Exploring 3 Undervalued Small Caps With Recent Insider Buying

As 2025 draws to a close, the U.S. stock market has experienced a robust year with major indices like the Nasdaq, S&P 500, and Dow Jones posting significant gains despite ending on a four-session losing streak. Amidst these broader market dynamics, small-cap stocks continue to capture investor interest due to their potential for growth and value opportunities. In this context, identifying promising small-cap stocks often involves looking at those with strong fundamentals and recent insider buying activity as indicators of potential undervaluation in the current economic climate.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| MVB Financial | 10.1x | 1.9x | 23.58% | ★★★★★★ |

| Peoples Bancorp | 10.4x | 1.9x | 47.64% | ★★★★★☆ |

| Shore Bancshares | 10.4x | 2.8x | 44.05% | ★★★★☆☆ |

| Metropolitan Bank Holding | 12.4x | 3.0x | 35.99% | ★★★★☆☆ |

| Union Bankshares | 9.6x | 2.1x | 22.04% | ★★★★☆☆ |

| S&T Bancorp | 11.3x | 3.8x | 37.72% | ★★★★☆☆ |

| Farmland Partners | 6.3x | 7.8x | -87.83% | ★★★★☆☆ |

| Citizens & Northern | 13.3x | 3.3x | 32.02% | ★★★☆☆☆ |

| Stock Yards Bancorp | 14.2x | 5.1x | 36.14% | ★★★☆☆☆ |

| Omega Flex | 18.5x | 3.0x | 0.68% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

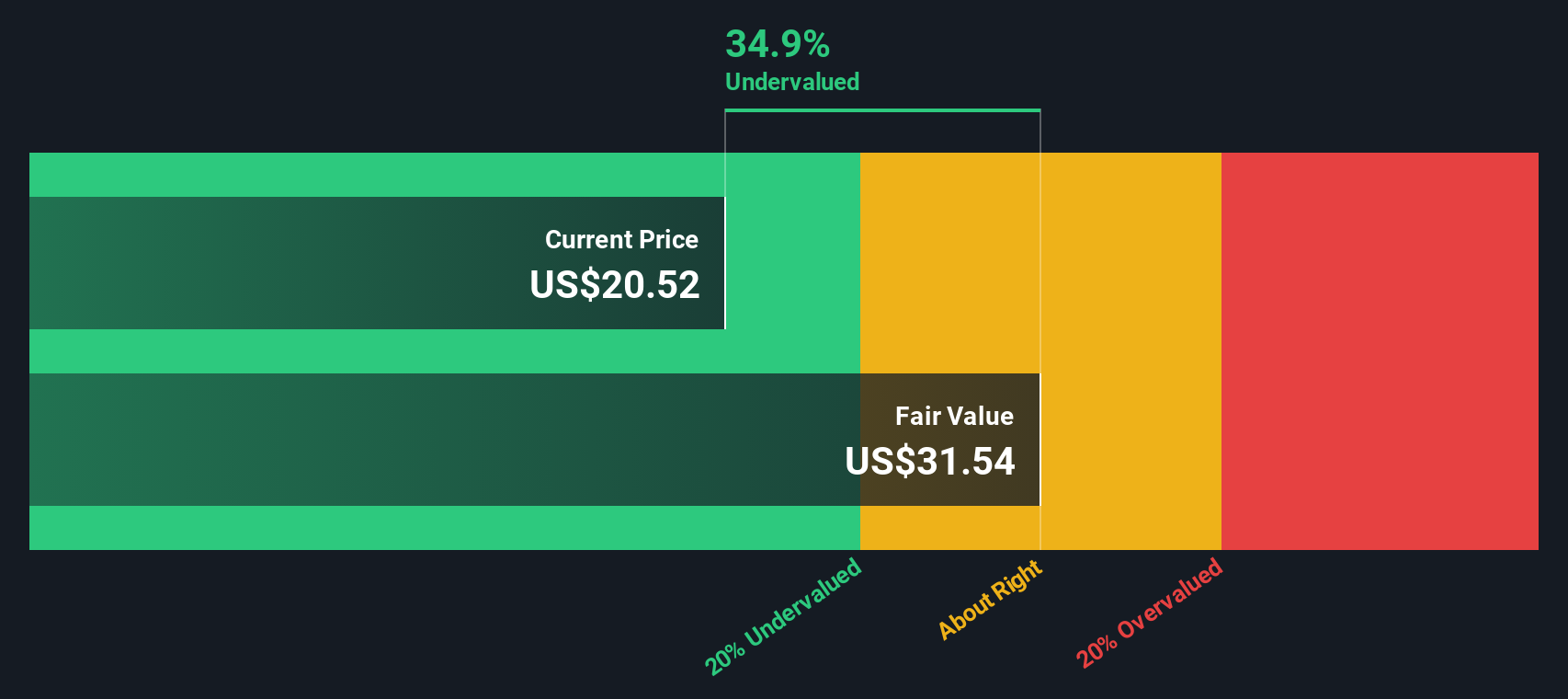

MVB Financial (MVBF)

Simply Wall St Value Rating: ★★★★★★

Overview: MVB Financial operates as a financial holding company providing core banking services, mortgage banking, and other financial solutions, with a market cap of approximately $0.24 billion.

