Uncovering US Undiscovered Gems in January 2026

As we step into 2026, the U.S. stock market reflects a year of robust growth despite ending on a slightly sour note with several consecutive losses. With major indices like the Nasdaq and S&P 500 posting significant gains driven by technology firms, investors are keenly observing how these trends might influence opportunities in smaller-cap stocks. Identifying promising stocks often involves looking for companies that can thrive amidst broader market shifts and economic indicators, particularly those poised to capitalize on emerging technologies or niche markets.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Morris State Bancshares | 1.99% | 2.14% | 1.63% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Franklin Financial Services | 127.01% | 5.48% | -4.56% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| First Northern Community Bancorp | NA | 7.79% | 11.96% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| Pure Cycle | 4.76% | 6.42% | -1.58% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Capital City Bank Group (CCBG)

Simply Wall St Value Rating: ★★★★★★

Overview: Capital City Bank Group, Inc. is a financial holding company for Capital City Bank, offering diverse banking services to individual and corporate clients with a market capitalization of $726.62 million.

Operations: Capital City Bank Group generates revenue primarily from its commercial banking segment, which contributed $246.43 million.

Capital City Bank Group, a financial entity with total assets of US$4.3 billion and equity of US$540.6 million, has shown steady growth with earnings increasing 14.5% annually over the past five years. Despite not outpacing the industry last year, its net interest margin stands at 4.1%, supported by a robust allowance for bad loans at 0.3% of total loans and appropriate non-performing loan levels. Recently, it declared a quarterly dividend of US$0.26 per share and completed a share buyback program amounting to US$2.06 million for 73,439 shares, reflecting strategic capital management efforts amidst leadership changes in retail operations.

- Navigate through the intricacies of Capital City Bank Group with our comprehensive health report here.

Gain insights into Capital City Bank Group's past trends and performance with our Past report.

Western New England Bancorp (WNEB)

Simply Wall St Value Rating: ★★★★★★

Overview: Western New England Bancorp, Inc. serves as the holding company for Westfield Bank, offering a variety of commercial and retail banking products and services to individuals and businesses, with a market cap of $255.83 million.

Operations: Westfield Bank, under Western New England Bancorp, generates revenue primarily from its community banking segment, totaling $79.08 million. The company's market capitalization stands at approximately $255.83 million.

Western New England Bancorp, with total assets of US$2.7 billion and equity of US$243.6 million, is making strides in the banking sector. Its earnings grew by 22.6% over the past year, surpassing the industry average of 18.5%. The bank's deposits stand at US$2.3 billion against loans totaling US$2.1 billion, showcasing a strong deposit base primarily from low-risk sources (94%). It maintains a sufficient allowance for bad loans at 0.3%, ensuring financial stability while offering dividends and completing share buybacks worth $0.26 million recently, reflecting shareholder confidence and robust financial health.

- Click here and access our complete health analysis report to understand the dynamics of Western New England Bancorp.

Understand Western New England Bancorp's track record by examining our Past report.

