Asian Penny Stocks To Watch In January 2026

As the Asian markets continue to navigate a complex global landscape, characterized by mixed economic signals and evolving investor sentiment, opportunities for growth remain a focal point. Penny stocks, often associated with smaller or emerging companies, still hold potential for investors seeking affordability and growth. By identifying those with strong financials and clear growth prospects, investors can uncover promising opportunities in this niche sector.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.44 | HK$890.67M | ✅ 4 ⚠️ 1 View Analysis > |

| Asia Medical and Agricultural Laboratory and Research Center (SET:AMARC) | THB2.60 | THB1.09B | ✅ 3 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.54 | HK$2.11B | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect Medical Health Management (SEHK:1830) | HK$1.24 | HK$1.56B | ✅ 1 ⚠️ 2 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.101 | SGD52.87M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.48 | SGD13.7B | ✅ 5 ⚠️ 1 View Analysis > |

| NagaCorp (SEHK:3918) | HK$4.66 | HK$20.61B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$137.01M | ✅ 2 ⚠️ 5 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.46 | HK$51.78B | ✅ 4 ⚠️ 2 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.91 | NZ$244.72M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 963 stocks from our Asian Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Goldstream Investment (SEHK:1328)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Goldstream Investment Limited is an investment holding company involved in investment management and strategic direct investments in China and Hong Kong, with a market cap of HK$790.81 million.

Operations: The company's revenue is derived from two main segments: Investment Management (IM) Business, contributing HK$25.93 million, and Strategic Direct Investments (SDI) Business, generating HK$72.56 million.

Market Cap: HK$790.81M

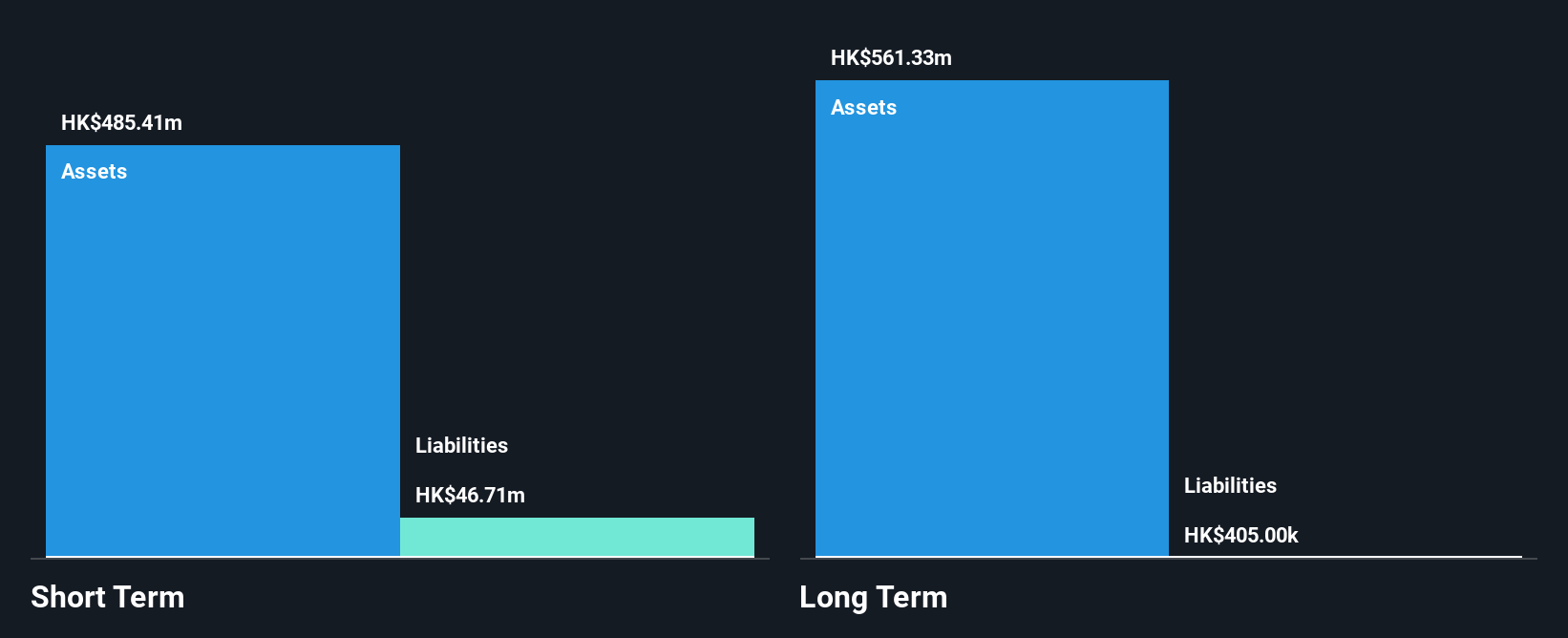

Goldstream Investment Limited, with a market cap of HK$790.81 million, derives its revenue from Investment Management and Strategic Direct Investments segments. Despite recent negative earnings growth of -15%, the company has managed to maintain high-quality earnings and improve its net profit margin over the past five years. The management team and board are experienced, contributing to strategic stability despite a highly volatile share price in recent months. Goldstream's financial health is bolstered by significant short-term assets exceeding liabilities and being debt-free, which positions it well for potential future opportunities in the capital markets sector.

- Click here to discover the nuances of Goldstream Investment with our detailed analytical financial health report.

- Gain insights into Goldstream Investment's historical outcomes by reviewing our past performance report.

