Sensus Healthcare And 2 Other Penny Stocks Worth Considering

As the United States stock market kicks off the new year with mixed results, investors are keenly observing opportunities that might arise amid fluctuating indices. Penny stocks, often seen as a vestige of bygone trading days, continue to capture interest due to their potential for high returns and accessibility for smaller investors. Despite their name, these stocks can offer substantial value when backed by solid financials and strategic positioning in the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.49 | $533.62M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.90 | $687.16M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8251 | $141.11M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.27 | $550.22M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.11 | $1.27B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.07 | $528.35M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Cricut (CRCT) | $4.95 | $1.05B | ✅ 2 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.99105 | $7.2M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.95 | $89.49M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 343 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Sensus Healthcare (SRTS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sensus Healthcare, Inc. is a medical device company that manufactures and sells radiation therapy devices to healthcare providers globally, with a market cap of $65.37 million.

Operations: The company generates revenue from its Medical Laser Systems segment, which amounted to $35.61 million.

Market Cap: $65.37M

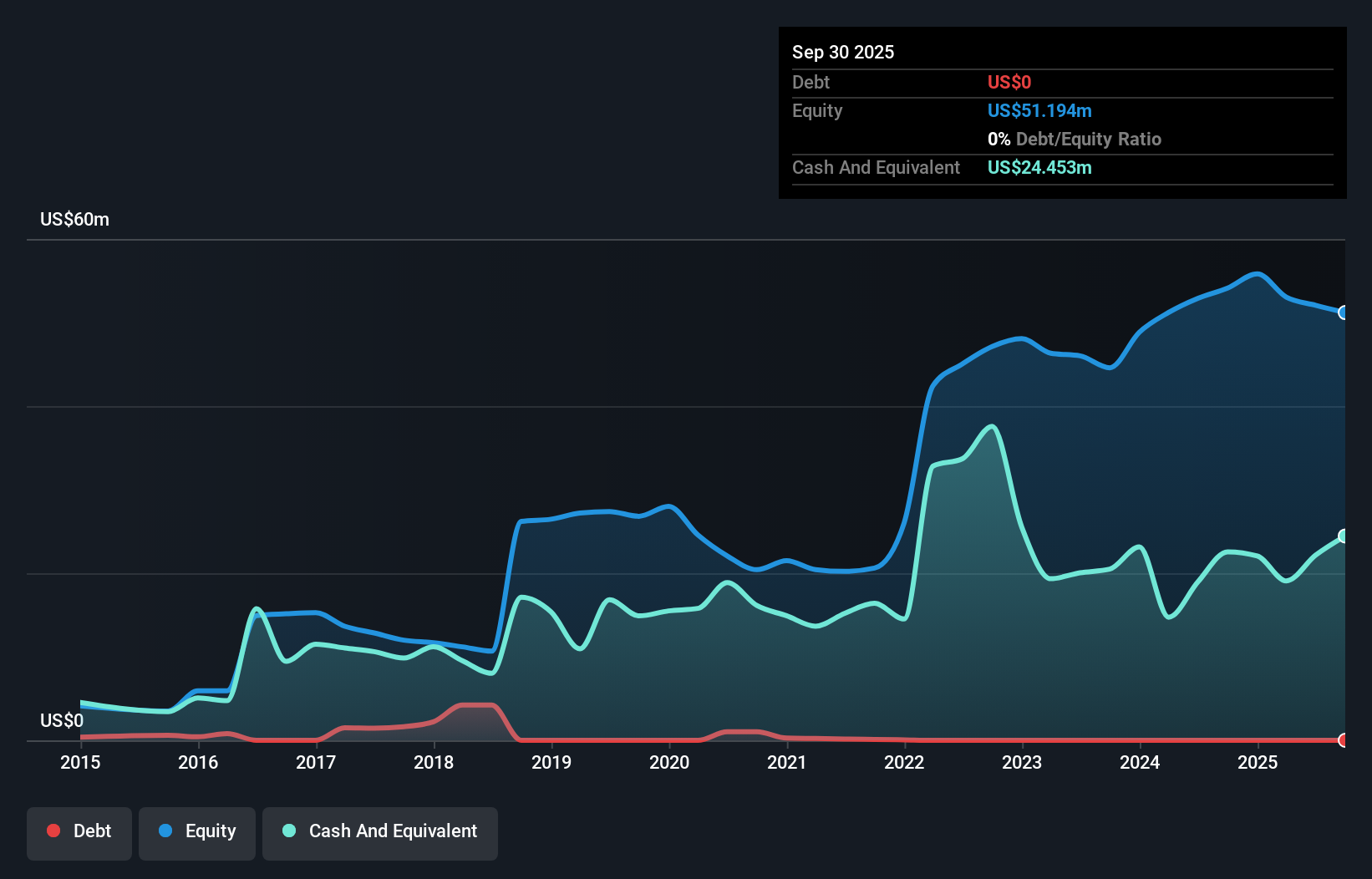

Sensus Healthcare, Inc., a medical device company with a market cap of US$65.37 million, is navigating the challenges typical of penny stocks. Despite being unprofitable with a negative return on equity and declining sales in recent quarters, the company remains debt-free and has strong asset coverage for liabilities. The management team is experienced, with key leadership changes aimed at enhancing global sales and commercial strategy following new reimbursement codes for its technologies. Analysts anticipate significant earnings growth ahead, although past volatility remains stable. Recent board changes reflect ongoing efforts to strengthen governance amid evolving market dynamics.

- Click to explore a detailed breakdown of our findings in Sensus Healthcare's financial health report.

- Examine Sensus Healthcare's earnings growth report to understand how analysts expect it to perform.

BioLargo (BLGO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BioLargo, Inc. invents, develops, and commercializes various platform technologies with a market cap of $58.03 million.

Operations: The company generates revenue from its BLEST segment, which accounts for $2.84 million, and its ONM Environmental segment, contributing $8.74 million.

