3 European Stocks Estimated To Be Up To 46% Below Intrinsic Value

As the pan-European STOXX Europe 600 Index closes just shy of a record high amid positive sentiment about future earnings and economic prospects, investors are keenly observing potential opportunities in undervalued stocks. In such an environment, identifying stocks estimated to be significantly below their intrinsic value can provide compelling investment opportunities, as they may offer a margin of safety against market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimot (WSE:UNT) | PLN130.00 | PLN257.58 | 49.5% |

| Streamwide (ENXTPA:ALSTW) | €72.80 | €142.77 | 49% |

| LINK Mobility Group Holding (OB:LINK) | NOK33.90 | NOK66.31 | 48.9% |

| Kreate Group Oyj (HLSE:KREATE) | €12.55 | €24.87 | 49.5% |

| KB Components (OM:KBC) | SEK41.90 | SEK83.17 | 49.6% |

| Gesco (XTRA:GSC1) | €14.25 | €27.99 | 49.1% |

| Fodelia Oyj (HLSE:FODELIA) | €5.40 | €10.72 | 49.6% |

| Exail Technologies (ENXTPA:EXA) | €81.50 | €159.26 | 48.8% |

| Dynavox Group (OM:DYVOX) | SEK102.00 | SEK203.01 | 49.8% |

| Allcore (BIT:CORE) | €1.35 | €2.66 | 49.3% |

We're going to check out a few of the best picks from our screener tool.

Obrascón Huarte Lain (BME:OHLA)

Overview: Obrascón Huarte Lain, S.A. operates in the construction and concession sectors across various international markets including the United States, Canada, and Europe, with a market cap of €494.22 million.

Operations: The company's revenue is primarily derived from its construction segment, which accounts for €3.40 billion, followed by the industrial segment contributing €164.09 million.

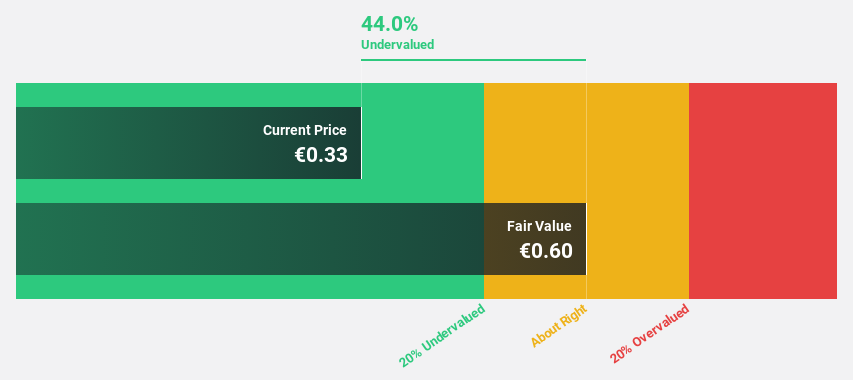

Estimated Discount To Fair Value: 34%

Obrascón Huarte Lain (OHLA) is trading at a good value, 34% below its estimated fair value of €0.54, indicating it may be undervalued based on discounted cash flow analysis. Despite recent volatility and shareholder dilution, OHLA's earnings have grown 30.4% annually over five years and are forecasted to grow 78.29% per year, with profitability expected in three years. Recent earnings show a reduced net loss of €45.6 million for the nine months ending September 2025 compared to the previous year.

- Our earnings growth report unveils the potential for significant increases in Obrascón Huarte Lain's future results.

- Dive into the specifics of Obrascón Huarte Lain here with our thorough financial health report.

Kitron (OB:KIT)

Overview: Kitron ASA is an electronics manufacturing services provider operating in multiple countries, including Norway and the United States, with a market cap of NOK15.73 billion.

Operations: The company generates revenue of €665.20 million from its Electronics Manufacturing Services (EMS) segment.

