Megaron S.A. (WSE:MEG) Soars 31% But It's A Story Of Risk Vs Reward

Megaron S.A. (WSE:MEG) shareholders have had their patience rewarded with a 31% share price jump in the last month. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

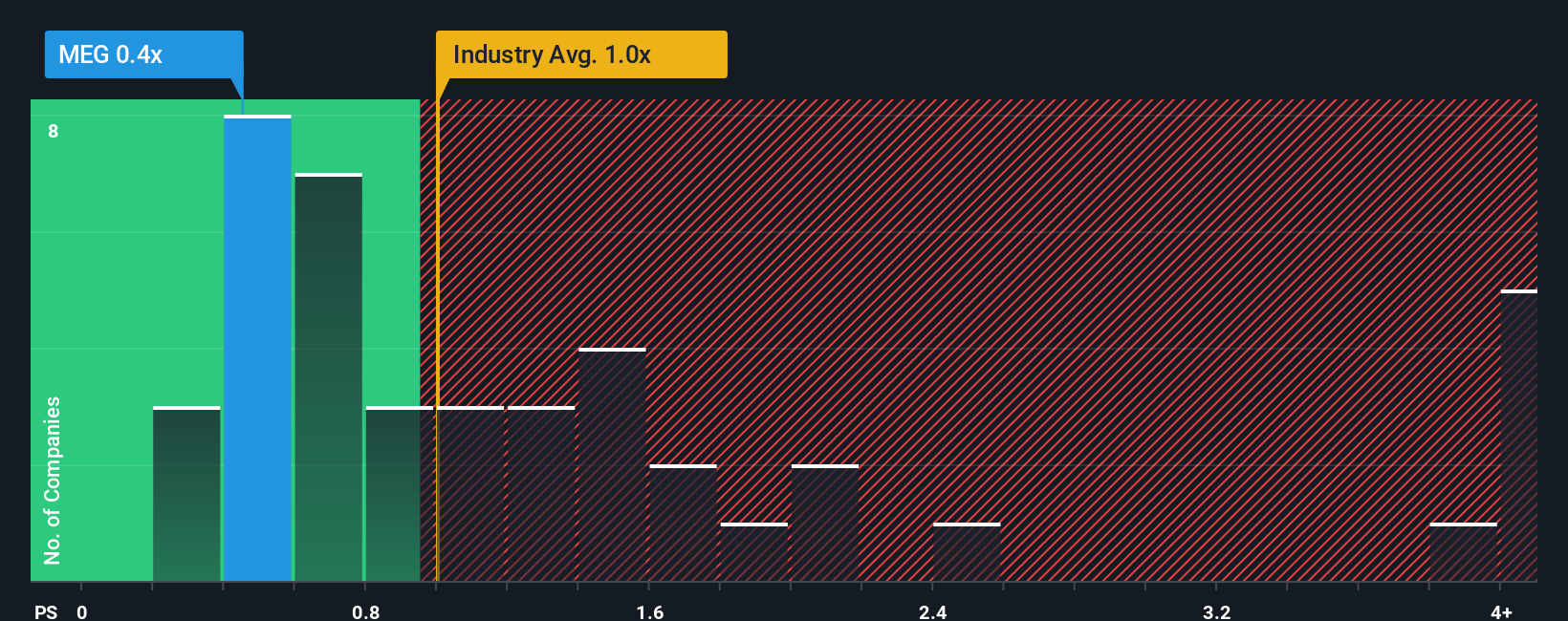

Even after such a large jump in price, when close to half the companies operating in Poland's Basic Materials industry have price-to-sales ratios (or "P/S") above 1x, you may still consider Megaron as an enticing stock to check out with its 0.4x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for Megaron

What Does Megaron's P/S Mean For Shareholders?

For example, consider that Megaron's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Megaron will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Megaron's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 11%. This means it has also seen a slide in revenue over the longer-term as revenue is down 16% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for a contraction of 7.7% shows the industry is even less attractive on an annualised basis.

In light of this, the fact Megaron's P/S sits below the majority of other companies is peculiar but certainly not shocking. There's no guarantee the P/S has found a floor yet with recent revenue going backwards, despite the industry heading down even harder. Even just maintaining these prices will be difficult to achieve as recent revenue trends are already weighing down the shares excessively.

What Does Megaron's P/S Mean For Investors?

The latest share price surge wasn't enough to lift Megaron's P/S close to the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

A look into numbers has shown it's somewhat unexpected that Megaron has a lower P/S than the industry average, given its recent three-year revenue performance which was better than anticipated for an industry facing challenges. When we see better than average revenue growth but a lower than average P/S, we must assume that potential risks are what might be placing significant pressure on the P/S ratio. Perhaps there is some hesitation about the company's ability to stay its recent course and resist the broader industry turmoil. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

And what about other risks? Every company has them, and we've spotted 5 warning signs for Megaron (of which 3 are a bit unpleasant!) you should know about.

If you're unsure about the strength of Megaron's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報