Earnings Preview: What To Expect From Church & Dwight's Report

With a market cap of $20.1 billion, Church & Dwight Co., Inc. (CHD) is a consumer packaged goods company that develops, manufactures, and markets household, personal care, and specialty products across its Consumer Domestic, Consumer International, and Specialty Products segments. It sells a wide portfolio of well-known brands across retail, e-commerce, industrial, and agricultural channels worldwide.

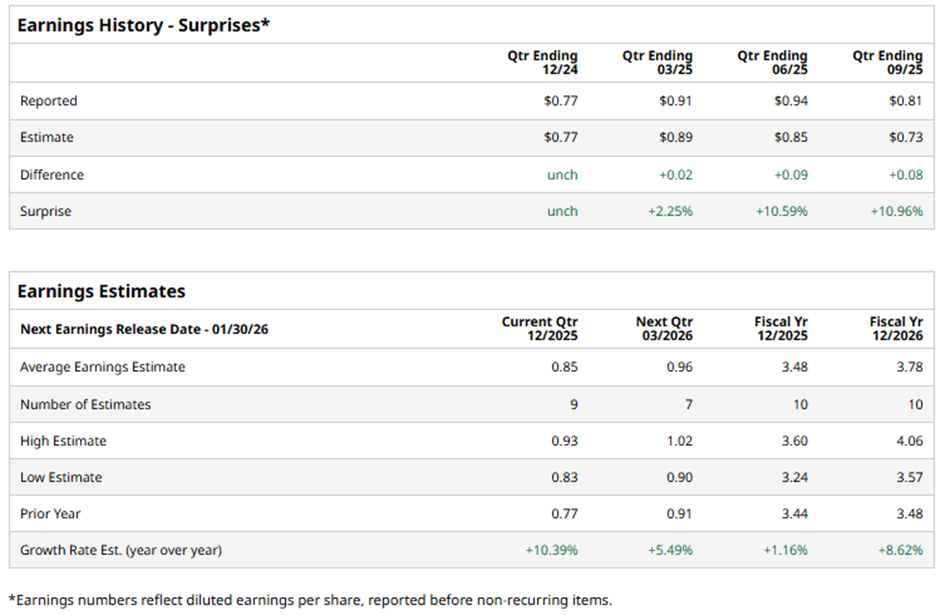

The Ewing, New Jersey-based company is set to release its fiscal Q4 2025 results soon. Ahead of this event, analysts project CHD to report an adjusted EPS of $0.85, a 10.4% increase from $0.77 in the year-ago quarter. It has surpassed or met Wall Street's bottom-line estimates in the past four quarters.

For fiscal 2025, analysts forecast the maker of household and personal products to report adjusted EPS of $3.48, up 1.2% from $3.44 in fiscal 2024. Moreover, adjusted EPS is expected to grow 8.6% year-over-year to $3.78 in fiscal 2026.

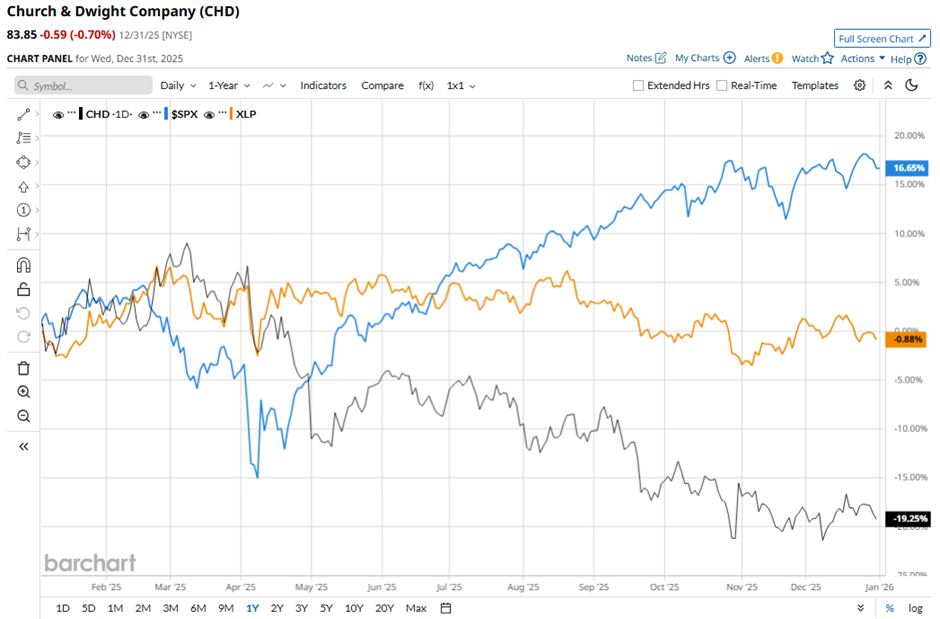

Shares of Church & Dwight have dipped 19.9% over the past 52 weeks, underperforming the broader S&P 500 Index's ($SPX) 16.4% gain and the State Street Consumer Staples Select Sector SPDR ETF's (XLP) marginal decline over the same time frame.

Shares of Church & Dwight climbed 7.2% on Oct. 31 after the company reported stronger-than-expected Q3 2025 results, with adjusted EPS of $0.81 beating Wall Street estimates and exceeding the company’s own outlook of $0.72. Revenue rose 5% year-over-year to $1.59 billion, surpassing forecasts, while all three segments delivered solid organic growth and cash from operations jumped 19.6% to $435.5 million. Also, management raised its full-year guidance, including adjusted EPS of about $3.49, higher cash from operations of approximately $1.2 billion, and a narrower-than-expected gross margin contraction.

Analysts' consensus view on CHD stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 21 analysts covering the stock, nine suggest a "Strong Buy," one recommends a "Moderate Buy," eight give a "Hold," and three have a "Strong Sell." The average analyst price target for Church & Dwight is $97.78, suggesting a potential upside of 16.6% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Nasdaq

Nasdaq 華爾街日報

華爾街日報