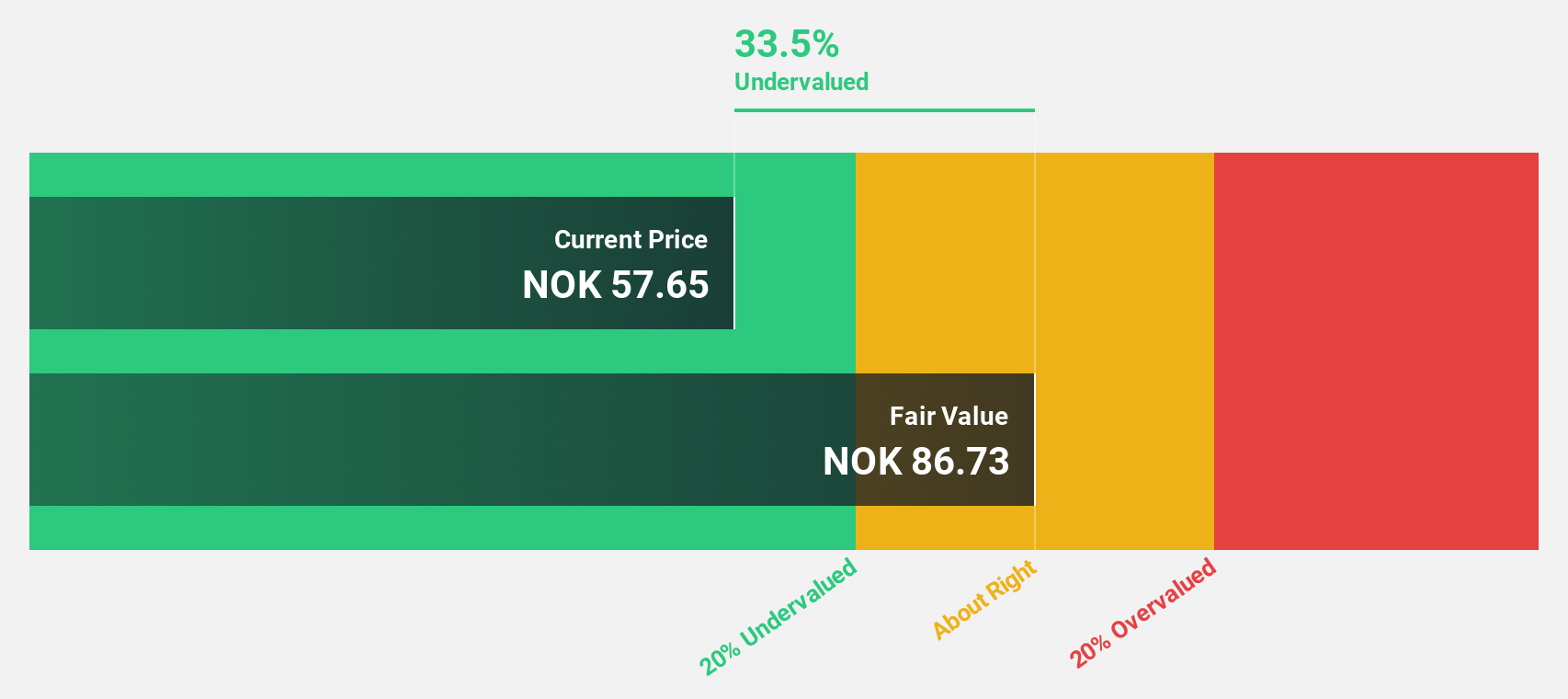

Estimated Discount To Fair Value: 46%

Kitron is currently trading at a significant discount to its estimated fair value, with shares priced 46% below this benchmark. The company's earnings are projected to grow substantially, outpacing the broader Norwegian market. Recent client announcements highlight robust demand in the defense and energy sectors, with new contracts totaling over EUR 142 million set for delivery starting in 2026. Kitron's strategic expansion and strong cash flow potential position it well within the undervalued stock landscape in Europe.

- The growth report we've compiled suggests that Kitron's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Kitron stock in this financial health report.

Diagnostyka (WSE:DIA)

Overview: Diagnostyka S.A. operates as a medical laboratory and has a market cap of PLN5.77 billion.

Operations: The company's revenue segment is Medical Labs & Research, generating PLN2.30 billion.

