January 2026's Leading Growth Companies With Insider Influence

As 2025 concludes, the U.S. stock market has shown impressive resilience with major indexes like the Nasdaq, S&P 500, and Dow Jones Industrial Average posting substantial gains despite a challenging final trading week. In this environment of robust growth and evolving economic policies, companies with high insider ownership can offer unique insights into their potential for success, as insiders often have a deeper understanding of their company's prospects and challenges.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Super Micro Computer (SMCI) | 13.9% | 50.7% |

| StubHub Holdings (STUB) | 14.1% | 59% |

| SES AI (SES) | 12% | 68.9% |

| Prairie Operating (PROP) | 31.8% | 100% |

| Niu Technologies (NIU) | 37.2% | 93.7% |

| Credo Technology Group Holding (CRDO) | 10.1% | 30.7% |

| Corcept Therapeutics (CORT) | 11.5% | 44% |

| Bitdeer Technologies Group (BTDR) | 33.4% | 135.5% |

| Atour Lifestyle Holdings (ATAT) | 18% | 24.4% |

| Astera Labs (ALAB) | 10.5% | 29.0% |

We're going to check out a few of the best picks from our screener tool.

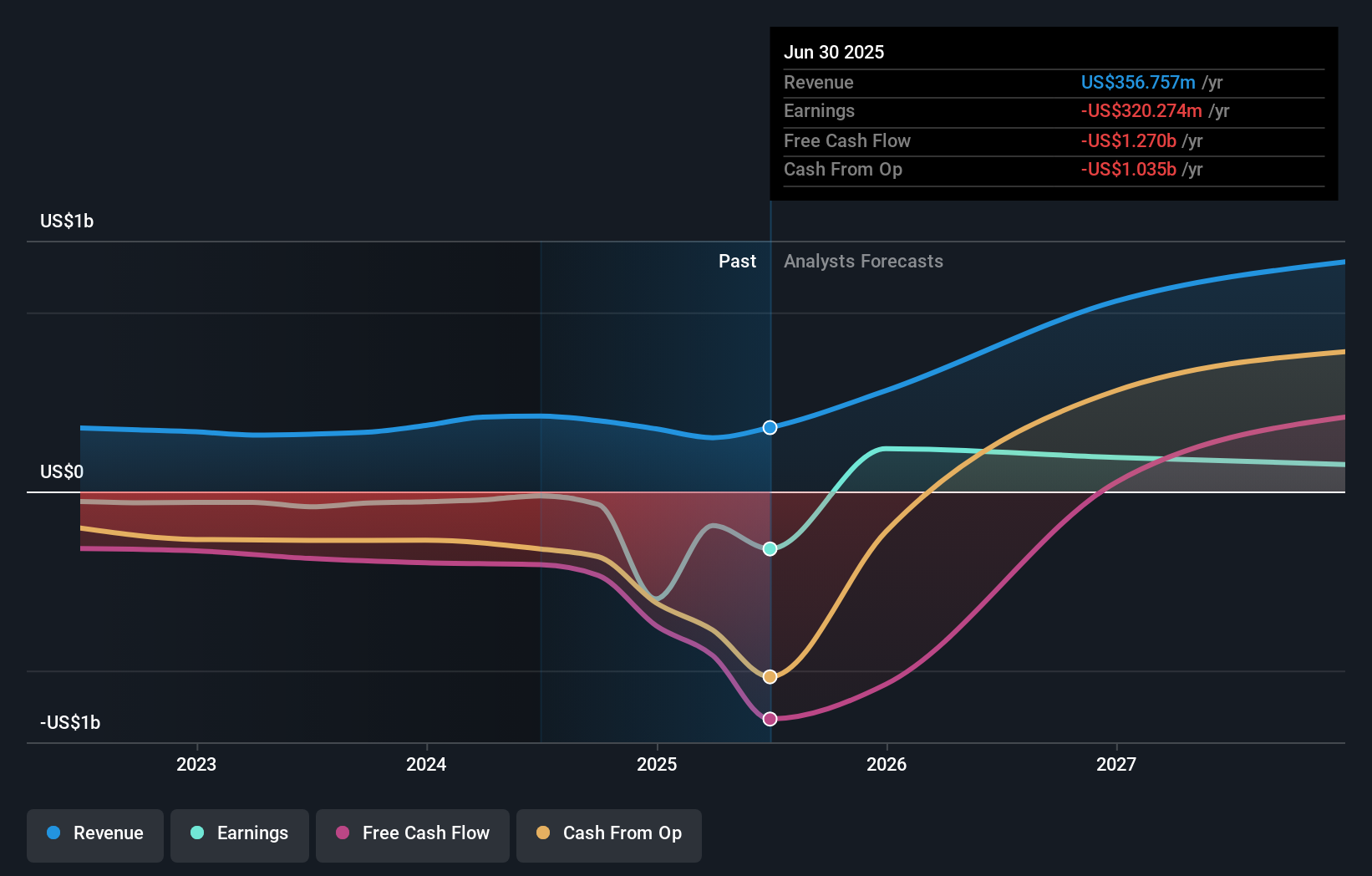

Bitdeer Technologies Group (BTDR)

