ASX Growth Stocks With High Insider Stakes For January 2026

As the Australian market winds down for the year, with a slight dip influenced by profit-taking and holiday closures, investors are keeping an eye on growth opportunities amidst fluctuating commodity prices and strong performances from Wall Street. In this context, stocks with high insider ownership often signal confidence in their potential for long-term growth, making them appealing to those looking to navigate the current economic landscape.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Wisr (ASX:WZR) | 10.2% | 96.3% |

| Titomic (ASX:TTT) | 14.8% | 74.9% |

| Sea Forest (ASX:SEA) | 15.1% | 92.6% |

| Polymetals Resources (ASX:POL) | 32.9% | 108% |

| Pointerra (ASX:3DP) | 19.8% | 110.3% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| IperionX (ASX:IPX) | 17.1% | 94.9% |

| Echo IQ (ASX:EIQ) | 19% | 51.4% |

| BlinkLab (ASX:BB1) | 32.1% | 101.4% |

| Adveritas (ASX:AV1) | 18.4% | 96.8% |

We'll examine a selection from our screener results.

Australian Ethical Investment (ASX:AEF)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Australian Ethical Investment Ltd is a publicly owned investment manager with a market cap of A$572.77 million.

Operations: The company generates revenue primarily through its Funds Management segment, which accounts for A$119.38 million.

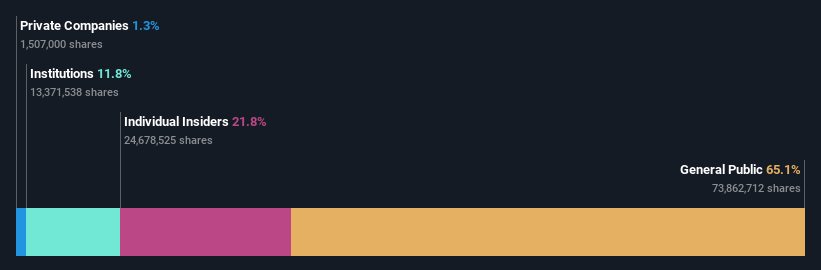

Insider Ownership: 22.5%

Australian Ethical Investment is poised for growth, with its revenue expected to increase at 10.4% annually, outpacing the broader Australian market's 6.1%. Despite a forecasted earnings growth of 18.34%, which is robust yet not exceptionally high, the company boasts a very high future return on equity of 59.2%. While insider trading activity has been quiet recently and dividend stability remains an issue, its strong financial performance supports its growth trajectory.

- Unlock comprehensive insights into our analysis of Australian Ethical Investment stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of Australian Ethical Investment shares in the market.

Australian Finance Group (ASX:AFG)

