Exel Composites Oyj (HEL:EXL1V) Stock Rockets 26% But Many Are Still Ignoring The Company

The Exel Composites Oyj (HEL:EXL1V) share price has done very well over the last month, posting an excellent gain of 26%. Looking back a bit further, it's encouraging to see the stock is up 61% in the last year.

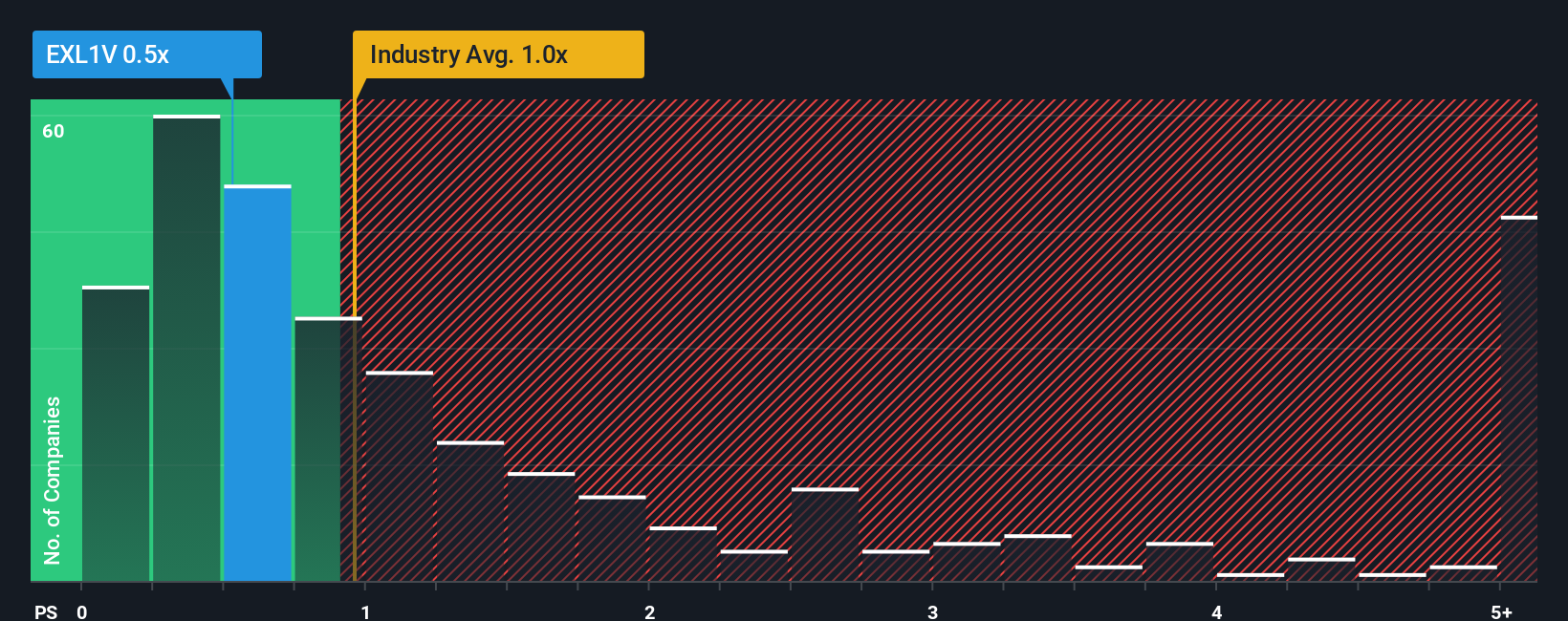

In spite of the firm bounce in price, it's still not a stretch to say that Exel Composites Oyj's price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Machinery industry in Finland, where the median P/S ratio is around 1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Check out our latest analysis for Exel Composites Oyj

What Does Exel Composites Oyj's P/S Mean For Shareholders?

There hasn't been much to differentiate Exel Composites Oyj's and the industry's revenue growth lately. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Exel Composites Oyj.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Exel Composites Oyj's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a decent 2.7% gain to the company's revenues. Still, lamentably revenue has fallen 30% in aggregate from three years ago, which is disappointing. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 16% per year over the next three years. That's shaping up to be materially higher than the 5.2% each year growth forecast for the broader industry.

In light of this, it's curious that Exel Composites Oyj's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Exel Composites Oyj appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Exel Composites Oyj's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Exel Composites Oyj (1 can't be ignored!) that you should be aware of before investing here.

If you're unsure about the strength of Exel Composites Oyj's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報