3 European Stocks Estimated To Be Trading At Discounts Of Up To 47.6%

As the pan-European STOXX Europe 600 Index edges closer to record highs, buoyed by optimism around future earnings and economic prospects, investors are increasingly on the lookout for opportunities that may be trading below their intrinsic value. In this context, identifying undervalued stocks becomes crucial, as they offer potential for growth amid a cautiously optimistic market environment where strategic selection based on fundamentals can lead to rewarding outcomes.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimot (WSE:UNT) | PLN130.00 | PLN257.58 | 49.5% |

| Streamwide (ENXTPA:ALSTW) | €72.80 | €142.77 | 49% |

| LINK Mobility Group Holding (OB:LINK) | NOK33.90 | NOK66.31 | 48.9% |

| Kreate Group Oyj (HLSE:KREATE) | €12.55 | €24.87 | 49.5% |

| KB Components (OM:KBC) | SEK41.90 | SEK83.17 | 49.6% |

| Gesco (XTRA:GSC1) | €14.25 | €27.99 | 49.1% |

| Fodelia Oyj (HLSE:FODELIA) | €5.40 | €10.72 | 49.6% |

| Exail Technologies (ENXTPA:EXA) | €81.50 | €159.26 | 48.8% |

| Dynavox Group (OM:DYVOX) | SEK102.00 | SEK203.01 | 49.8% |

| Allcore (BIT:CORE) | €1.35 | €2.66 | 49.3% |

Underneath we present a selection of stocks filtered out by our screen.

Lectra (ENXTPA:LSS)

Overview: Lectra SA offers industrial intelligence solutions for the fashion, automotive, and furniture markets globally, with a market cap of €969.29 million.

Operations: The company's revenue is segmented into the following regions: €168.04 million from the Americas, €126.97 million from Asia-Pacific, and €220.55 million from EMEA (Europe, Middle East and Africa).