Simply Wall St Growth Rating: ★★★★☆☆

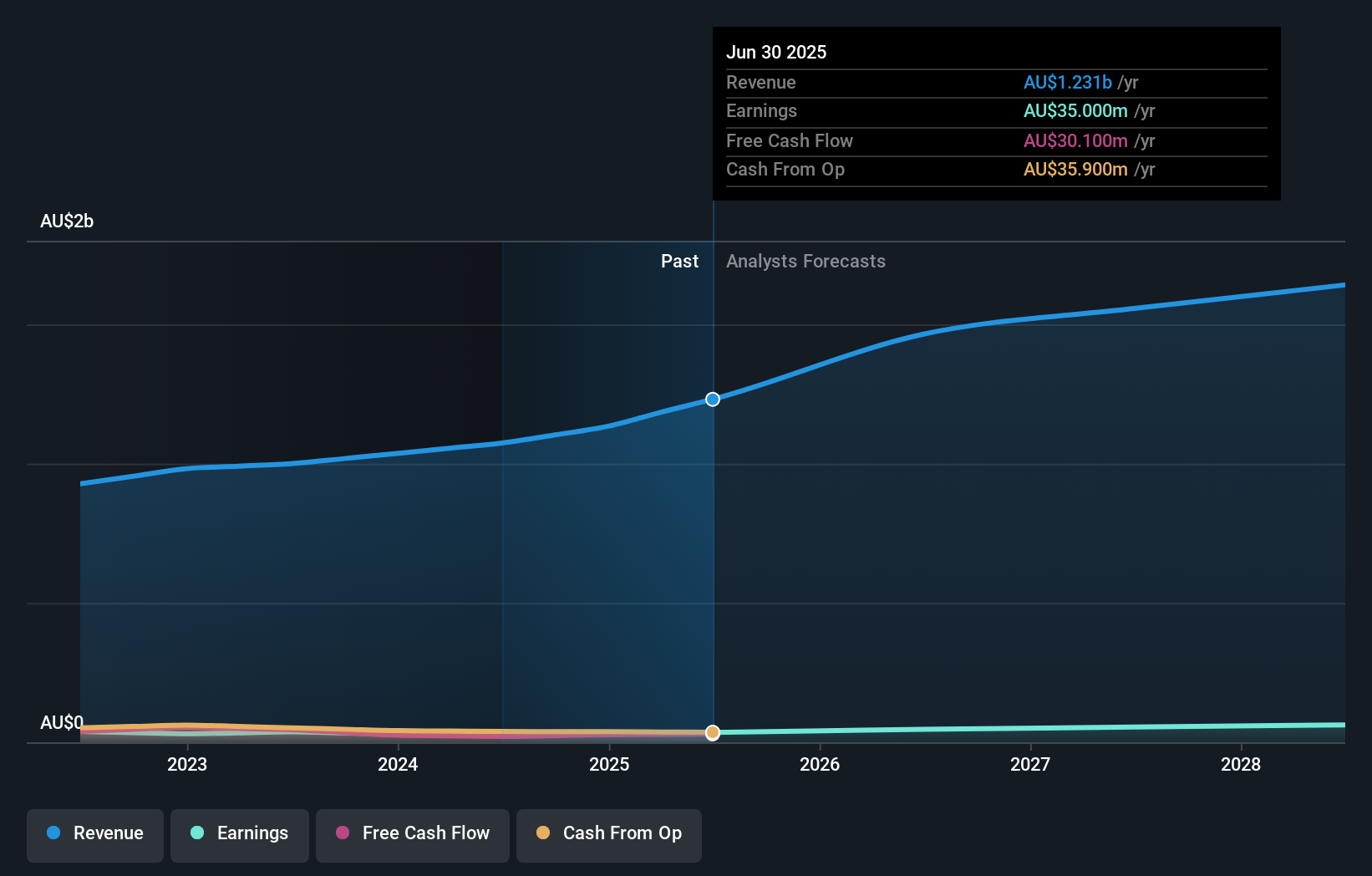

Overview: Australian Finance Group Limited, with a market cap of A$592.44 million, operates in the mortgage broking business across Australia through its subsidiaries.

Operations: The company's revenue primarily comes from its Distribution segment, which generated A$934.50 million, and its Manufacturing segment, contributing A$330.30 million.

Insider Ownership: 20.1%

Australian Finance Group is positioned for growth, with earnings projected to rise at 18.1% annually, surpassing the Australian market's 12.1%. The company's return on equity is expected to reach a high of 22.4% in three years. Although revenue growth at 9% per year lags behind its earnings expansion, it still exceeds market averages. Trading slightly below fair value and lacking recent insider trading activity, AFG faces challenges with debt coverage and dividend stability.

- Navigate through the intricacies of Australian Finance Group with our comprehensive analyst estimates report here.

- Our valuation report here indicates Australian Finance Group may be overvalued.

Chrysos (ASX:C79)

