3 Stocks Estimated To Be Trading At Discounts Up To 47.2%

As 2025 draws to a close, the U.S. stock market has experienced a robust year with major indexes like the Nasdaq, S&P 500, and Dow Jones Industrial Average posting significant gains despite recent losses. In light of these market dynamics, identifying undervalued stocks that are trading at discounts can be an attractive strategy for investors looking to capitalize on potential growth opportunities within this fluctuating environment.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Valley National Bancorp (VLY) | $11.68 | $23.05 | 49.3% |

| SmartStop Self Storage REIT (SMA) | $30.94 | $60.67 | 49% |

| Investar Holding (ISTR) | $26.72 | $52.64 | 49.2% |

| Horizon Bancorp (HBNC) | $16.96 | $33.83 | 49.9% |

| Hims & Hers Health (HIMS) | $32.47 | $63.39 | 48.8% |

| Heritage Financial (HFWA) | $23.65 | $46.41 | 49% |

| Gaotu Techedu (GOTU) | $2.32 | $4.56 | 49.1% |

| Dime Community Bancshares (DCOM) | $30.09 | $60.07 | 49.9% |

| CNB Financial (CCNE) | $26.17 | $50.87 | 48.6% |

| BillionToOne (BLLN) | $81.84 | $160.13 | 48.9% |

We're going to check out a few of the best picks from our screener tool.

AST SpaceMobile (ASTS)

Overview: AST SpaceMobile, Inc. designs and develops the BlueBird satellite constellation in the United States, with a market cap of $26.89 billion.

Operations: The company's revenue segment includes Wireless Communications Equipment, generating $18.53 million.

Estimated Discount To Fair Value: 29.0%

AST SpaceMobile is trading at US$72.63, significantly below its estimated fair value of US$102.27, suggesting potential undervaluation based on cash flows. Despite recent insider selling and share price volatility, the company forecasts robust revenue growth at 44.4% annually and aims for profitability within three years. Recent expansions in manufacturing facilities and strategic partnerships with major telecoms like Verizon enhance its operational capabilities, positioning it well for future growth in space-based cellular broadband connectivity.

- Our expertly prepared growth report on AST SpaceMobile implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of AST SpaceMobile.

Viant Technology (DSP)

Overview: Viant Technology Inc. operates as an advertising technology company with a market cap of $751.70 million.

Operations: The company generates revenue primarily from its Enterprise Technology Platform, which amounted to $324.13 million.

Estimated Discount To Fair Value: 30.7%

Viant Technology, trading at US$12.04, is undervalued by over 20% compared to its estimated fair value of US$17.36. Despite low forecasted return on equity, the company anticipates significant earnings growth of 44.21% annually, outpacing the US market average. Strategic partnerships with iHeartMedia and Molson Coors enhance its programmatic advertising capabilities and addressability across audio networks and CTV channels, potentially driving revenue growth faster than the broader market's pace.

- Upon reviewing our latest growth report, Viant Technology's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Viant Technology.

VTEX (VTEX)

Overview: VTEX, along with its subsidiaries, offers a software-as-a-service digital commerce platform for enterprise brands and retailers, with a market cap of $668.10 million.

Operations: The company's revenue is primarily derived from its Internet Software & Services segment, totaling $234.12 million.

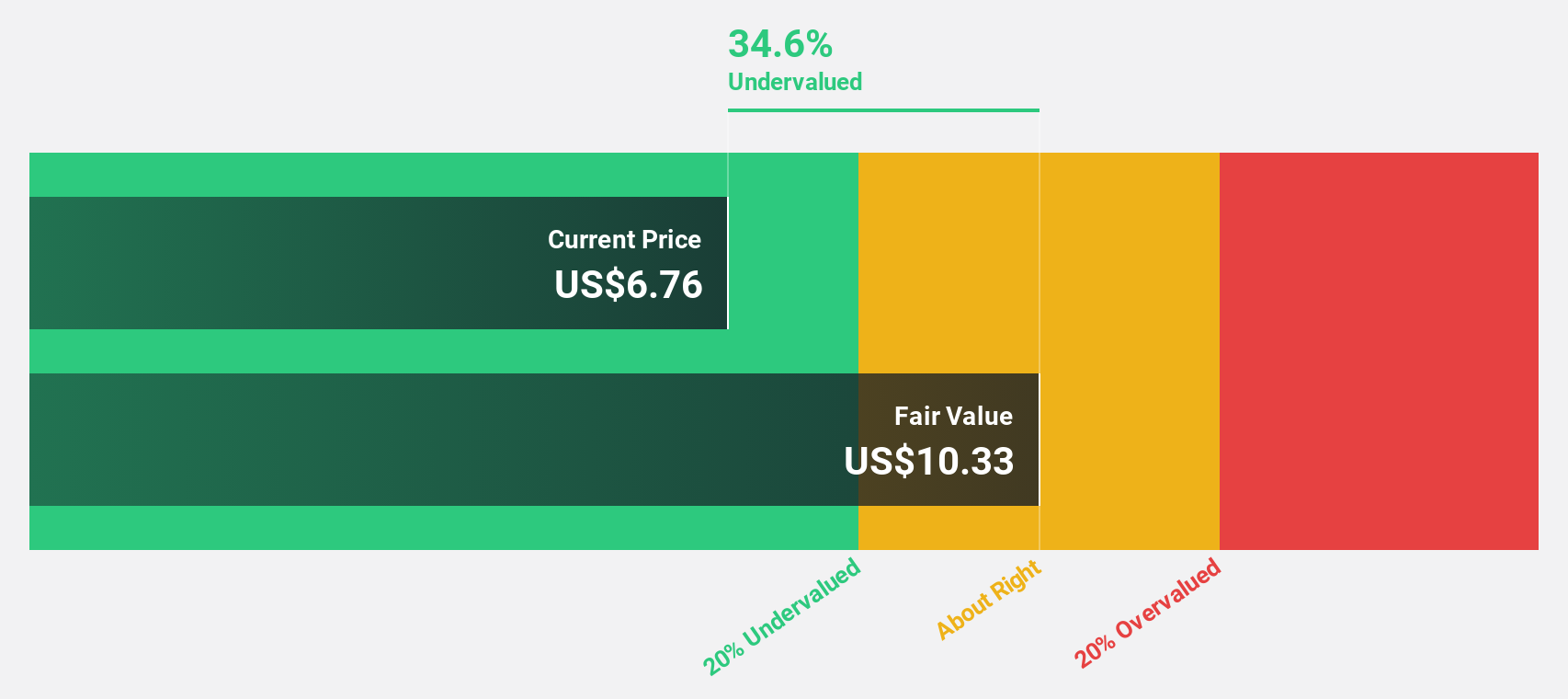

Estimated Discount To Fair Value: 47.2%

VTEX, trading at US$3.76, is significantly undervalued with a fair value estimate of US$7.12, offering potential upside based on cash flows. Despite a low forecasted return on equity of 12.7%, earnings are expected to grow by 36.71% annually, surpassing the broader market's growth rate. Recent earnings reports show consistent revenue and net income growth year-over-year, supported by strategic share buybacks worth US$27.59 million, enhancing shareholder value amidst robust financial performance projections.

- Insights from our recent growth report point to a promising forecast for VTEX's business outlook.

- Get an in-depth perspective on VTEX's balance sheet by reading our health report here.

Key Takeaways

- Click this link to deep-dive into the 187 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報