IPO News | CoolSai Smart Second Delivery Hong Kong Stock Exchange is the world's leading smartphone ODM company

The Zhitong Finance App learned that according to the Hong Kong Stock Exchange's disclosure on December 31, Coolside Intelligent Technology Co., Ltd. (hereinafter: Coolside Smart) submitted a listing application to the main board of the Hong Kong Stock Exchange, and CITIC Securities is its sole sponsor. This is the second time this year that the company has submitted a listing application to the Hong Kong Stock Exchange on June 25.

Company profile

According to the prospectus, Cool Smart is the world's leading smartphone ODM company, providing solutions covering product definition, R&D, supply chain management, manufacturing and after-sales service. During the record period, the company's revenue came from more than 70 countries or regions, covering Asia, America, Europe, Oceania and Africa. According to Frost & Sullivan data, in 2024, in terms of shipment volume, Cool Sai Smart is the world's second largest ODM solution provider for local smartphone brands; in the first quarter of 2025, Cool Smart rose to the top of the list.

Over the years, Cool Smart has become a leading global smartphone ODM company. It has extensive experience in independently operating and managing smartphone brands, thereby making the company stand out from most market participants that mainly started with other brand manufacturers. The company's smart hardware product definition ability can accurately define products based on a deep understanding of various environments such as the overall consumption level of relevant countries or regions, the main functional preferences facing customer groups, local culture and competitive patterns.

With excellent product definition capabilities, Coolpad Intelligence provides customized products that meet specific customer needs while maintaining cost advantages and excellent product performance to provide a better consumer experience. During the track record period, Cool Smart mainly provided customers with (i) smart devices, including (a) consumer smartphones, (b) three-proof mobile phones with waterproof, dustproof, and shockproof functions designed for industrial end users, and (c) other Internet of Things (IoT) devices, which refer to Internet devices that collect, connect, and exchange data with other networked devices; (ii) printed circuit board components (core components of smartphones) and Internet services as independent products, including (a) consumer smartphone printed circuit board components and Internet services, and (b) three-proof mobile phone printed circuit board components, and (c) other IoT related printed circuit board components; and (iii) others, mainly including material procurement and research and design services.

In 2006, Cool Smart successfully designed and developed the first printed circuit board component to meet the growing market demand for mobile phones and other products. The company designs and develops printed circuit board components according to the specifications provided by the customer and the various functions that the customer expects the product to have. Furthermore, the company launched its first consumer smartphone in 2011 and the first rugged phone in 2019, all of which are milestones in the company's product development process.

In order to keep up with technology development trends and anticipate the growing popularity trend of smartphones, over the years, Cool Sai Smart has established core technology systems for consumer smartphones and rugged phones. The company designs and supplies smartphones with a wide range of technical specifications to meet the needs of customers in different regions of the world. In addition, anticipating the potential growth potential of the IoT market, Cool Smart also invested resources in the research and development of other IoT products, and launched the first IoT-related printed circuit board in 2022 and the first IoT product in 2024.

As of July 31, 2025, Cool Smart has developed more than 598 smartphone and printed circuit board component models, as well as more than 46 other smart devices. In addition, the company continues to optimize the self-developed DiDoOs and achieve multiple iterations to meet the specific customization needs of local brands and telecom operators around the world and enhance the user experience. As of July 31, 2025, the company's global sales network has covered more than 70 countries or regions, spanning Asia, America, Europe, Oceania and Africa.

Financial data

revenue

In 2022, 2023, 2024, and 2025 for the seven months ended July 31, the company achieved revenue of approximately RMB 1,713 billion (RMB, same below), RMB 2,702 billion, RMB 2,717 billion, and RMB 1,584 billion, respectively.

Profit for the year/period

In 2022, 2023, 2024, and 2025 for the seven months ended July 31, the company recorded annual/period profits of approximately 110 million yuan, 203 million yuan, 207 million yuan and 103 million yuan, respectively.