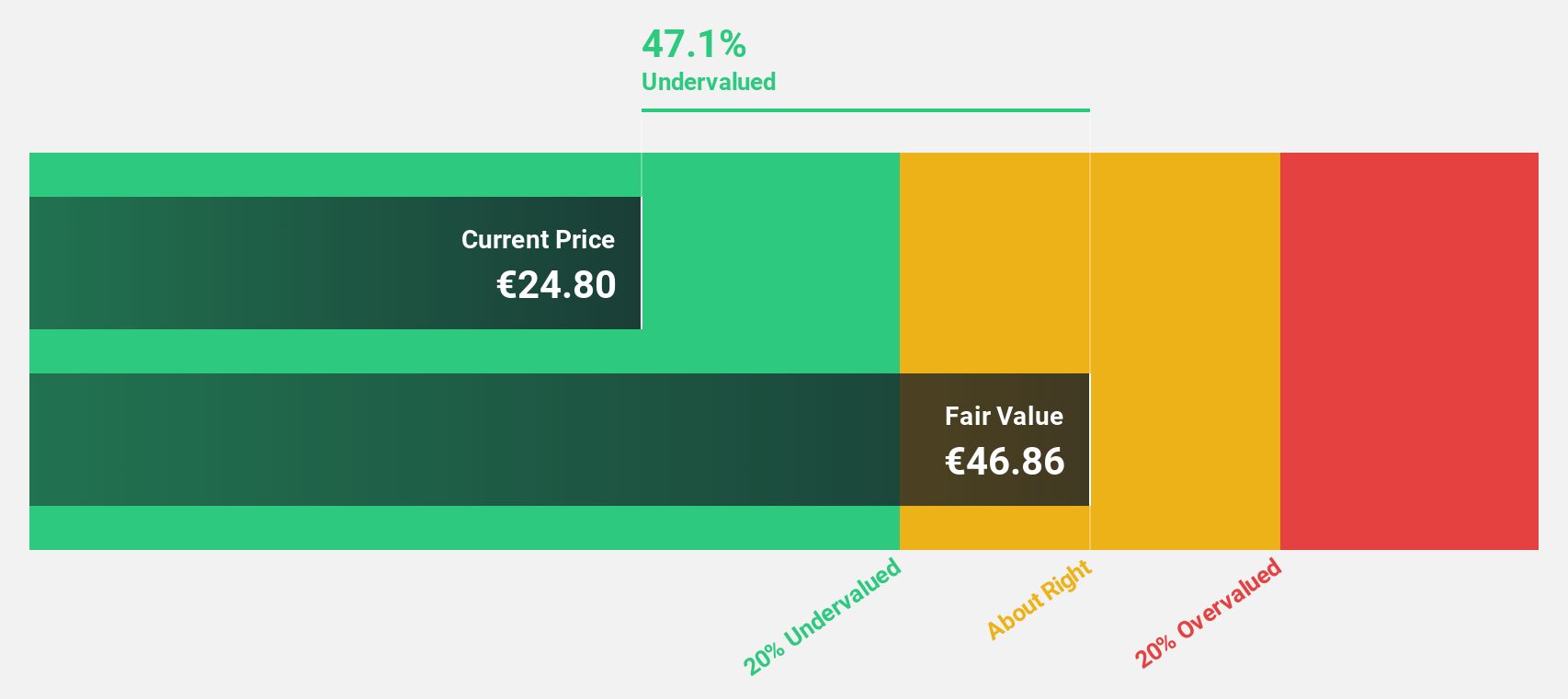

Estimated Discount To Fair Value: 37.1%

Lectra is trading at €25.5, significantly below its estimated fair value of €40.55, indicating it may be undervalued based on cash flows. Despite recent declines in sales and net income for the nine months ending September 2025, the company's earnings are projected to grow substantially at 20.4% annually, outpacing the French market's growth rate of 12%. However, its return on equity is forecasted to remain low at 11.6% in three years.

- In light of our recent growth report, it seems possible that Lectra's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Lectra's balance sheet health report.

Aker BioMarine (OB:AKBM)

Overview: Aker BioMarine ASA is a biotech innovator that develops and supplies krill-derived products for consumer health and wellness worldwide, with a market cap of NOK8.66 billion.

Operations: Revenue Segments (in millions of $): Aker BioMarine's revenue is primarily generated from its krill-derived products aimed at enhancing consumer health and wellness globally.

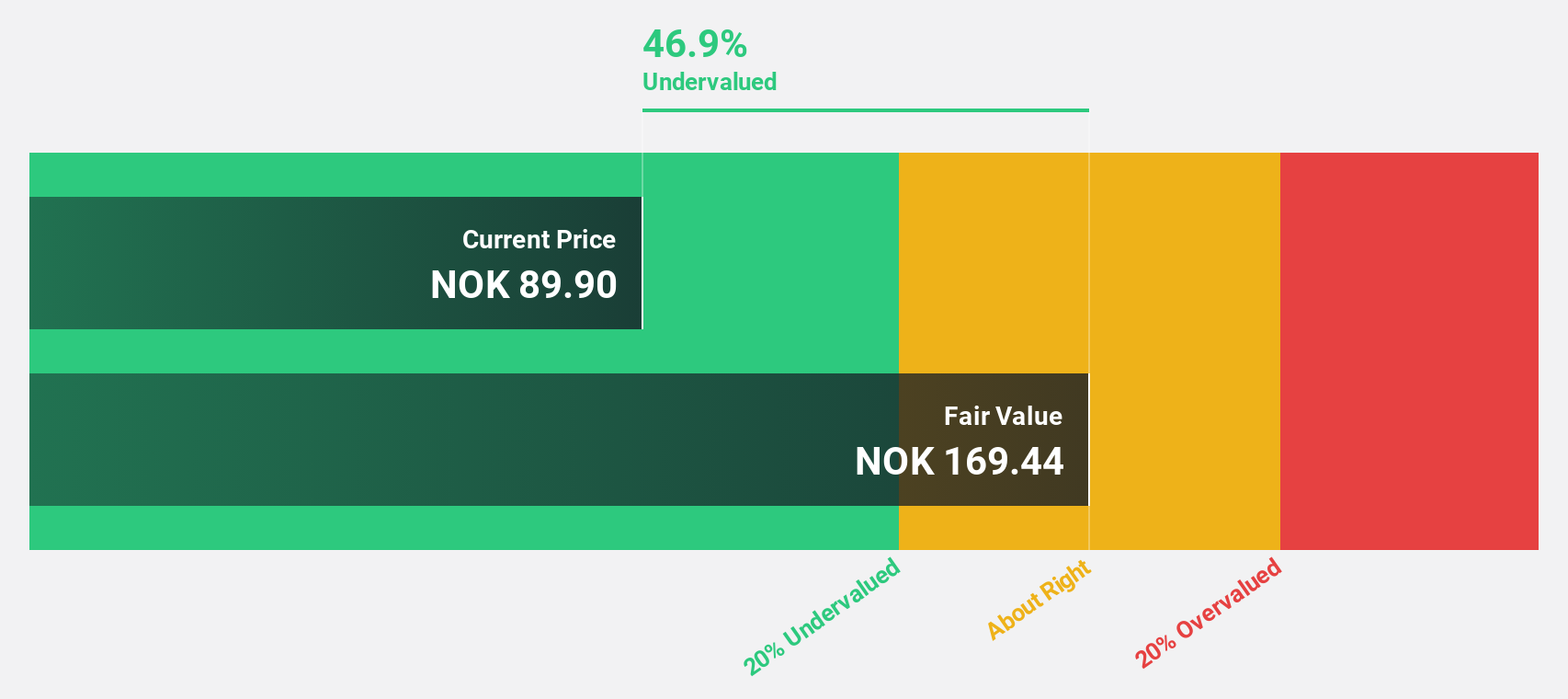

Estimated Discount To Fair Value: 44%

Aker BioMarine is trading at NOK98.7, well below its estimated fair value of NOK176.22, highlighting potential undervaluation based on cash flows. Despite a significant drop in net income for the third quarter of 2025 compared to the previous year, the company is expected to achieve profitability within three years and grow earnings by over 100% annually. Revenue growth forecasts also surpass the Norwegian market average, though return on equity remains modestly forecasted at 15.9%.

