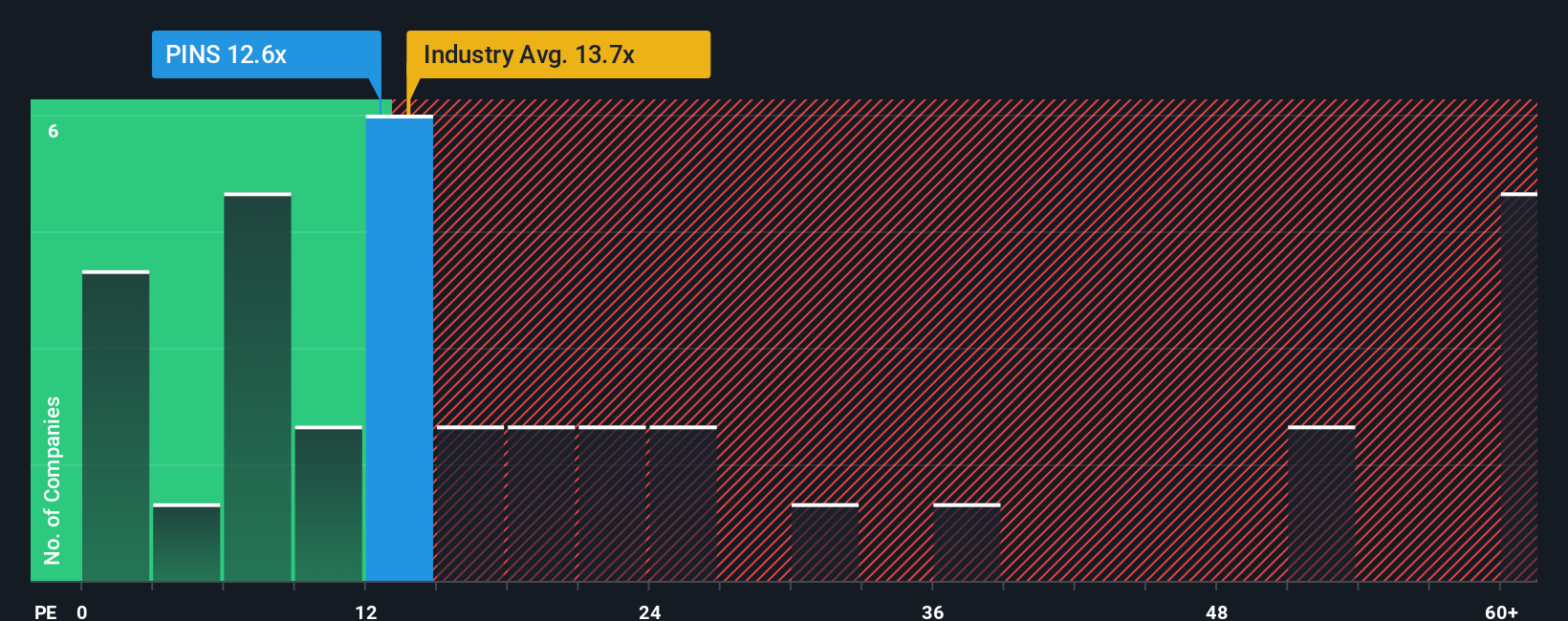

For a profitable business like Pinterest, the price to earnings ratio is a useful yardstick because it links what investors pay today to the earnings the company is already generating. In general, faster growth and lower perceived risk justify a higher PE multiple, while slower growth or higher uncertainty should be reflected in a lower one.

Pinterest currently trades on a PE of about 9.03x, well below both the Interactive Media and Services industry average of roughly 15.45x and an even richer peer group average near 71.66x. To move beyond simple comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates the PE you would expect for Pinterest given its earnings growth outlook, industry, profit margins, size and key risks. This makes it more tailored than blunt peer or sector averages that may bundle together very different businesses.

On that basis, Pinterest’s Fair Ratio comes out at around 16.72x, meaning the shares trade at a meaningful discount to what those fundamentals might warrant. That gap suggests the market is still pricing in a cautious view of the company’s prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1464 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Pinterest Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Pinterest’s story with a set of numbers, from future revenue and margins through to an explicit fair value per share. A Narrative on Simply Wall St is your own scenario, where you spell out how you think Pinterest will grow, how profitable it can become and what multiple it deserves. The platform automatically turns that story into a forecast and a fair value that you can compare to today’s price to help frame a buy, hold or sell decision. Narratives live inside the Community page and are easy to use. Because they update dynamically as new earnings, news and estimates come in, your fair value view stays current without you rebuilding a model from scratch. For example, one Pinterest Narrative might assume slower growth, lower margins and a fair value near $26, while another bakes in stronger commerce execution and higher long term profitability to arrive closer to $43, illustrating how different but clearly defined perspectives can coexist and guide real world decisions.

Do you think there's more to the story for Pinterest? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報