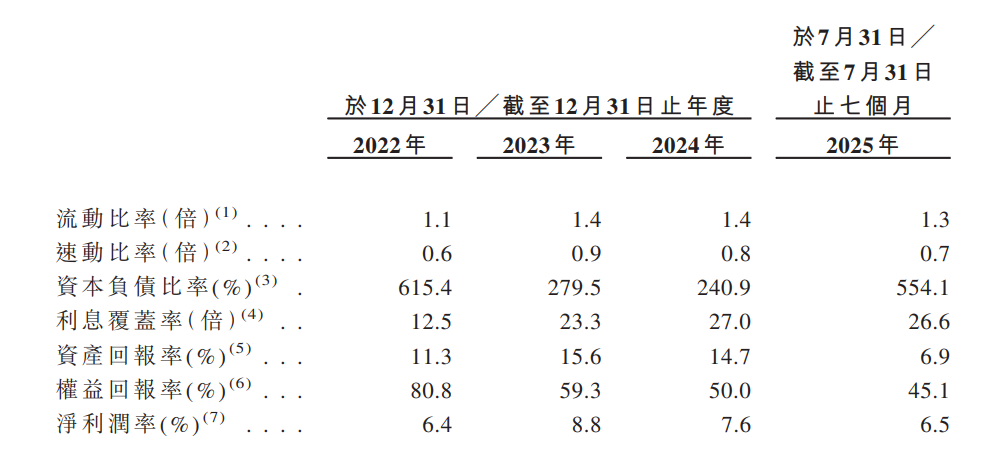

Net profit margin

In 2022, 2023, 2024, and 2025 for the seven months ended July 31, the company recorded net profit margins of 6.4%, 8.8%, 7.6%, and 6.5%, respectively.

Industry Overview

According to their sales scope and shipment volume, smart hardware products can be divided into two categories: global brands and local brands. Local brands are mainly focused on specific regional markets and can better meet local market needs. From 2020 to 2024, smart hardware shipments from local brands rose from 191 million units to 276 million units, and are expected to grow further during the forecast period, reaching 388 million units in 2029.

Compared with global brands, local brands continue to increase their share of overall smart hardware shipments with advantages such as flexibility and quick response, cost performance advantages, personalized and innovative design, and accurate market segmentation. In 2024, local brands accounted for 11.3% of total smart hardware shipments, and their market penetration rate is expected to increase steadily, and is expected to reach 13.9% by 2029.

In recent years, the global smartphone market has become close to saturation. Consumer demand for new smartphones has slowed down, and the frequency of switching has declined. As a result, the growth rate of global smartphone shipments fluctuated slightly from 1,323 billion units in 2020 to 1,313 billion units in 2024. During the forecast period, the continuous development of innovative products such as AI smartphones, 5G smartphones, and foldable phones will bring new growth impetus to the future growth of the global smartphone market.

At the same time, in emerging markets such as South Asia, the Middle East, and Latin America, there is still plenty of room for improvement in the current smartphone penetration rate. As the economy develops in these emerging regions and residents' demand for smart devices continues to increase, it is expected to become an important driving force for future growth in global smartphone shipments, driving global smartphone shipments from 1,363 billion units in 2025 to 1,475 billion units in 2029, with a compound annual growth rate of 2.0%.

By region, the smartphone market in developed regions represented by the US and Europe has become saturated, mainly reflected in high penetration rates and extended consumer switching cycles. In these markets, the popularity of smartphones is close to that of the public, making new demand extremely limited. At the same time, due to the continuous improvement in the performance and durability of existing equipment, the urgency for consumers to upgrade to new devices has declined drastically. Furthermore, the market is mainly dominated by a few global brands. These brands are highly similar in function and design, and lack differentiated innovation, which further curbs consumers' desire to buy, leading to insufficient overall market growth momentum.

In contrast, the smartphone market in emerging markets represented by South Asia, the Middle East, and Latin America still has good room for development. In the South Asian market, especially in the Indian market, a large proportion of people still use functional devices. Due to India's huge population base, smartphones have great potential for demand in the region. With the development of the Indian economy, the future transition from feature phones to smartphones will further drive the development of the smartphone market. Therefore, the increase in smartphone penetration in India will be the core driving factor driving the overall development of the smartphone market in South Asia.