Simply Wall St Growth Rating: ★★★★★★

Overview: Bitdeer Technologies Group is a technology company specializing in blockchain and high-performance computing (HPC) with operations in Singapore, the United States, Bhutan, and Norway, and has a market cap of $2.65 billion.

Operations: The company generates revenue primarily from its data processing segment, which amounts to $464.44 million.

Insider Ownership: 33.4%

Earnings Growth Forecast: 135.5% p.a.

Bitdeer Technologies Group is trading significantly below its estimated fair value, suggesting potential undervaluation. The company forecasts robust revenue growth of 65.6% annually, surpassing the US market average. Despite high volatility in share price and recent shareholder dilution, Bitdeer is expected to achieve profitability within three years, with a high future return on equity. Recent operating results indicate substantial growth in hash rate and Bitcoin mining capabilities, although legal challenges may pose risks.

- Unlock comprehensive insights into our analysis of Bitdeer Technologies Group stock in this growth report.

- Our valuation report unveils the possibility Bitdeer Technologies Group's shares may be trading at a discount.

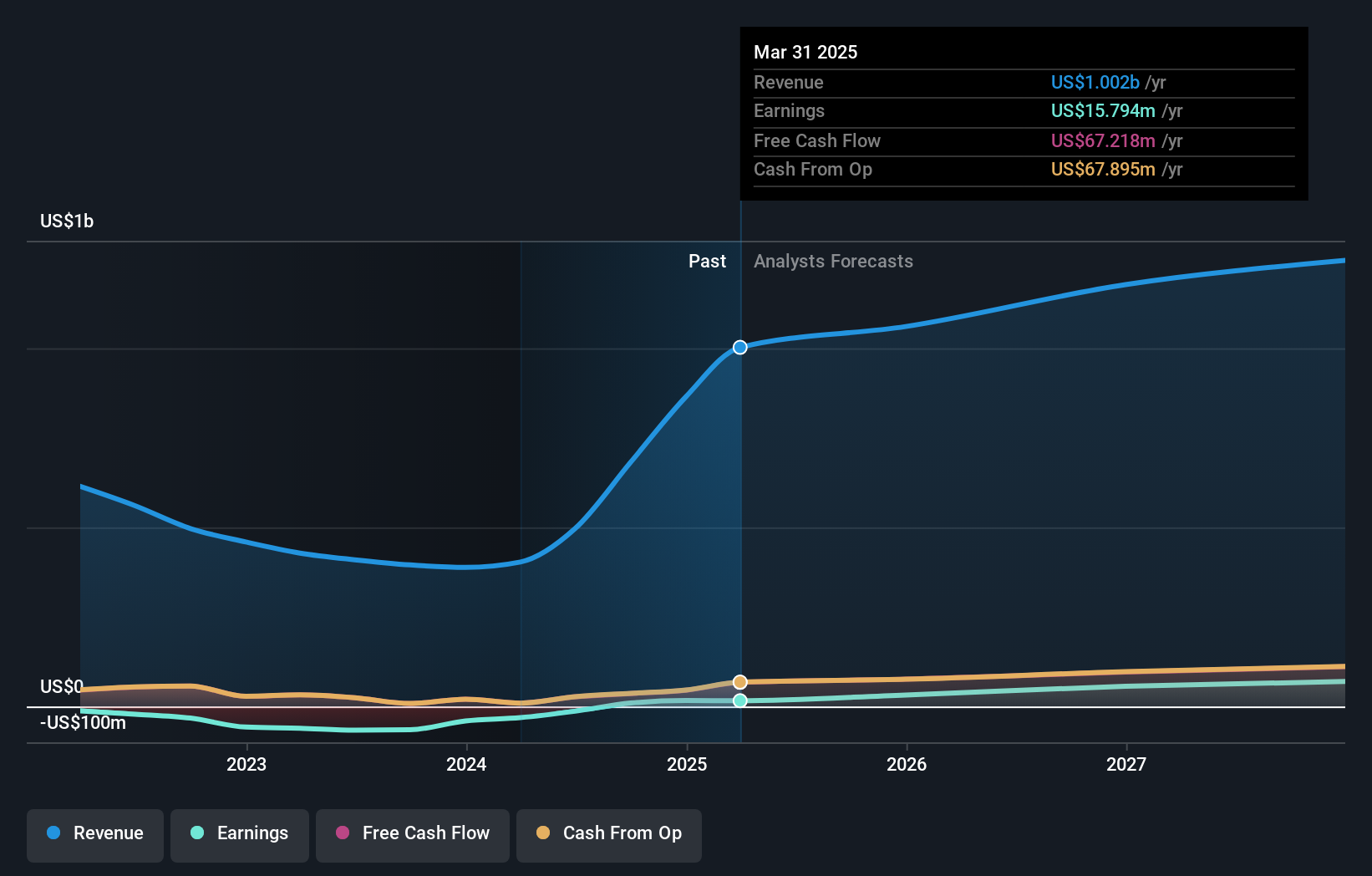

MediaAlpha (MAX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: MediaAlpha, Inc. operates an insurance customer acquisition platform in the United States and has a market cap of approximately $844 million.

Operations: The company generates revenue of $1.12 billion from its Internet Information Providers segment.

Insider Ownership: 20.7%

Earnings Growth Forecast: 51.7% p.a.

MediaAlpha is trading well below its estimated fair value, indicating potential undervaluation. Despite slower revenue growth forecasts of 6.9% annually compared to the US market, earnings are expected to grow significantly at 51.74% per year, potentially achieving profitability within three years with a very high future return on equity. Recent insider activity shows more buying than selling, although significant selling occurred in the past quarter. Recent by-law amendments and board changes reflect ongoing corporate governance adjustments.

