Saudi Kayan Petrochemical Company (TADAWUL:2350) Might Not Be As Mispriced As It Looks

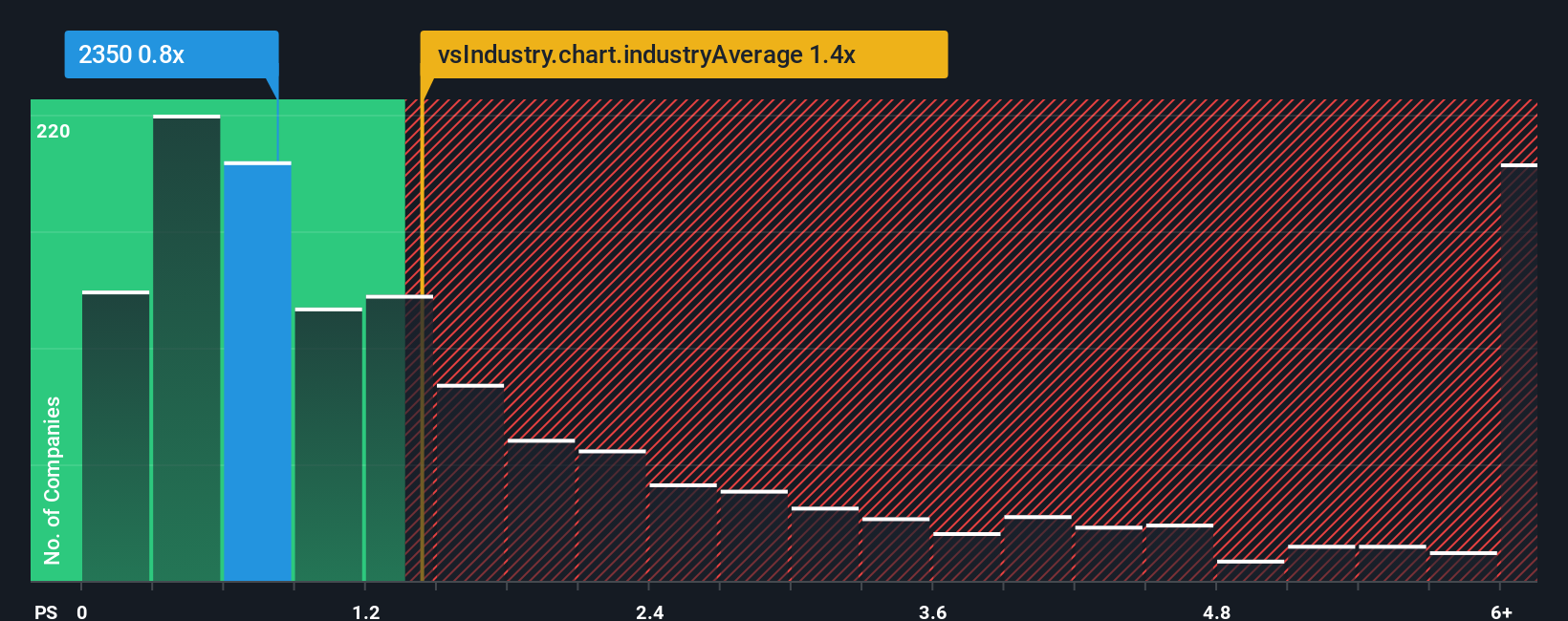

Saudi Kayan Petrochemical Company's (TADAWUL:2350) price-to-sales (or "P/S") ratio of 0.8x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Chemicals industry in Saudi Arabia have P/S ratios greater than 1.5x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Saudi Kayan Petrochemical

What Does Saudi Kayan Petrochemical's Recent Performance Look Like?

Recent revenue growth for Saudi Kayan Petrochemical has been in line with the industry. One possibility is that the P/S ratio is low because investors think this modest revenue performance may begin to slide. If you like the company, you'd be hoping this isn't the case so that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Saudi Kayan Petrochemical will help you uncover what's on the horizon.How Is Saudi Kayan Petrochemical's Revenue Growth Trending?

In order to justify its P/S ratio, Saudi Kayan Petrochemical would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 32% drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 4.4% each year as estimated by the six analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 2.7% per annum, which is not materially different.

With this in consideration, we find it intriguing that Saudi Kayan Petrochemical's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Bottom Line On Saudi Kayan Petrochemical's P/S

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It looks to us like the P/S figures for Saudi Kayan Petrochemical remain low despite growth that is expected to be in line with other companies in the industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Before you settle on your opinion, we've discovered 1 warning sign for Saudi Kayan Petrochemical that you should be aware of.

If you're unsure about the strength of Saudi Kayan Petrochemical's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報