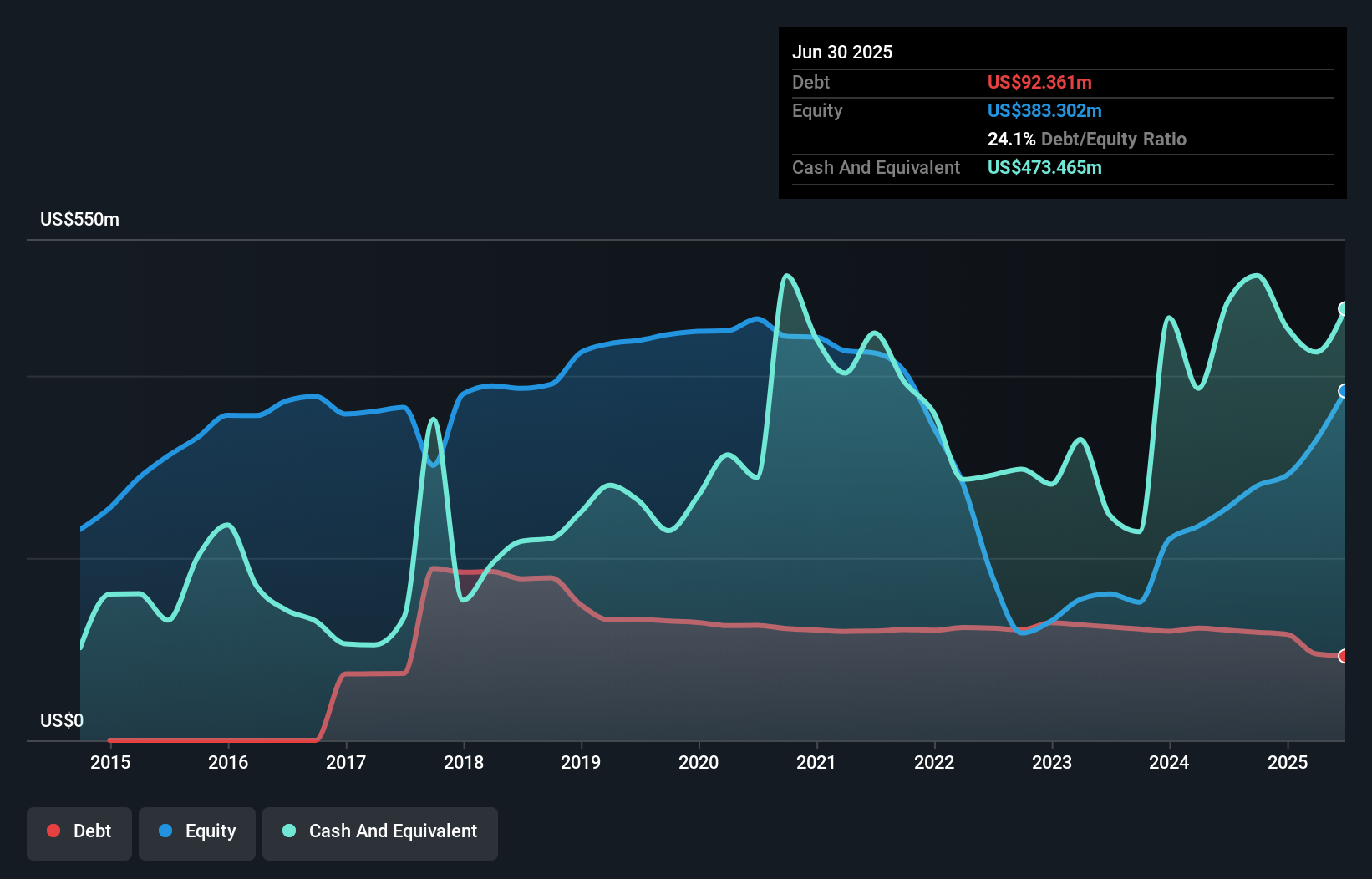

Heritage Insurance Holdings (HRTG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Heritage Insurance Holdings, Inc. operates through its subsidiaries to offer personal and commercial residential insurance products, with a market cap of approximately $855 million.

Operations: The primary revenue stream for Heritage Insurance Holdings comes from its residential property insurance segment, generating approximately $842.28 million.

Heritage Insurance Holdings, a nimble player in the insurance sector, has demonstrated impressive earnings growth of 106.7% over the past year, outpacing industry averages. Despite significant insider selling recently, its debt management is commendable with a reduction in the debt-to-equity ratio from 27.7% to 18.1% over five years. The company is trading at nearly 68% below its estimated fair value and maintains robust interest coverage with EBIT covering interest payments by 24 times. However, future earnings are expected to decline by an average of 5.1% annually over the next three years due to market challenges and rising costs.

Taking Advantage

- Access the full spectrum of 301 US Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報