Photronics, Inc.'s (NASDAQ:PLAB) Shares Bounce 38% But Its Business Still Trails The Market

The Photronics, Inc. (NASDAQ:PLAB) share price has done very well over the last month, posting an excellent gain of 38%. Looking back a bit further, it's encouraging to see the stock is up 39% in the last year.

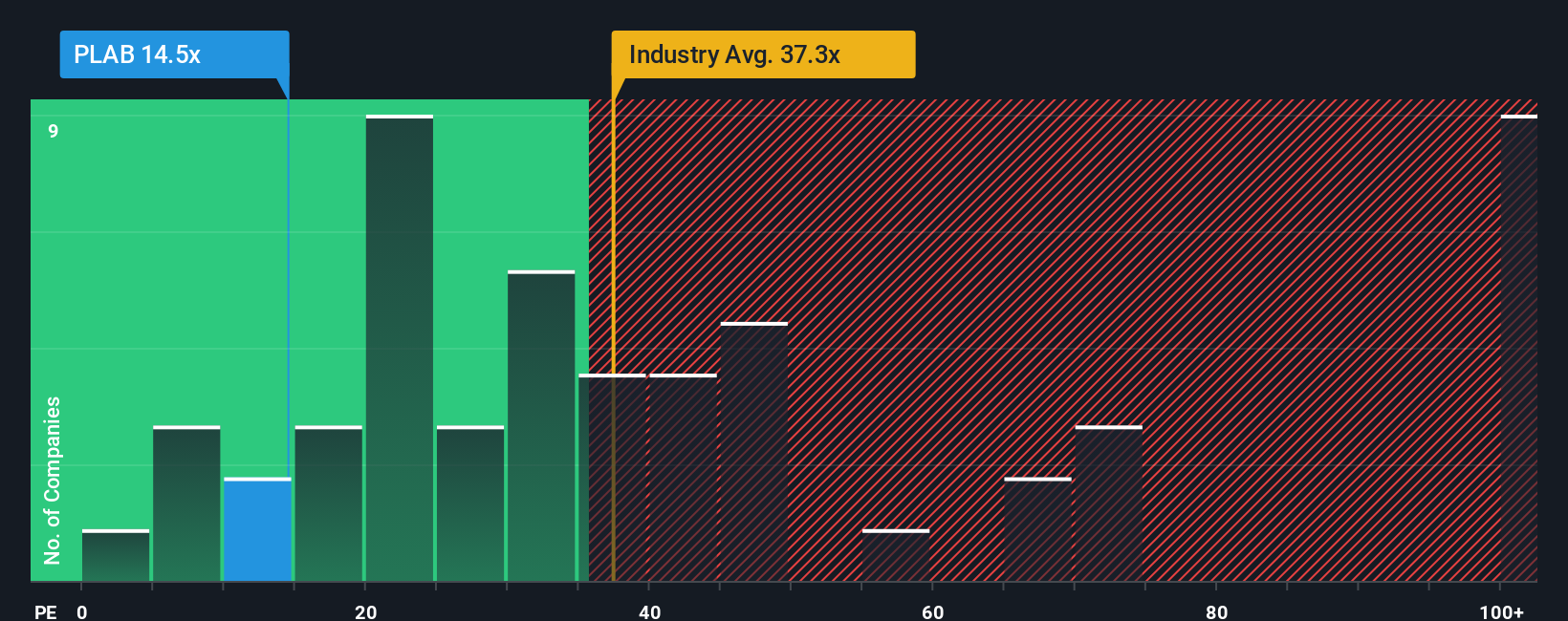

Although its price has surged higher, given about half the companies in the United States have price-to-earnings ratios (or "P/E's") above 20x, you may still consider Photronics as an attractive investment with its 14.5x P/E ratio. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Photronics could be doing better as it's been growing earnings less than most other companies lately. It seems that many are expecting the uninspiring earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Photronics

How Is Photronics' Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Photronics' to be considered reasonable.

If we review the last year of earnings growth, the company posted a worthy increase of 8.1%. EPS has also lifted 18% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of earnings growth.

Shifting to the future, estimates from the dual analysts covering the company suggest earnings growth is heading into negative territory, declining 8.0% over the next year. With the market predicted to deliver 16% growth , that's a disappointing outcome.

In light of this, it's understandable that Photronics' P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Photronics' P/E

The latest share price surge wasn't enough to lift Photronics' P/E close to the market median. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Photronics' analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Photronics (at least 1 which can't be ignored), and understanding these should be part of your investment process.

If these risks are making you reconsider your opinion on Photronics, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報