- Our growth report here indicates Aker BioMarine may be poised for an improving outlook.

- Navigate through the intricacies of Aker BioMarine with our comprehensive financial health report here.

Atea (OB:ATEA)

Overview: Atea ASA delivers IT infrastructure and related solutions to businesses and public sector organizations across the Nordic countries and Baltic regions, with a market cap of NOK17.58 billion.

Operations: The company's revenue is derived from several segments, including Norway (NOK9.27 billion), Sweden (NOK13.73 billion), Denmark (NOK8.56 billion), Finland (NOK3.48 billion), and the Baltics (NOK1.90 billion).

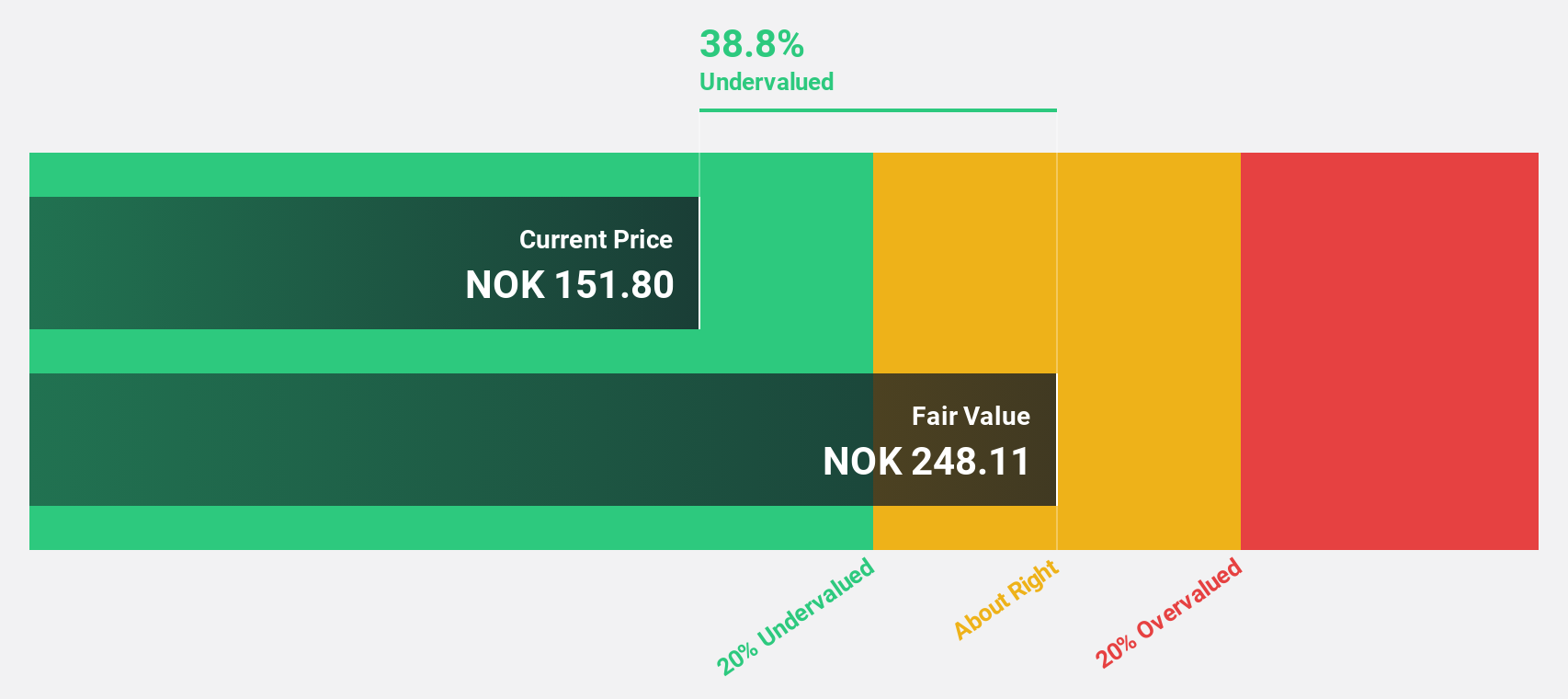

Estimated Discount To Fair Value: 47.6%

Atea is trading at NOK157.8, significantly below its estimated fair value of NOK300.94, indicating potential undervaluation based on cash flows. The company recently secured major contracts with Tradebroker and NATO, boosting future revenue prospects. Despite a modest 3.5% earnings growth last year, Atea's earnings are forecast to grow 18.5% annually, outpacing the Norwegian market average of 15.4%. However, dividend coverage remains weak despite an attractive yield of 4.44%.

- Our comprehensive growth report raises the possibility that Atea is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of Atea stock in this financial health report.

Summing It All Up

- Navigate through the entire inventory of 195 Undervalued European Stocks Based On Cash Flows here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報