Operations: Core Banking is the primary revenue stream, generating $126.58 million, while Mortgage Banking and Financial Holding Company contribute $7.09 million and $8.12 million, respectively. The company's net income margin has shown variability, reaching as high as 33.92% in early 2021 but adjusting to around 19.16% by late 2025. Operating expenses are a significant component of costs, with General & Administrative Expenses consistently being the largest expense category over time.

PE: 10.1x

MVB Financial, a smaller company in the financial sector, shows potential for value-focused investors. Recent insider confidence is evident with Michael Giorgio purchasing 5,700 shares valued at US$100,320. The company's net income surged to US$17.14 million in Q3 2025 from US$2.08 million the previous year. A consistent dividend of $0.17 per share underscores stability while a completed buyback program reflects strategic capital management. Earnings are projected to grow annually by 8.91%.

- Get an in-depth perspective on MVB Financial's performance by reading our valuation report here.

Gain insights into MVB Financial's past trends and performance with our Past report.

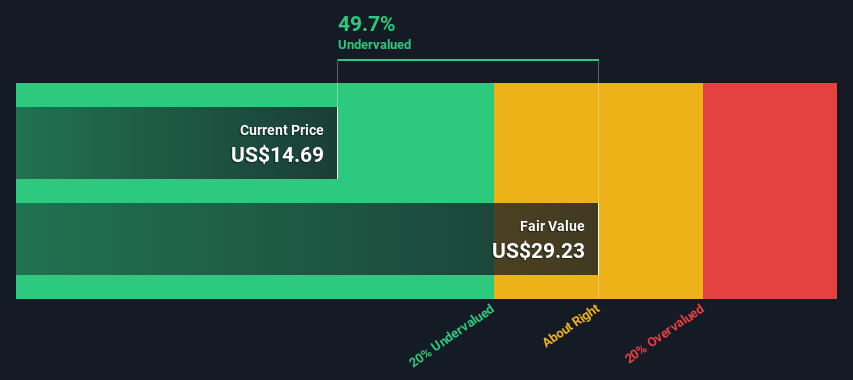

Colony Bankcorp (CBAN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Colony Bankcorp operates primarily through its Banking, Mortgage Banking, and Small Business Specialty Lending divisions, with a market capitalization of $0.17 billion.

Operations: Colony Bankcorp's revenue primarily stems from its Banking Division, with additional contributions from the Mortgage Banking and Small Business Specialty Lending divisions. The company's net income margin has shown an upward trend, reaching 22.72% in recent periods. Operating expenses are largely driven by general and administrative costs, which have consistently been a significant portion of total expenses over time.

PE: 11.2x

Colony Bankcorp, a smaller player in the financial sector, has demonstrated insider confidence with recent share purchases. The company reported a net income of US$5.82 million for Q3 2025, up from US$5.63 million the previous year, alongside net interest income growth to US$22.7 million from US$18.54 million. Despite reporting higher loan charge-offs at $1.83 million compared to $139,000 last year, earnings are projected to grow by 27% annually, highlighting potential for future value appreciation amidst its strategic initiatives like expanding brand awareness under new leadership and extending its buyback plan through 2026.

- Delve into the full analysis valuation report here for a deeper understanding of Colony Bankcorp.

Review our historical performance report to gain insights into Colony Bankcorp's's past performance.

Farmland Partners (FPI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Farmland Partners is a real estate investment trust (REIT) focusing on owning and managing high-quality farmland across North America, with a market cap of approximately $0.57 billion.

Operations: The company generates revenue primarily through its commercial real estate investments, with a notable gross profit margin of 80.63% as of the latest period. Operating expenses and non-operating expenses are significant components, impacting overall profitability.

PE: 6.3x

Farmland Partners, a small cap in the U.S., recently announced a special dividend of $0.20 per share, payable on January 7, 2026. Despite declining third-quarter revenue to US$11.25 million from US$13.32 million year-over-year, net income rose to US$10.12 million for the nine months ended September 30, 2025. The company completed a significant buyback program by repurchasing over half its shares since May 2017 for approximately $195.97 million, signaling potential insider confidence and value recognition amidst forecasted earnings declines over the next three years.

Turning Ideas Into Actions

- Access the full spectrum of 78 Undervalued US Small Caps With Insider Buying by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報