Due to the poor economic development of most countries in the Middle East region, local consumers are less likely to consume smartphones. Currently, the smartphone market in the region is still dominated by mid-range and low-end models. However, with the development of the Middle Eastern and African oil countries' economies and rising residents' incomes, consumer demand for smartphones, especially entry-level smartphones, will increase significantly. Meanwhile, Middle Eastern operators are actively promoting the 5G layout, all of which will drive the development of the smartphone market.

In the Latin American smartphone market, the continued entry of Chinese brands and increased competition are expected to drive the development of the smartphone market in the region. Overall, the smartphone market in South Asia, the Middle East, and Latin America will maintain a relatively rapid growth level from 2025 to 2029. Smartphone shipments are expected to grow from 191 million units, 113 million units, and 139 million units in 2025 to 205 million units, 123 million units, and 154 million units in 2029, respectively, with CAGR reaching 1.8%, 2.0%, and 2.7%, respectively.

Board Information

The company's board of directors consists of 6 directors, including 3 executive directors and 3 independent non-executive directors. The company's directors serve for a term of three years and can be re-elected after the term expires.

Shareholding structure

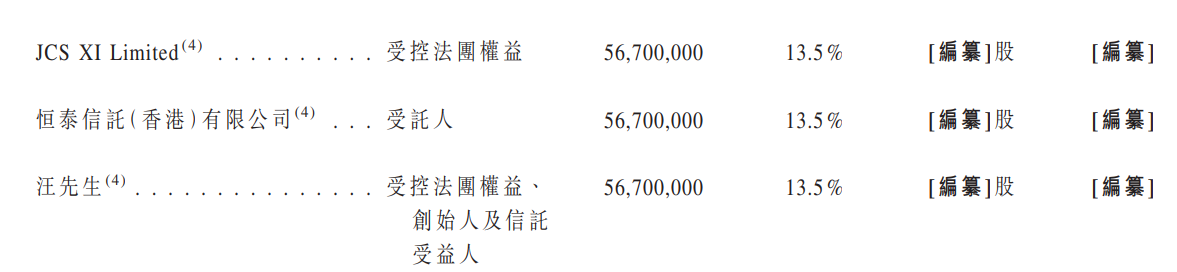

Through a series of capital increases and transfers, Coolside Communications held about 63% of the shares, Mr. Wang held 13.5% of the shares, Mr. Wu held 13.5% of the shares, Shenzhen Borui held 3.2% of the shares, Shenzhen Borui held 3.1% of the shares, Shenzhen Zhiheng held 2.2% of the shares, and Shenzhen Bofeng held 1.5% of the shares, respectively.

Intermediary team

Sole sponsor: CITIC Securities (Hong Kong) Limited.

Company Legal Adviser: Hong Kong Law: Linklaters; Related Chinese Law: Jingtian Gongcheng Law Firm; Law relating to Third Party Payments in Hong Kong: Lu Junyu; Law relating to Cayman Islands Law: Hengli Law Firm; Related US Law: Sherman Shi Law Group P.C.; Yemeni Law: Sheikh Mohammed Abdullah Sons; Related International Sanctions Law: Ashurst Tokyo (Ashurst Horitsu) Jimusho Gaikokuho Kyodo Jigyo).

Sole Sponsor Legal Adviser: Regarding Hong Kong Law: Shengde Law Firm; Regarding Chinese Law: JunHe Law Firm.

Auditor and reporting accountant: KPMG.

Industry consultant: Frost & Sullivan (Beijing) Consulting Co., Ltd. Shanghai Branch.

Property Valuer: Bohao Enterprise Consulting Co., Ltd.

Compliance Advisor: Ligao Corporate Finance Ltd.

Nasdaq

Nasdaq 華爾街日報

華爾街日報