Why We're Not Concerned Yet About Tchaikapharma High Quality Medicines AD's (BUL:THQM) 48% Share Price Plunge

Tchaikapharma High Quality Medicines AD (BUL:THQM) shareholders won't be pleased to see that the share price has had a very rough month, dropping 48% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 45% share price drop.

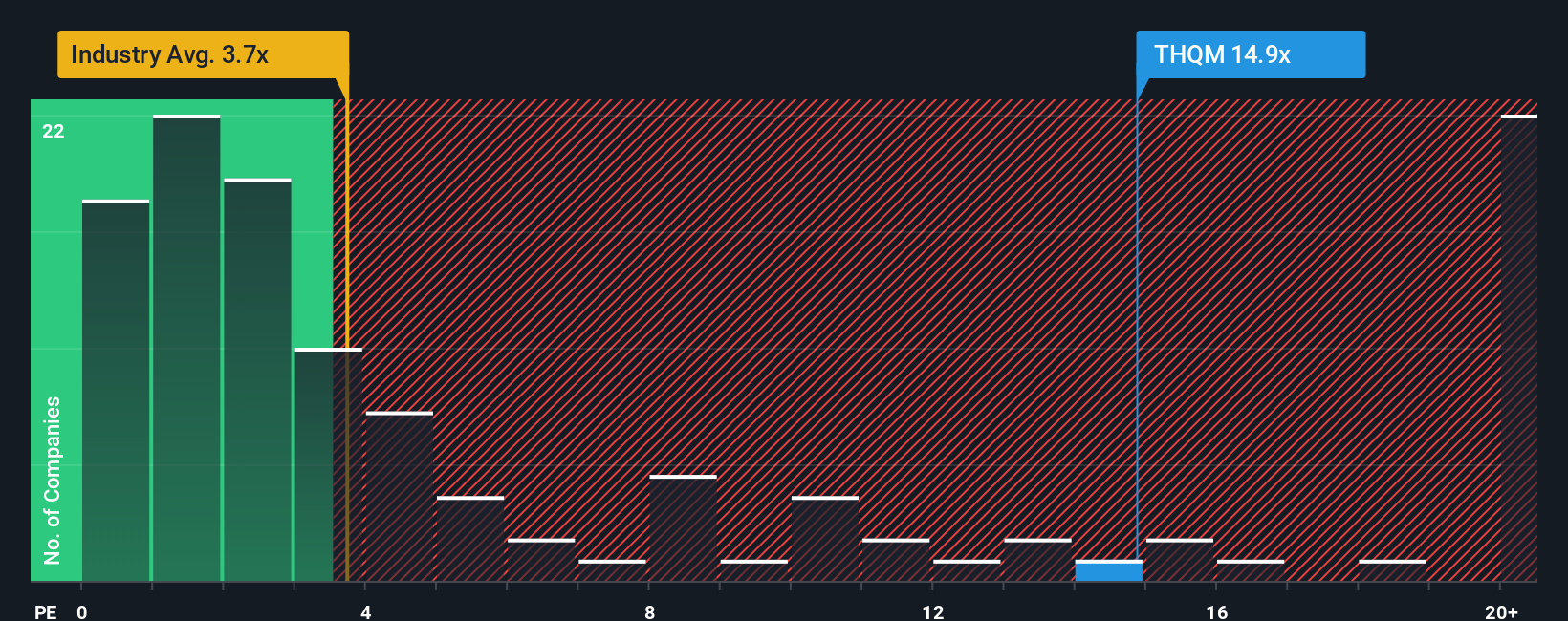

Even after such a large drop in price, when almost half of the companies in Bulgaria's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 3.7x, you may still consider Tchaikapharma High Quality Medicines AD as a stock not worth researching with its 14.9x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Tchaikapharma High Quality Medicines AD

What Does Tchaikapharma High Quality Medicines AD's P/S Mean For Shareholders?

Revenue has risen firmly for Tchaikapharma High Quality Medicines AD recently, which is pleasing to see. It might be that many expect the respectable revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Tchaikapharma High Quality Medicines AD's earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

Tchaikapharma High Quality Medicines AD's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 22%. The latest three year period has also seen an excellent 51% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 2.5% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in consideration, it's not hard to understand why Tchaikapharma High Quality Medicines AD's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Tchaikapharma High Quality Medicines AD's P/S

A significant share price dive has done very little to deflate Tchaikapharma High Quality Medicines AD's very lofty P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Tchaikapharma High Quality Medicines AD maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

Having said that, be aware Tchaikapharma High Quality Medicines AD is showing 1 warning sign in our investment analysis, you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報