Investors Continue Waiting On Sidelines For HCA Healthcare, Inc. (NYSE:HCA)

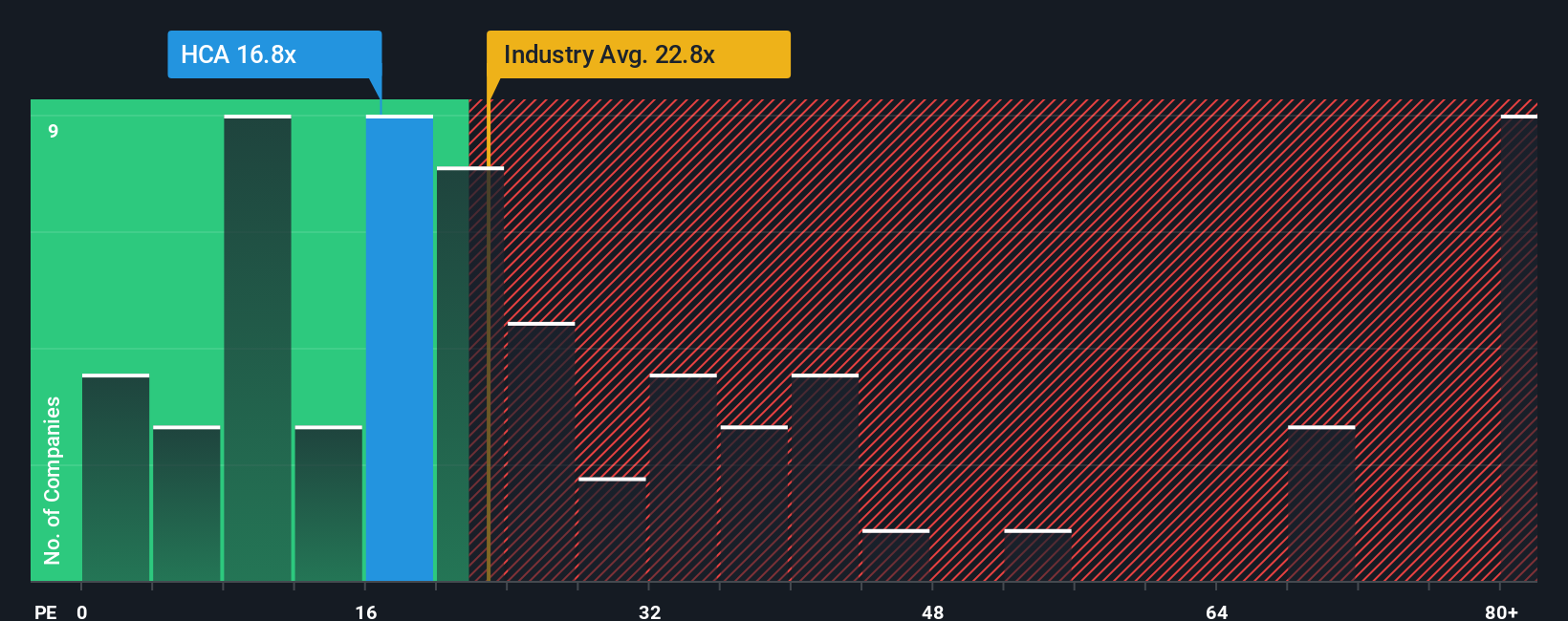

HCA Healthcare, Inc.'s (NYSE:HCA) price-to-earnings (or "P/E") ratio of 16.8x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 19x and even P/E's above 34x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been advantageous for HCA Healthcare as its earnings have been rising faster than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for HCA Healthcare

Is There Any Growth For HCA Healthcare?

There's an inherent assumption that a company should underperform the market for P/E ratios like HCA Healthcare's to be considered reasonable.

Retrospectively, the last year delivered an exceptional 16% gain to the company's bottom line. The latest three year period has also seen an excellent 54% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 11% each year as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 11% per year, which is not materially different.

In light of this, it's peculiar that HCA Healthcare's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that HCA Healthcare currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

You should always think about risks. Case in point, we've spotted 2 warning signs for HCA Healthcare you should be aware of, and 1 of them is a bit unpleasant.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報