Top Dividend Stocks In Global For January 2026

As global markets navigate a landscape marked by record highs in U.S. indices and mixed economic signals from Europe and Asia, investors are increasingly focused on strategies that can provide stability and income. In this context, dividend stocks stand out as a compelling option, offering the potential for regular income streams amidst economic fluctuations and market optimism driven by technological advancements like AI.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO) | 5.46% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.74% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 5.42% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.15% | ★★★★★★ |

| NCD (TSE:4783) | 3.99% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.00% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 4.21% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.62% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.86% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.74% | ★★★★★★ |

Click here to see the full list of 1283 stocks from our Top Global Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

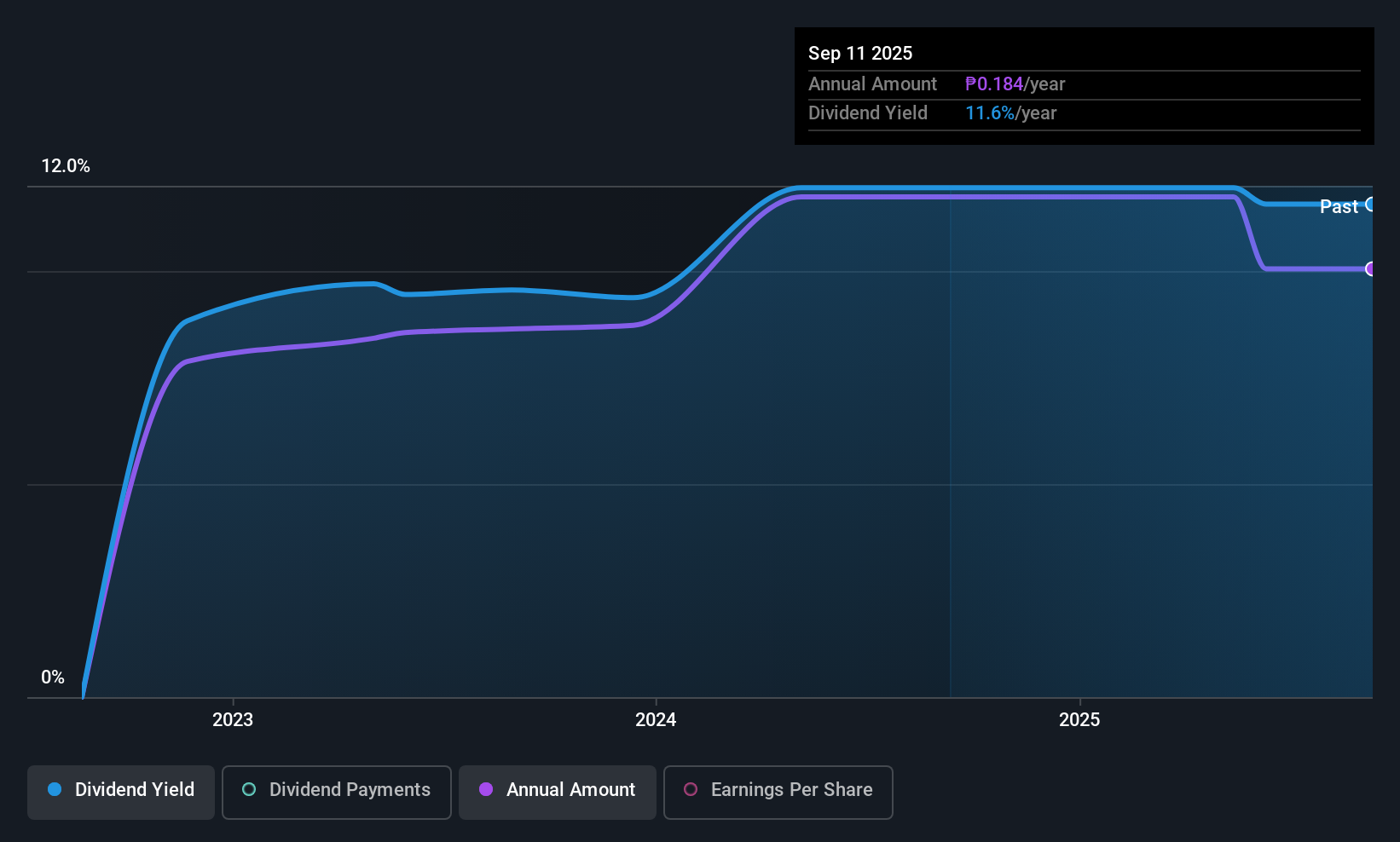

VistaREIT (PSE:VREIT)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: VistaREIT Inc is a real estate investment trust with a market capitalization of ₱10.28 billion, focusing on property investments and management.

Operations: VistaREIT Inc generates revenue of ₱2.63 billion from leasing retail malls and BPO commercial centers.

Dividend Yield: 12.9%

VistaREIT's recent earnings show steady growth, with net income rising to PHP 382.91 million for Q3 2025. Despite a short dividend history of three years, its dividends are well-covered by both earnings and cash flows, boasting a low payout ratio of 16.4% and a cash payout ratio of 41.4%. The dividend yield is among the top in the Philippine market, though share price volatility and brief dividend history may concern some investors.

- Take a closer look at VistaREIT's potential here in our dividend report.

- Our valuation report unveils the possibility VistaREIT's shares may be trading at a discount.

Liton Technology (TPEX:6175)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Liton Technology Corp. specializes in the manufacture and sale of etched and formed aluminum foils, with a market capitalization of NT$7.71 billion.

