European Penny Stocks: 3 Picks With Market Caps Under €80M

As European markets edge closer to record highs, driven by optimism around future earnings and economic conditions, investors are increasingly on the lookout for opportunities in lesser-known areas. While the term 'penny stocks' might seem outdated, these smaller or newer companies can still offer significant potential when they possess solid financials. In this article, we explore three European penny stocks that exemplify financial strength and growth potential, offering a compelling case for those seeking hidden value in quality companies.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.488 | €1.54B | ✅ 4 ⚠️ 3 View Analysis > |

| Orthex Oyj (HLSE:ORTHEX) | €4.69 | €82.58M | ✅ 4 ⚠️ 1 View Analysis > |

| DigiTouch (BIT:DGT) | €1.98 | €27.08M | ✅ 3 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.31 | €221.96M | ✅ 3 ⚠️ 3 View Analysis > |

| Libertas 7 (BME:LIB) | €3.00 | €63.63M | ✅ 3 ⚠️ 3 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.43 | €391.54M | ✅ 4 ⚠️ 1 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.95 | €76.42M | ✅ 2 ⚠️ 4 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.265 | €313.07M | ✅ 4 ⚠️ 1 View Analysis > |

| Dovre Group (HLSE:DOV1V) | €0.0726 | €7.89M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 286 stocks from our European Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Riber (ENXTPA:ALRIB)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Riber S.A. specializes in providing molecular beam epitaxy (MBE) products and related services for the compound semiconductor research and industrial sectors, with a market cap of €72.82 million.

Operations: The company's revenue is primarily derived from its Semiconductor Equipment and Services segment, which generated €38.12 million.

Market Cap: €72.82M

Riber S.A. recently secured a significant order for two MBE 6000 systems from a European customer, highlighting its strong position in the semiconductor equipment market. While the company's revenue generation is stable, with €38.12 million from its Semiconductor Equipment and Services segment, it faces challenges such as a low return on equity of 14.8% and declining profit margins from last year. However, Riber's financial health remains robust with short-term assets exceeding liabilities and debt well covered by operating cash flow. The company trades at a favorable price-to-earnings ratio compared to industry peers but struggles with negative earnings growth over the past year.

- Click to explore a detailed breakdown of our findings in Riber's financial health report.

- Explore Riber's analyst forecasts in our growth report.

Fondia Oyj (HLSE:FONDIA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fondia Oyj is a legal services provider operating in Finland, Sweden, Estonia, and Lithuania with a market cap of €18.47 million.

Operations: The company's revenue is primarily derived from its Business Services segment, totaling €24.51 million.

Market Cap: €18.47M

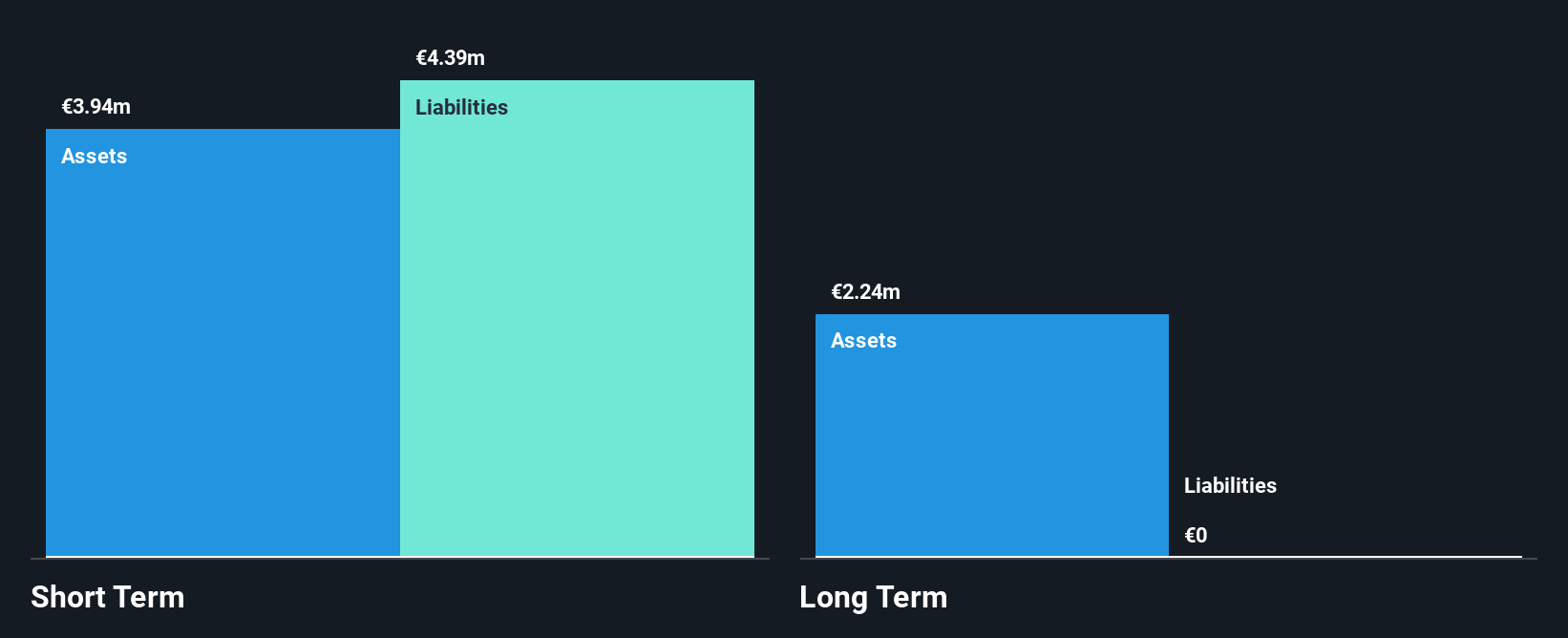

Fondia Oyj, with a market cap of €18.47 million, operates in the legal services sector across Finland, Sweden, Estonia, and Lithuania. Despite being debt-free and having stable weekly volatility at 3%, Fondia is currently unprofitable with a negative return on equity of -0.045%. The company has no long-term liabilities but faces challenges as its short-term assets (€3.9M) are insufficient to cover short-term liabilities (€4.4M). Recent executive changes and the launch of Lextopia signal strategic moves towards innovation in legal services, aiming to enhance future growth prospects despite current financial hurdles.

- Click here and access our complete financial health analysis report to understand the dynamics of Fondia Oyj.

- Evaluate Fondia Oyj's prospects by accessing our earnings growth report.

TREX (WSE:TRX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TREX S.A. operates in Poland, selling sports equipment under the TREX SPORT brand name, with a market cap of PLN27.75 million.

Operations: TREX S.A. does not report specific revenue segments for its operations in Poland.

Market Cap: PLN27.75M

TREX S.A., with a market cap of PLN27.75 million, has recently become profitable and reported significant revenue growth, reaching PLN32.17 million for the first nine months of 2025 compared to PLN13.78 million the previous year. The company is debt-free, which reduces financial risk, and its short-term assets exceed liabilities by PLN2.4 million, indicating solid liquidity management. However, its share price remains highly volatile compared to other Polish stocks. TREX's recent initiation of a share buyback program demonstrates confidence in future prospects but may not immediately stabilize share price fluctuations or address low return on equity concerns (11%).

- Navigate through the intricacies of TREX with our comprehensive balance sheet health report here.

- Review our historical performance report to gain insights into TREX's track record.

Seize The Opportunity

- Explore the 286 names from our European Penny Stocks screener here.

- Seeking Other Investments? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報