- Click to explore a detailed breakdown of our findings in MediaAlpha's earnings growth report.

- According our valuation report, there's an indication that MediaAlpha's share price might be on the cheaper side.

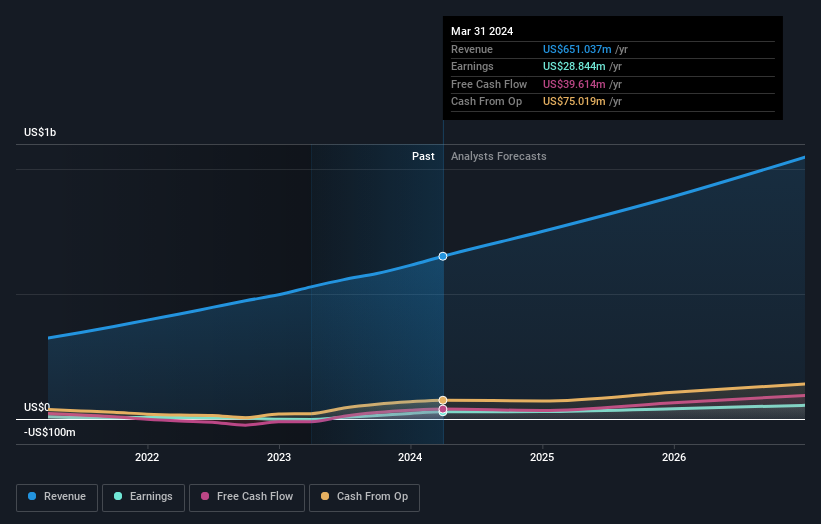

Paymentus Holdings (PAY)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Paymentus Holdings, Inc. offers cloud-based bill payment technology and solutions both in the United States and internationally, with a market cap of approximately $3.96 billion.

Operations: Paymentus Holdings generates revenue primarily through its services to financial companies, amounting to $1.12 billion.

Insider Ownership: 30%

Earnings Growth Forecast: 28.2% p.a.

Paymentus Holdings is experiencing robust growth, with earnings expected to grow significantly at 28.2% annually, outpacing the US market. Revenue is forecasted to increase by 19.6% per year, also surpassing market averages. Recent quarterly results showed strong performance with US$310.74 million in sales and a net income of US$17.74 million for Q3 2025, reflecting substantial year-over-year growth. The company maintains high insider ownership but lacks recent insider trading activity.

- Delve into the full analysis future growth report here for a deeper understanding of Paymentus Holdings.

- The valuation report we've compiled suggests that Paymentus Holdings' current price could be inflated.

Where To Now?

- Get an in-depth perspective on all 213 Fast Growing US Companies With High Insider Ownership by using our screener here.

- Looking For Alternative Opportunities? Explore 29 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報