Market Cap: $58.03M

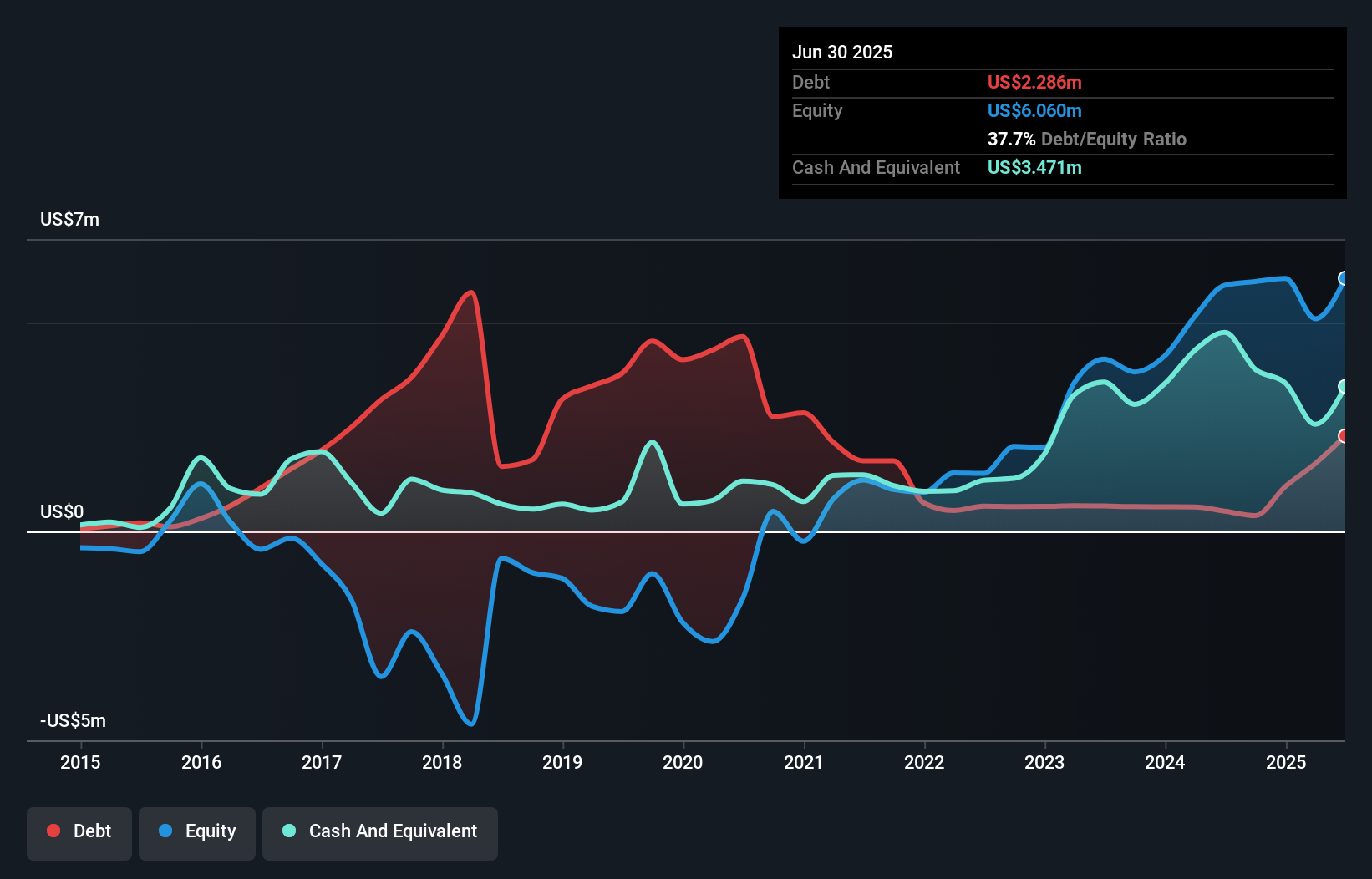

BioLargo, Inc. faces challenges typical of penny stocks, including unprofitability and a negative return on equity. Recent earnings reports show declining revenue and increased net loss year-over-year, with a current market cap of US$58.03 million. Despite these hurdles, the company has reduced its debt-to-equity ratio significantly over five years and maintains more cash than total debt. Short-term assets exceed both short- and long-term liabilities, providing some financial stability. The seasoned management team continues to engage in industry conferences to bolster visibility amid ongoing efforts to improve financial performance within a constrained cash runway environment.

- Navigate through the intricacies of BioLargo with our comprehensive balance sheet health report here.

- Understand BioLargo's earnings outlook by examining our growth report.

Radnostix (INIS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Radnostix, Inc. operates in the nuclear medicine and life sciences sectors by manufacturing and selling calibration and reference standards, cobalt-60 products, sodium iodide I-131 drug product, and radiochemicals both domestically and internationally, with a market cap of $32.35 million.

Operations: The company generates revenue from Cobalt Products ($2.24 billion), Theranostics Products ($6.93 billion), and Calibration & Reference Products ($4.72 billion).

Market Cap: $32.35M

Radnostix, Inc., recently renamed from International Isotopes Inc., operates in the nuclear medicine sector with a market cap of US$32.35 million. Despite generating significant revenue from its Cobalt, Theranostics, and Calibration & Reference Products lines, the company remains unprofitable with a negative return on equity and increasing losses over five years. Its high net debt-to-equity ratio of 106.8% suggests financial leverage concerns, although short-term assets cover immediate liabilities. The board is experienced, but share price volatility persists. Recent bylaw changes aim to improve governance while new board member Dr. Duke Fu brings expertise in nuclear pharmaceuticals and regulatory compliance.

- Click here and access our complete financial health analysis report to understand the dynamics of Radnostix.

- Explore historical data to track Radnostix's performance over time in our past results report.

Next Steps

- Explore the 343 names from our US Penny Stocks screener here.

- Interested In Other Possibilities? The latest GPUs need a type of rare earth metal called Terbium and there are only 38 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報