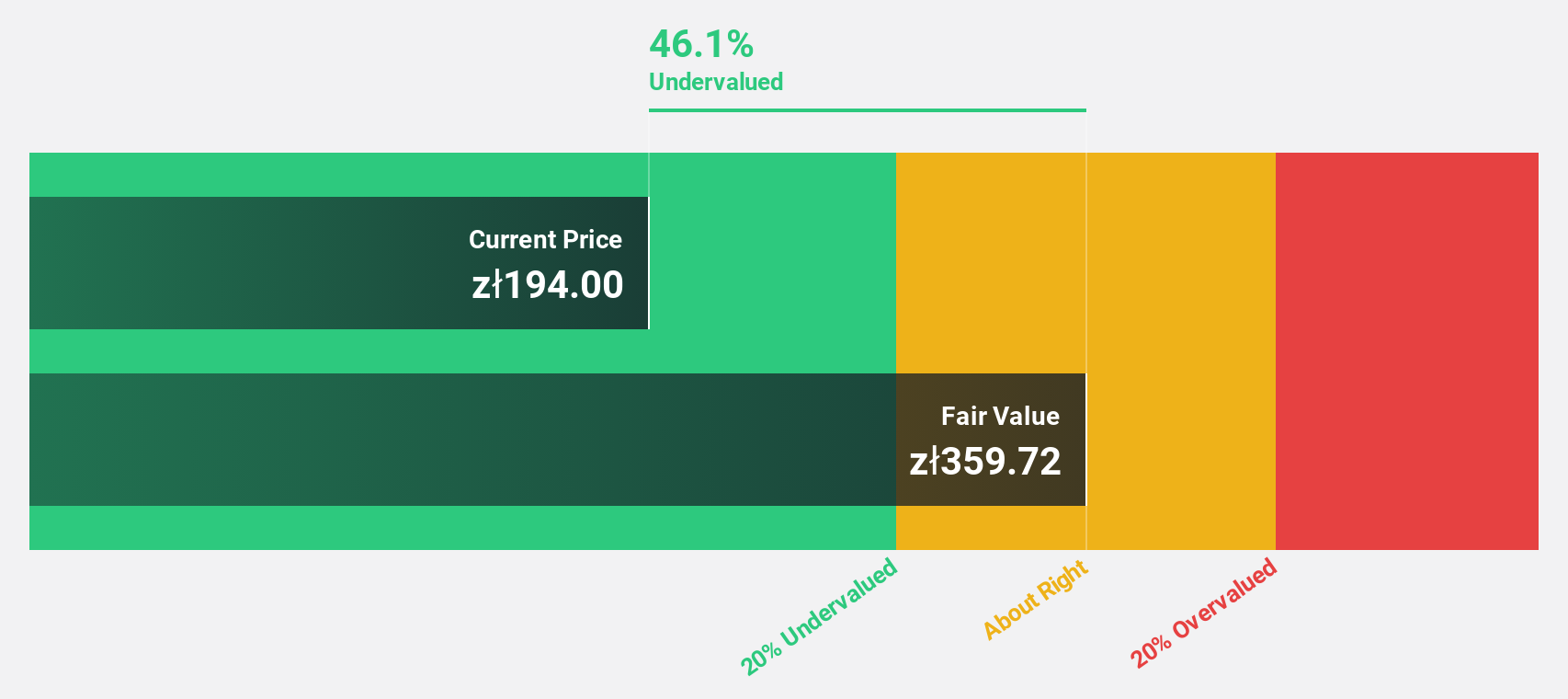

Estimated Discount To Fair Value: 32.1%

Diagnostyka S.A. appears undervalued, trading 32.1% below its estimated fair value of PLN 251.78, with a current price of PLN 171. Recent earnings reports show significant growth, with net income rising to PLN 78.06 million in Q3 from PLN 51.19 million last year, supported by increased revenue and sales figures. Although the company carries substantial debt, its earnings are projected to grow faster than the Polish market average, enhancing its appeal among undervalued stocks in Europe based on cash flows.

- Insights from our recent growth report point to a promising forecast for Diagnostyka's business outlook.

- Click here to discover the nuances of Diagnostyka with our detailed financial health report.

Taking Advantage

- Reveal the 195 hidden gems among our Undervalued European Stocks Based On Cash Flows screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報