Bulgarian Stock Exchange AD (BUL:BSE) Might Not Be As Mispriced As It Looks After Plunging 52%

Bulgarian Stock Exchange AD (BUL:BSE) shareholders that were waiting for something to happen have been dealt a blow with a 52% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 29% in that time.

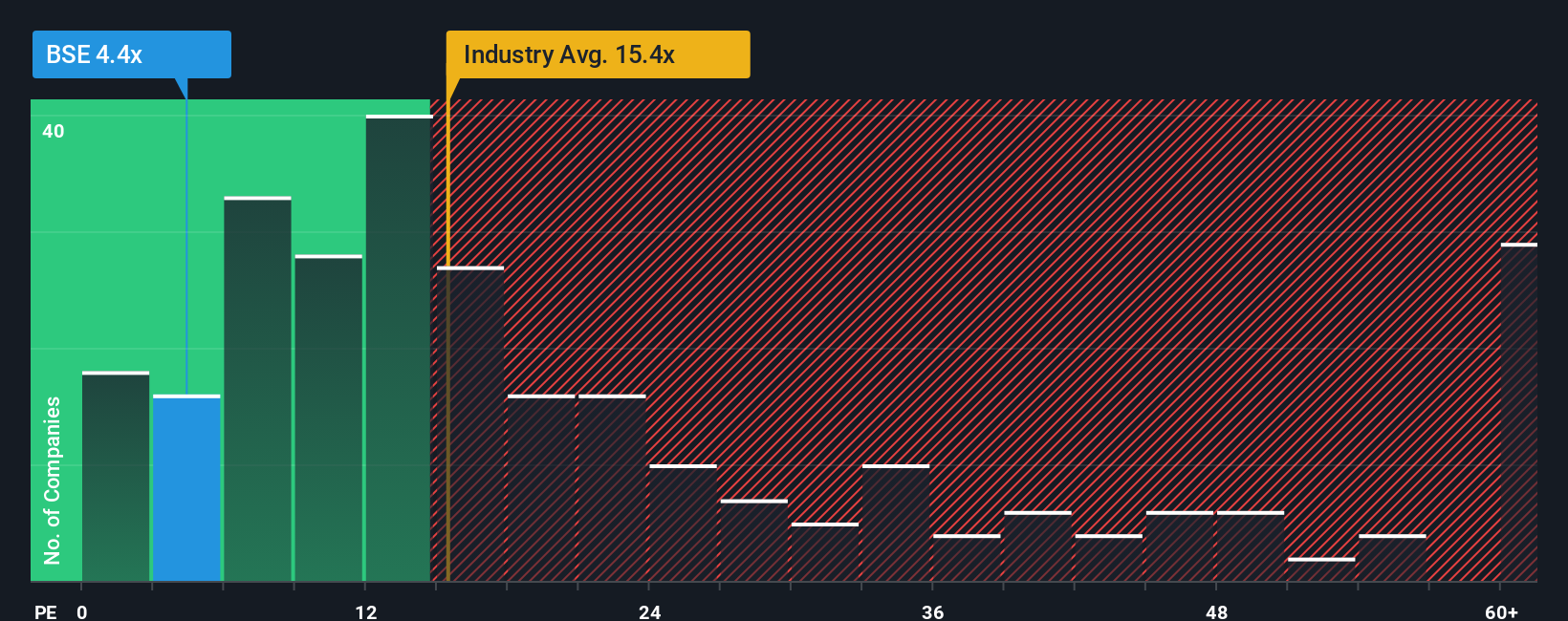

Following the heavy fall in price, Bulgarian Stock Exchange AD may be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 4.4x, since almost half of all companies in Bulgaria have P/E ratios greater than 12x and even P/E's higher than 28x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Earnings have risen firmly for Bulgarian Stock Exchange AD recently, which is pleasing to see. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

See our latest analysis for Bulgarian Stock Exchange AD

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as depressed as Bulgarian Stock Exchange AD's is when the company's growth is on track to lag the market decidedly.

Retrospectively, the last year delivered an exceptional 23% gain to the company's bottom line. The latest three year period has also seen an excellent 93% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

This is in contrast to the rest of the market, which is expected to grow by 21% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we find it odd that Bulgarian Stock Exchange AD is trading at a P/E lower than the market. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Final Word

Shares in Bulgarian Stock Exchange AD have plummeted and its P/E is now low enough to touch the ground. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Bulgarian Stock Exchange AD revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Bulgarian Stock Exchange AD (of which 2 shouldn't be ignored!) you should know about.

You might be able to find a better investment than Bulgarian Stock Exchange AD. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報