Operations: Liton Technology Corp. generates revenue from various regions, with NT$4.79 billion coming from China and NT$1.14 billion from Taiwan.

Dividend Yield: 3.2%

Liton Technology's dividend payments, though covered by earnings and cash flows with a payout ratio of 65% and cash payout ratio of 37.2%, have been unreliable over the past decade. The dividend yield is modest at 3.19%, trailing behind top-tier payers in Taiwan. Recent earnings revealed a decline in net income to TWD 108.2 million for Q3 2025 from TWD 151.99 million a year earlier, highlighting potential challenges for future payouts amidst volatile share prices.

- Get an in-depth perspective on Liton Technology's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Liton Technology is priced lower than what may be justified by its financials.

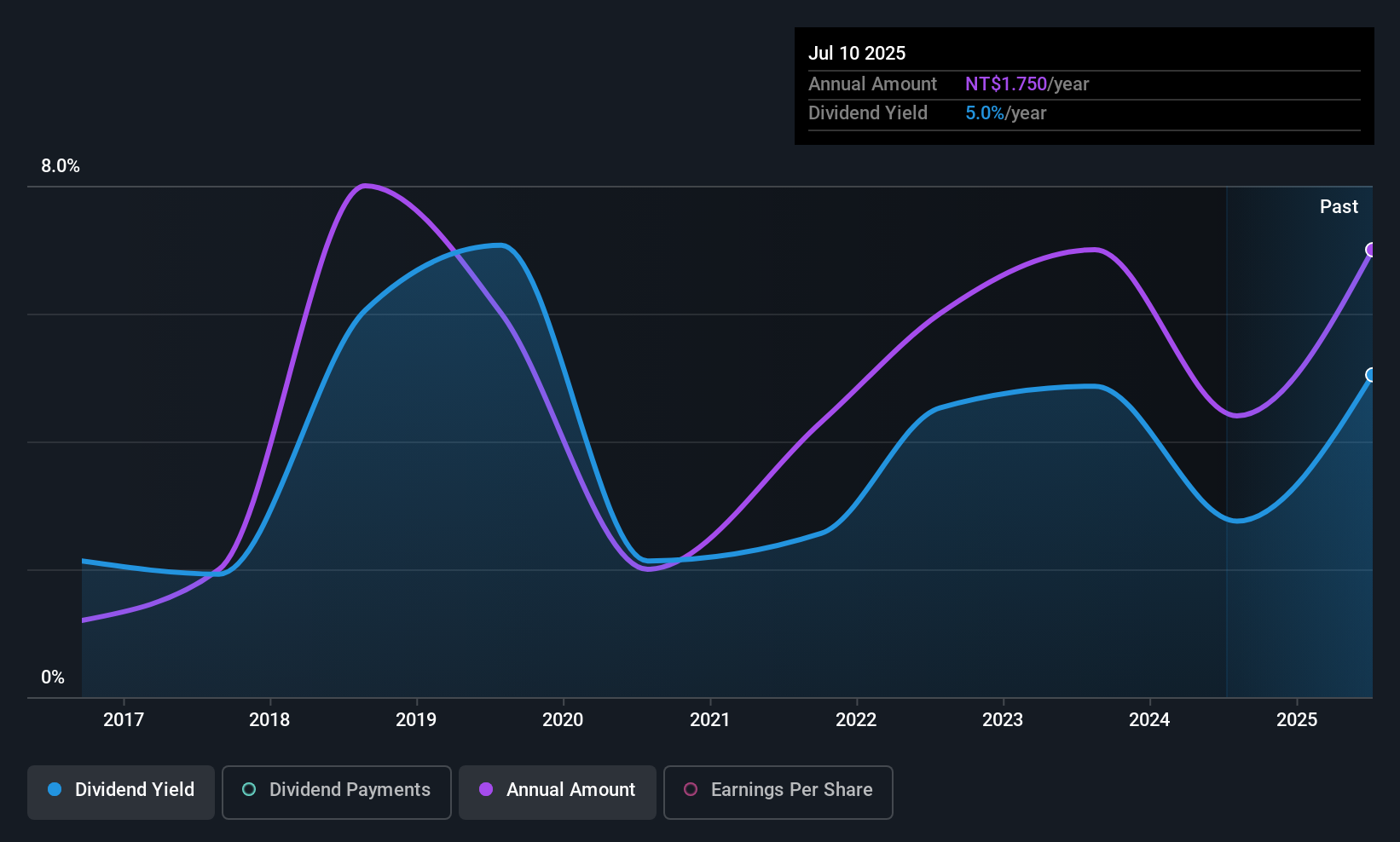

Voltronic Power Technology (TWSE:6409)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Voltronic Power Technology Corp., along with its subsidiaries, manufactures and sells uninterruptible power systems (UPS) in Taiwan and China, with a market cap of NT$85.17 billion.

Operations: Voltronic Power Technology Corp. generates revenue primarily from the manufacturing and trading of uninterruptible power systems and inverters, amounting to NT$20.89 billion.

Dividend Yield: 3.7%

Voltronic Power Technology's dividends have been stable and growing over the past decade, yet the high cash payout ratio of 96.5% raises concerns about sustainability from free cash flows. Despite a covered payout ratio of 78.9%, its dividend yield of 3.69% lags behind Taiwan's top-tier payers at 5.47%. Recent earnings show a decline with Q3 net income dropping to TWD 640.66 million from TWD 1,229.74 million last year, amidst volatile share prices.

- Dive into the specifics of Voltronic Power Technology here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Voltronic Power Technology is trading beyond its estimated value.

Seize The Opportunity

- Explore the 1283 names from our Top Global Dividend Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報