US Stock Forecast | Futures of the three major stock indexes are rising, Tesla (TSLA.US) Q4 delivery data will be released today

Pre-market market trends

1. Before the US stock market on January 2 (Friday), futures on the three major US stock indexes rose sharply. As of press release, Dow futures were up 0.45%, S&P 500 futures were up 0.62%, and NASDAQ futures were up 1.10%.

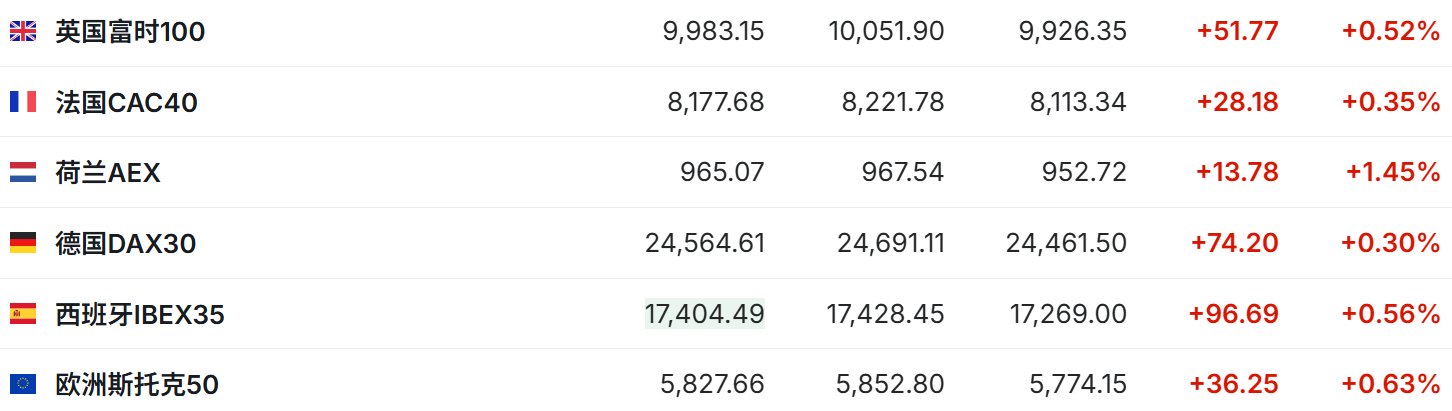

2. As of press release, the German DAX index rose 0.30%, the UK FTSE 100 index rose 0.52%, the French CAC40 index rose 0.35%, and the European Stoxx 50 index rose 0.63%.

3. As of press release, WTI crude oil fell 0.31% to $57.24 per barrel. Brent crude oil fell 0.35% to $60.64 per barrel.

Market news

The yield on 30-year US Treasury bonds hit a four-month high, and optimistic economic expectations seriously dampened safe-haven demand. US bonds fell on the first trading day of 2026, with 30-year US Treasury yields rising to the highest level since early September last year, as market optimism about US growth prospects weakened demand for safe-haven assets. The 30-year US Treasury yield once climbed 4 basis points to 4.88%; the 10-year US Treasury yield climbed 2 basis points to 4.19%. Prior to that, data showed that the number of jobless claims in the US fell to one of the lowest levels since the beginning of last week. Eugene Leow, a fixed income strategist at DBS Bank, said, “The rise in long-term yield fluctuations may reflect increased optimism about the US economy, which may also be echoed in the stock market.”

Oil prices stabilized at the beginning of the new year, and traders weighed OPEC+ meetings and geographical risks. After experiencing the biggest annual decline since 2020, oil prices stabilized on the first trading day of 2026, and traders weighed the upcoming OPEC+ meeting and geopolitical concerns. Due to an increase in oil supply from OPEC+ and its rivals, and a slowdown in global demand growth, oil prices fell by a cumulative total of nearly 20% in 2025, the biggest annual decline since 2020. Key OPEC+ member states, mainly Saudi Arabia and Russia, will hold a monthly video conference on January 4. According to three sources, against the backdrop of increasingly obvious signs of global oil oversupply, OPEC+ is expected to stick to its planned suspension of production increases when it meets this weekend.

After tightening supply drove copper prices to their biggest annual increase in 16 years, they rose again in the beginning of 2026. Copper prices resumed rising on the first trading day of 2026, in anticipation of tightening market supply. As of press release, LME copper futures rose 0.63% to $12543.70 per ton. In the past 2025, trade misalignment, geopolitical uncertainty, and supply shocks all contributed to a sharp rise in copper prices. LME copper prices rose 42% cumulatively in 2025, the biggest annual increase since 2009, and hit record highs one after another in a wave of strong increases at the end of last year.

Barclays: The next time the Federal Reserve cuts interest rates is expected in March. Barclays's American economists said in a report that the bank maintained its expectations that the Federal Reserve would cut interest rates twice in 2026, cutting interest rates by 25 basis points each in March and June, respectively. They believe that the risk surrounding this baseline forecast is biased towards delaying interest rate cuts. According to these economists, the minutes of the Federal Reserve's December policy meeting (where the Fed cut interest rates by 25 basis points) are in line with Barclays expectations that the January meeting will stand still, “because the US Federal Open Market Committee will take time to assess the impact of recent interest rate cuts.”

Individual stock news

Musk's “Autopilot Mania” can't hide the cold winter of sales! Tesla (TSLA.US) faces an even more severe test in 2026. According to the aggregated data, the market expects Tesla to be announced this Friday. The delivery volume for the fourth quarter was about 440,900 vehicles, down 11% from the previous year. Tesla also released a rare average forecast by self-developed analysts this week. Their expectations are even more pessimistic, believing that deliveries in the fourth quarter will drop 15% year over year. Wall Street is also increasingly pessimistic about Tesla's 2026 performance prospects. At this point two years ago, analysts also predicted that Tesla would deliver more than 3 million vehicles throughout the year; today, this average forecast has plummeted to about 1.8 million units. Investors are increasingly looking for Musk's optimistic vision of autonomous vehicles, yet the company's desire to win the favor of actual car buyers is a different story. Despite record deliveries in the third quarter, the company's car sales in the past six months are likely to be lower than the same period a year ago.

Shipments in the fourth quarter are estimated to plummet to 45,000 units. Apple (AAPL.US) plans to cut the production scale of Vision Pro. Due to sluggish consumer demand, Apple has reduced the scale of production and marketing of its Vision Pro headsets. According to IDC data, Apple's manufacturing partner Lixun Precision in China stopped production of Vision Pro at the beginning of last year. In 2024 (the year the device was released), it shipped 390,000 units. IDC estimates that Apple will only deliver 45,000 new devices in the fourth quarter of 2025 (including the busy holiday shopping season).

Ecovyst (ECVT.US) sold its Advanced Materials and Catalysts business unit to Technip Energies for $530 million. Ecovyst has completed the sale of its Advanced Materials and Catalysts (AM&C) division to Technip Energies, with net proceeds of approximately $530 million. With the acquisition of this business unit, Technip Energies expanded its expertise in advanced catalysts and accelerated the growth of its heat pump systems business.

Nasdaq

Nasdaq 華爾街日報

華爾街日報