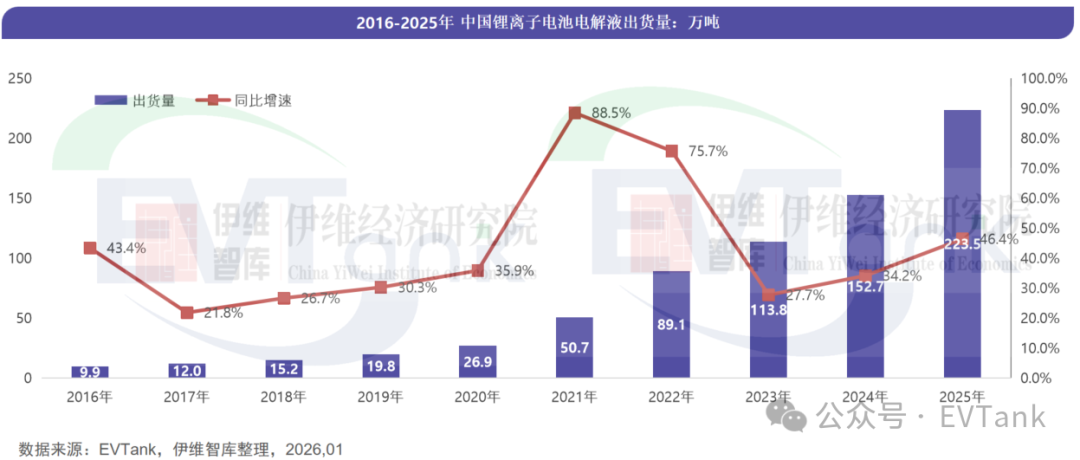

EVtank: In 2025, China's electrolyte shipment volume was 2.235,000 tons, and the industry ushered in a new phase of sharp rise in price

The Zhitong Finance App learned that recently, the research institute EVtank and Ivey Institute of Economics jointly released the “White Paper on the Development of China's Lithium-ion Battery Electrolyte Industry (2026)”. EVtank statistics show that in 2025, global lithium-ion battery electrolyte shipments increased by 44.5% year-on-year to 2.402 million tons. Of these, China's actual electrolyte shipments reached 2.235,000 tons, increasing its share of the global electrolyte market to 93.05%.

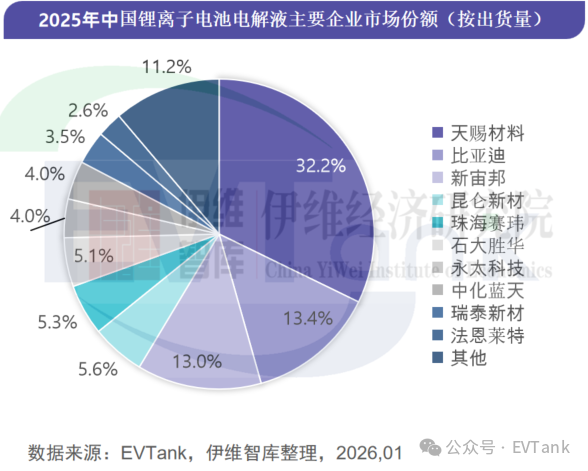

In terms of major companies, Tianci Materials ranked first with a shipment volume of 720,000 tons, and its market share increased to 32.2%, ranking first in the world for ten consecutive years. Companies with a faster year-on-year shipment growth rate in 2025 include Shida Shenghua, Yongtai Technology, Kunlun New Materials, and Zhuhai Saiwei. The four companies all had a year-on-year growth rate of more than 70%, significantly outperforming the industry's growth rate. Among the top ten companies in 2025, Kunlun New Materials rose one place to rank fourth in the industry. Ruitai New Materials and Farnlight's shipment rankings declined significantly.

According to EVtank's data in the “White Paper on the Development of China's Lithium-ion Battery Electrolyte Industry (2026)”, Enchem's global electrolyte shipments from overseas companies exceeded 80,000 tons in 2025, of which the Chinese factory shipped more than 40,000 tons, making it the largest electrolyte company with overseas shipments.

Judging from the competitive pattern of Chinese electrolyte companies, Tianci Materials has always been far ahead, and BYD produces and uses its own products. Among independent electrolyte companies, the market share of Kunlun New Materials and Zhuhai Saiwei is gradually increasing, and competition is fierce. Shi Da Shenghua and Yongtai Technology have developed rapidly in recent years, and Ruitai New Materials and Farnlight's top ten positions have been challenged.

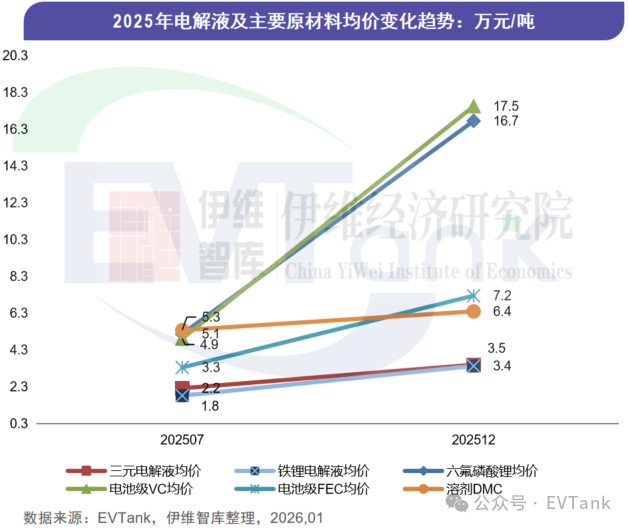

Judging from the market size, EVtank statistics show that the global electrolyte market size in 2025 was 56.42 billion yuan, up 37.6% year on year. The main reason was the large-scale increase in electrolyte shipments. Prices stabilized compared to 2024, but since the second half of 2025, due to rising prices of lithium hexafluorophosphate, solvents, and additives, the main raw materials of electrolytes, electrolyte prices also began a gradual process of price increase in the second half of the year. EVtank statistics show that the average price of lithium hexafluorophosphate rose from 49,000 yuan/ton in July 2025 to an average price of 167,000 yuan/ton in December, and VC also showed a significant increase.

Nasdaq

Nasdaq 華爾街日報

華爾街日報