After Leaping 25% Israel Land Development - Urban Renewal Ltd (TLV:ILDR) Shares Are Not Flying Under The Radar

Israel Land Development - Urban Renewal Ltd (TLV:ILDR) shares have continued their recent momentum with a 25% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 40% in the last year.

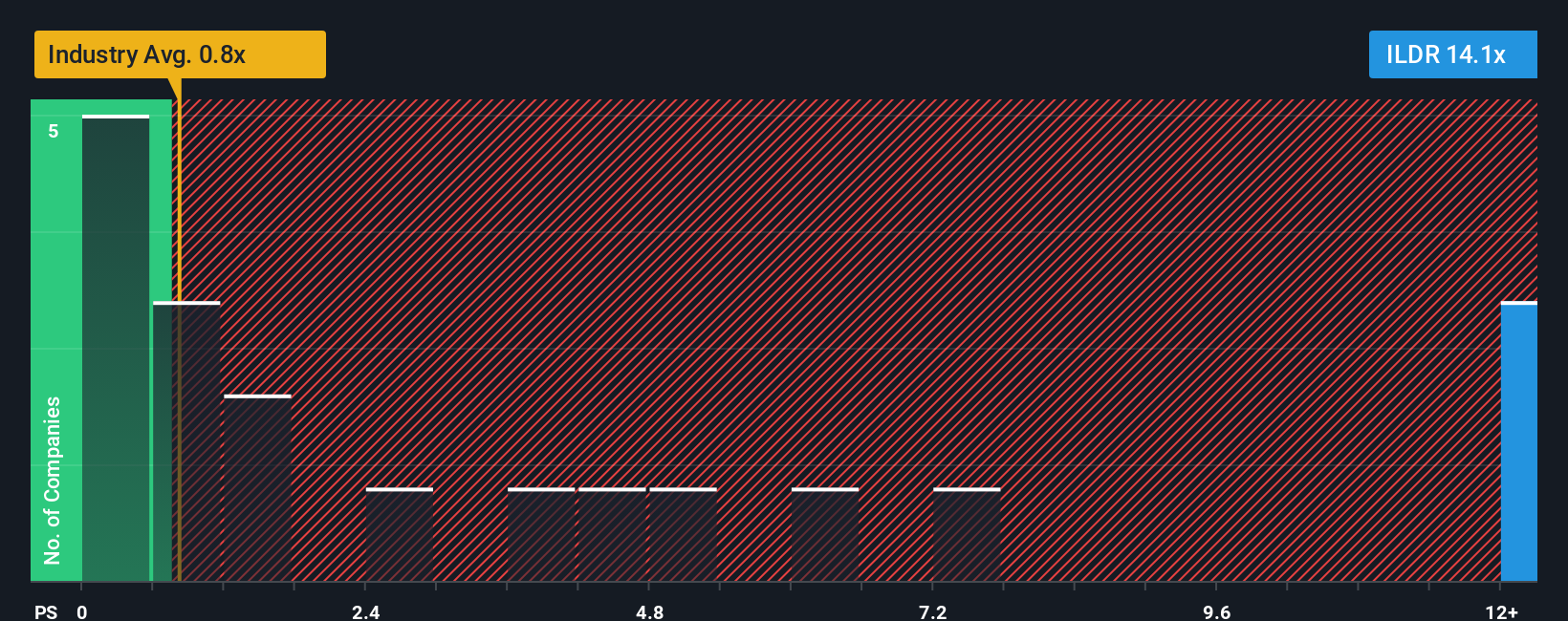

Following the firm bounce in price, you could be forgiven for thinking Israel Land Development - Urban Renewal is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 14.1x, considering almost half the companies in Israel's Oil and Gas industry have P/S ratios below 1.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Israel Land Development - Urban Renewal

What Does Israel Land Development - Urban Renewal's Recent Performance Look Like?

With revenue growth that's exceedingly strong of late, Israel Land Development - Urban Renewal has been doing very well. It seems that many are expecting the strong revenue performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Israel Land Development - Urban Renewal's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as Israel Land Development - Urban Renewal's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 56% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 192% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Weighing the recent medium-term upward revenue trajectory against the broader industry's one-year forecast for contraction of 1.6% shows it's a great look while it lasts.

With this in mind, it's clear to us why Israel Land Development - Urban Renewal's P/S exceeds that of its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the industry. Nonetheless, with most other businesses facing an uphill battle, staying on its current revenue path is no certainty.

The Bottom Line On Israel Land Development - Urban Renewal's P/S

Shares in Israel Land Development - Urban Renewal have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As detailed previously, the strength of Israel Land Development - Urban Renewal's recent revenue trends over the medium-term relative to a declining industry is part of the reason why it trades at a higher P/S than its industry counterparts. Right now shareholders are comfortable with the P/S as they are quite confident revenues aren't under threat. However, it'd be fair to raise concerns over whether this level of revenue performance will continue given the harsh conditions facing the industry. Otherwise, it's hard to see the share price falling strongly in the near future if its revenue performance persists.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Israel Land Development - Urban Renewal that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報