Why Investors Shouldn't Be Surprised By Ever Harvest Group Holdings Limited's (HKG:1549) 25% Share Price Plunge

The Ever Harvest Group Holdings Limited (HKG:1549) share price has fared very poorly over the last month, falling by a substantial 25%. Longer-term, the stock has been solid despite a difficult 30 days, gaining 13% in the last year.

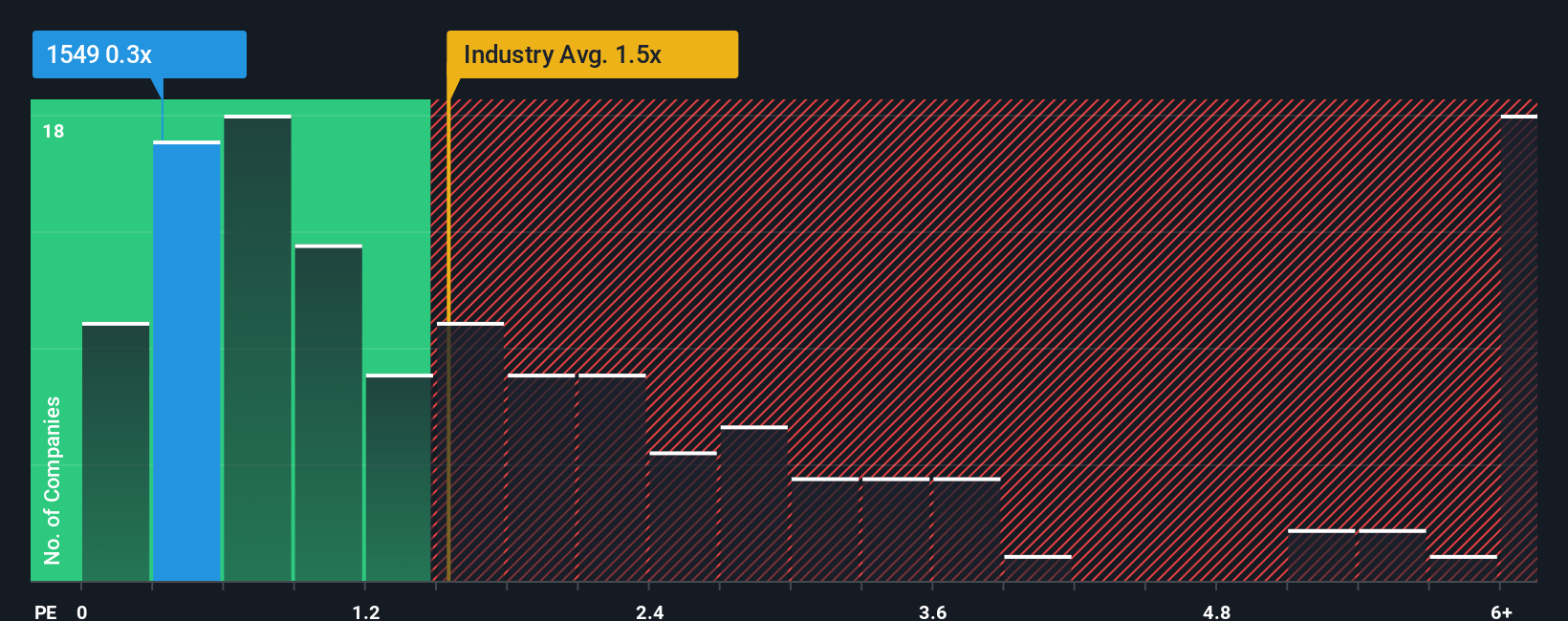

Although its price has dipped substantially, when close to half the companies operating in Hong Kong's Shipping industry have price-to-sales ratios (or "P/S") above 1x, you may still consider Ever Harvest Group Holdings as an enticing stock to check out with its 0.3x P/S ratio. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Ever Harvest Group Holdings

How Ever Harvest Group Holdings Has Been Performing

The revenue growth achieved at Ever Harvest Group Holdings over the last year would be more than acceptable for most companies. It might be that many expect the respectable revenue performance to degrade substantially, which has repressed the P/S. Those who are bullish on Ever Harvest Group Holdings will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Ever Harvest Group Holdings will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Ever Harvest Group Holdings would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 18%. Still, revenue has fallen 32% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for a contraction of 7.4% shows the industry is more attractive on an annualised basis regardless.

With this in consideration, it's no surprise that Ever Harvest Group Holdings' P/S falls short of its industry peers. However, when revenue shrink rapidly P/S often shrinks too, which could set up shareholders for future disappointment regardless. Even just maintaining these prices will be difficult to achieve as recent revenue trends are already weighing down the shares heavily.

The Bottom Line On Ever Harvest Group Holdings' P/S

The southerly movements of Ever Harvest Group Holdings' shares means its P/S is now sitting at a pretty low level. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Ever Harvest Group Holdings revealed its sharp three-year contraction in revenue is contributing to its low P/S, given the industry is set to shrink less severely. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Although, we would be concerned whether the company can even maintain its medium-term level of performance under these tough industry conditions. In the meantime, unless the company's relative performance improves, the share price will hit a barrier around these levels.

Having said that, be aware Ever Harvest Group Holdings is showing 3 warning signs in our investment analysis, and 1 of those is a bit unpleasant.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報