Sino-Entertainment Technology Holdings (SEHK:6933)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sino-Entertainment Technology Holdings Limited is an investment holding company that develops, publishes, and operates mobile games in the People's Republic of China, with a market cap of HK$342.40 million.

Operations: The company generates CN¥23.54 million from its mobile game business in the People's Republic of China.

Market Cap: HK$342.4M

Sino-Entertainment Technology Holdings, with a market cap of HK$342.40 million, faces challenges as it remains unprofitable and has seen losses increase by 47.3% annually over the past five years. Despite being debt-free and having no long-term liabilities, the company has less than a year of cash runway based on its current free cash flow. Its share price is highly volatile compared to most Hong Kong stocks, although its board is experienced with an average tenure of 5.3 years. The company's short-term assets significantly exceed its short-term liabilities, providing some financial buffer amidst uncertainties in profitability growth prospects.

- Navigate through the intricacies of Sino-Entertainment Technology Holdings with our comprehensive balance sheet health report here.

- Learn about Sino-Entertainment Technology Holdings' historical performance here.

Thai Beverage (SGX:Y92)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Thai Beverage Public Company Limited, along with its subsidiaries, is involved in the production and distribution of alcoholic and non-alcoholic beverages as well as food products across Thailand, Vietnam, Malaysia, Myanmar, Singapore, and other international markets; it has a market cap of SGD11.56 billion.

Operations: The company's revenue is primarily derived from its Spirits segment at THB119.41 billion, followed by Beer at THB123.56 billion, Non-Alcoholic Beverages at THB65.04 billion, and Food products contributing THB22.04 billion.

Market Cap: SGD11.56B

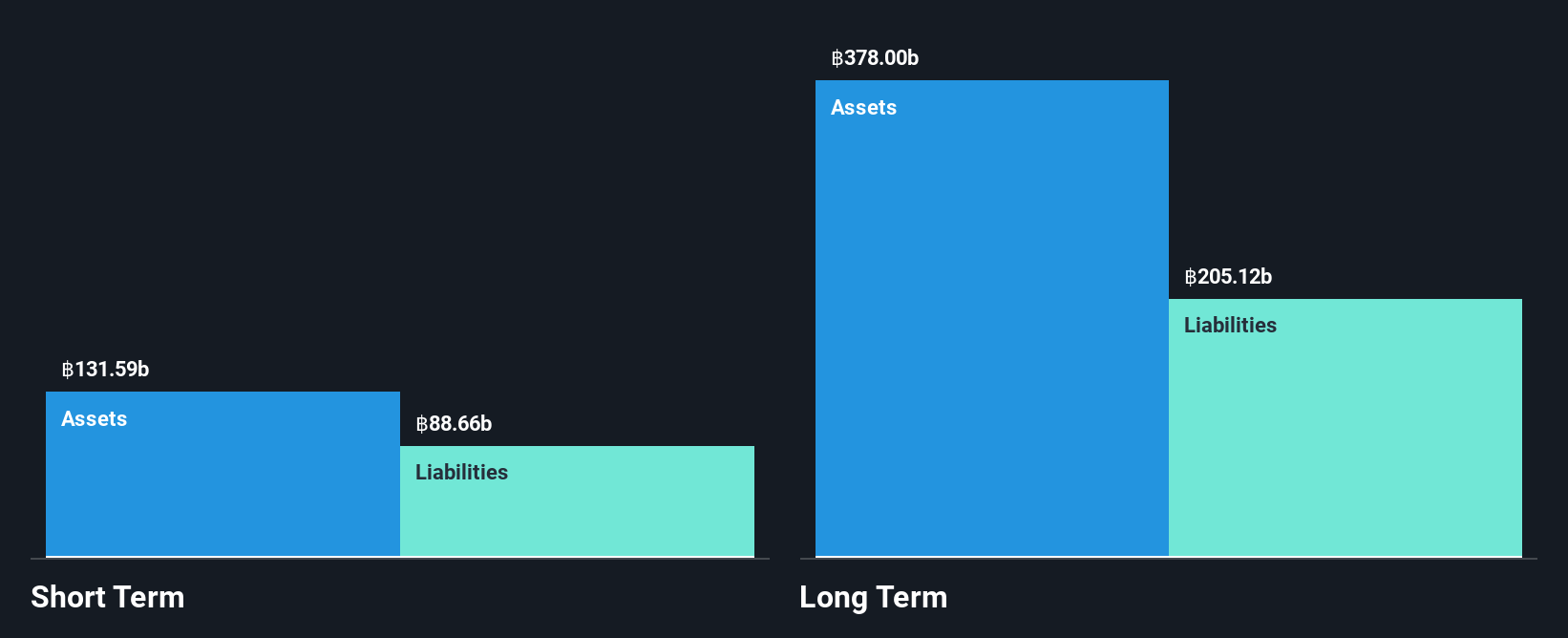

Thai Beverage's financial stability is supported by its substantial revenue streams, with spirits and beer being major contributors. Despite a slight decline in net income to THB25.36 billion for 2025, the company maintains a strong position with short-term assets exceeding short-term liabilities. However, its high net debt to equity ratio of 84.9% and lower profit margins compared to last year indicate financial leverage concerns. The company's earnings growth has been negative recently, but forecasts suggest potential improvement at 9.1% annually. Leadership changes aim to enhance governance and risk management, potentially influencing future strategic directions positively amidst current challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Thai Beverage.

- Learn about Thai Beverage's future growth trajectory here.

Summing It All Up

- Investigate our full lineup of 963 Asian Penny Stocks right here.

- Want To Explore Some Alternatives? These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報