Analyzing 3 Promising Penny Stocks With Market Caps Over $60M

As 2025 draws to a close, major U.S. stock indexes have experienced a mixed performance, with recent declines overshadowing a year of substantial gains driven by technology firms. In this context, penny stocks—though an outdated term—remain relevant as they often represent smaller or emerging companies that can offer unique investment opportunities. By focusing on those with strong financials and growth potential, investors may uncover promising prospects among these lesser-known stocks.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $2.49 | $574.34M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.89 | $679.93M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8343 | $142.68M | ✅ 4 ⚠️ 1 View Analysis > |

| LexinFintech Holdings (LX) | $3.29 | $553.59M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuya (TUYA) | $2.14 | $1.29B | ✅ 4 ⚠️ 1 View Analysis > |

| CI&T (CINT) | $4.24 | $556.91M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| Nephros (NEPH) | $4.72 | $50.16M | ✅ 3 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.98 | $7.12M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.97 | $89.94M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 341 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Anavex Life Sciences (AVXL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Anavex Life Sciences Corp. is a biopharmaceutical company with a market cap of approximately $339.52 million.

Operations: Anavex Life Sciences Corp. currently does not report any revenue segments.

Market Cap: $339.52M

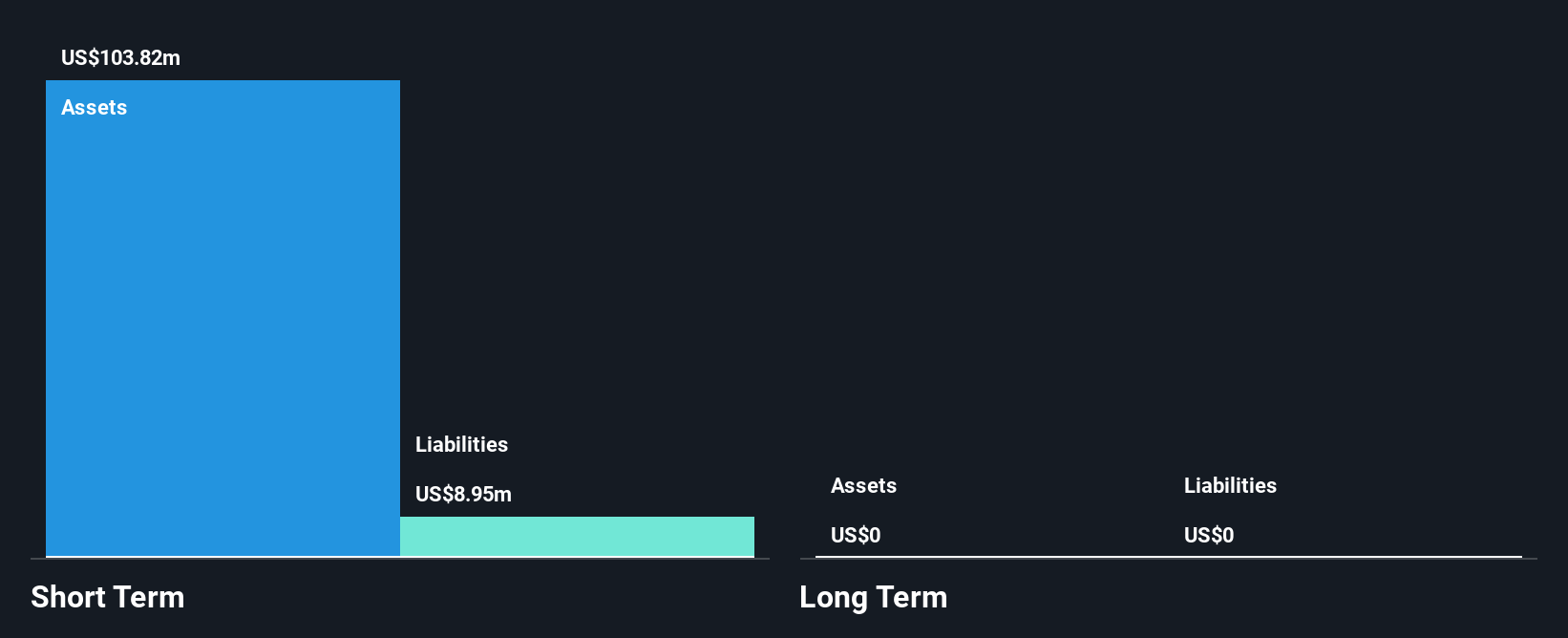

Anavex Life Sciences, with a market cap of US$339.52 million, is pre-revenue and focused on developing treatments for Alzheimer's disease and schizophrenia. Despite being unprofitable, the company has a stable cash runway exceeding two years and no debt liabilities. Recent developments include regulatory challenges in the EU concerning blarcamesine for Alzheimer's treatment, following a negative opinion from the European Medicines Agency's Committee for Medicinal Products. Anavex is seeking re-examination while also engaging with U.S. FDA regarding clinical trial results. The management team has an average tenure of 3.9 years, indicating experience in navigating these complex processes.