Simply Wall St Growth Rating: ★★★★★☆

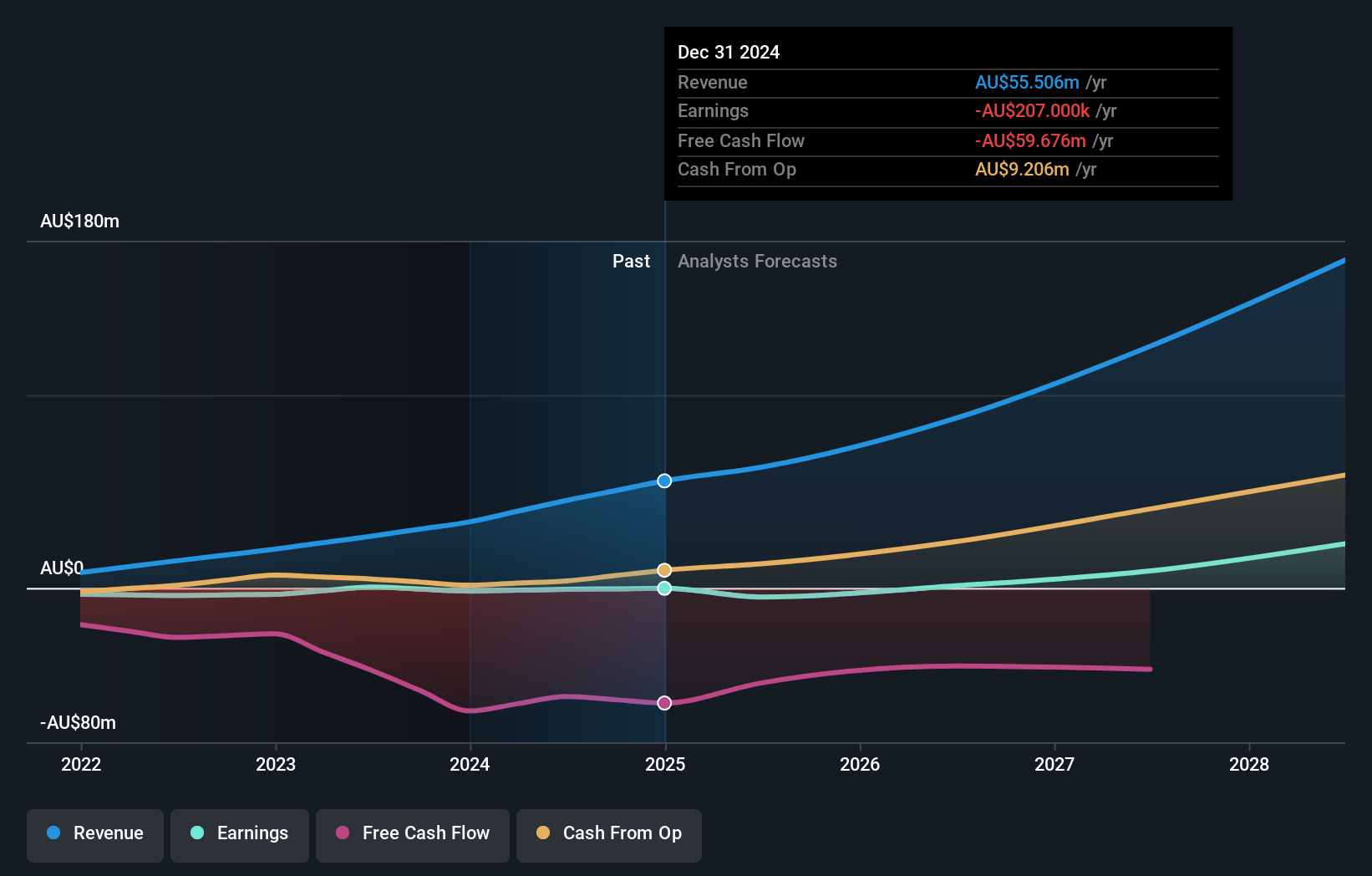

Overview: Chrysos Corporation Limited develops and supplies mining technologies across Europe, the Middle East, Africa, the Asia Pacific, and the Americas with a market cap of A$858.43 million.

Operations: Chrysos Corporation Limited generates revenue primarily from its mining services segment, amounting to A$66.11 million.

Insider Ownership: 15%

Chrysos Corporation is poised for significant growth, with revenue expected to increase by 22.6% annually, outpacing the broader Australian market. The company anticipates becoming profitable within three years, reflecting robust earnings growth of 65.01% per year. Recent board appointments enhance governance as Chrysos expands globally with its PhotonAssay technology. Insider confidence is evident through substantial share purchases in the past three months, suggesting strong internal belief in future prospects despite a short cash runway and low projected return on equity of 7.6%.

- Take a closer look at Chrysos' potential here in our earnings growth report.

- According our valuation report, there's an indication that Chrysos' share price might be on the expensive side.

Next Steps

- Delve into our full catalog of 111 Fast Growing ASX Companies With High Insider Ownership here.

- Searching for a Fresh Perspective? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報