Sentiment Still Eluding VNET Group, Inc. (NASDAQ:VNET)

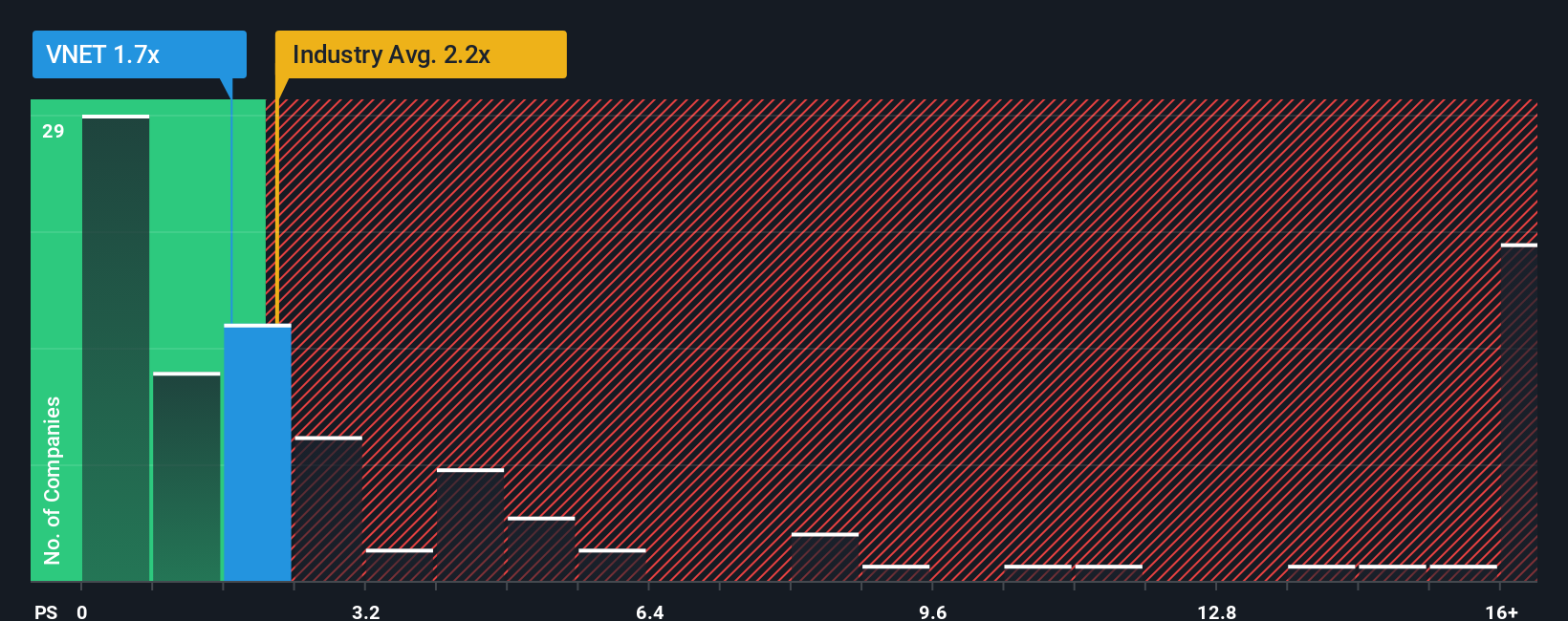

You may think that with a price-to-sales (or "P/S") ratio of 1.7x VNET Group, Inc. (NASDAQ:VNET) is a stock worth checking out, seeing as almost half of all the IT companies in the United States have P/S ratios greater than 2.2x and even P/S higher than 9x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for VNET Group

How Has VNET Group Performed Recently?

Recent revenue growth for VNET Group has been in line with the industry. It might be that many expect the mediocre revenue performance to degrade, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on VNET Group will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

VNET Group's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 20%. The strong recent performance means it was also able to grow revenue by 37% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 17% per year over the next three years. With the industry predicted to deliver 18% growth each year, the company is positioned for a comparable revenue result.

In light of this, it's peculiar that VNET Group's P/S sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

It looks to us like the P/S figures for VNET Group remain low despite growth that is expected to be in line with other companies in the industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

And what about other risks? Every company has them, and we've spotted 1 warning sign for VNET Group you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報