- Navigate through the intricacies of Anavex Life Sciences with our comprehensive balance sheet health report here.

- Learn about Anavex Life Sciences' future growth trajectory here.

Caesarstone (CSTE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Caesarstone Ltd. designs, develops, manufactures, and sells engineered stone and porcelain products across various global markets under its own brands, with a market cap of $65.66 million.

Operations: The company's revenue is primarily derived from its Building Products segment, totaling $400.66 million.

Market Cap: $65.66M

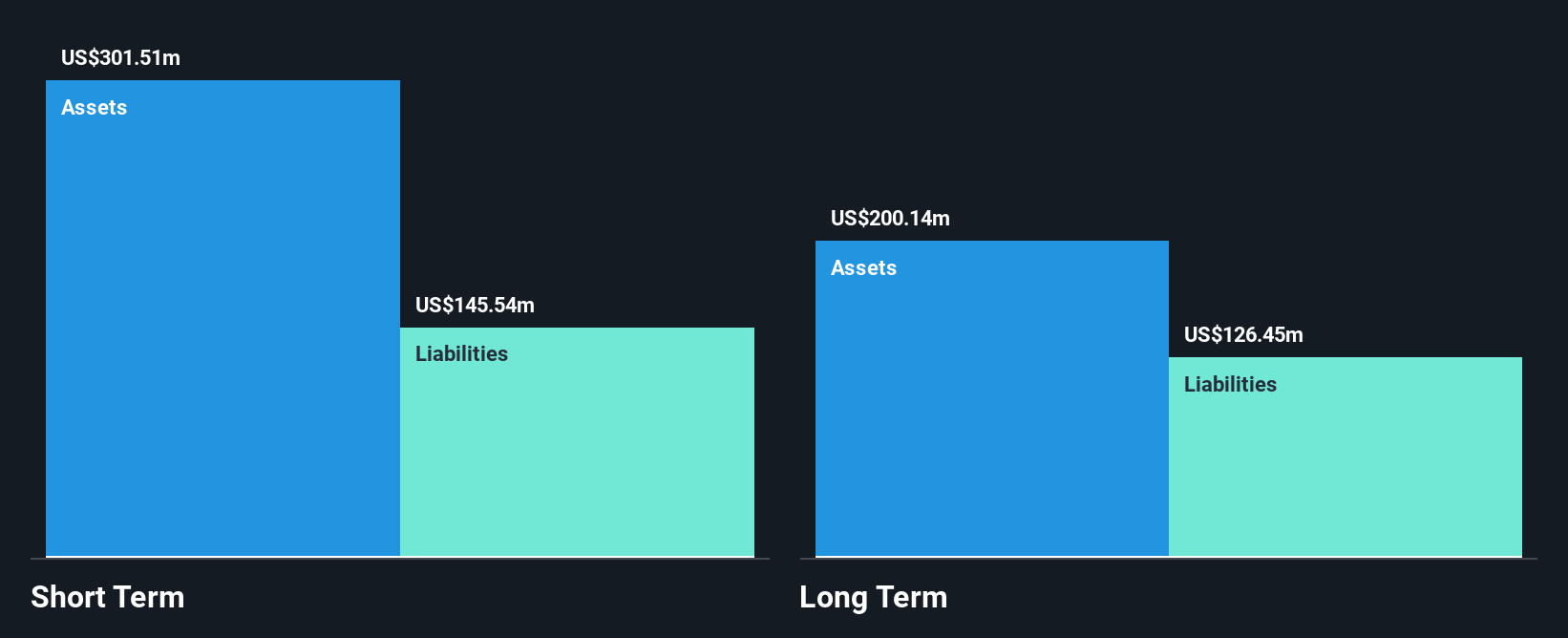

Caesarstone Ltd., with a market cap of US$65.66 million, is facing financial challenges as evidenced by its recent earnings report showing a net loss of US$18.1 million for Q3 2025, up from the previous year. Despite these losses, the company maintains more cash than total debt and has short-term assets exceeding liabilities, indicating some financial stability. Recent strategic restructuring efforts include closing a manufacturing facility in Israel to improve competitiveness and profitability. Management changes bring experienced leadership with Yaron Arzi's appointment to the board, potentially aiding in navigating ongoing operational adjustments and market demands.

- Unlock comprehensive insights into our analysis of Caesarstone stock in this financial health report.

- Explore Caesarstone's analyst forecasts in our growth report.

Realbotix (XBOT.F)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Realbotix Corp., with a market cap of $67.03 million, develops customizable human-like robots with artificial intelligence integration in Canada.

Operations: The company's revenue segment is derived entirely from Canada, totaling $2.70 million.

Market Cap: $67.03M

Realbotix Corp., with a market cap of $67.03 million, is navigating the penny stock landscape with both opportunities and challenges. The company has recently raised CAD 7 million through private placements to bolster its financial runway, which was initially forecasted to last five months. Despite being unprofitable, Realbotix's short-term assets exceed liabilities and it holds more cash than debt, providing some financial cushion. The appointment of Scott Meyers as CFO aims to strengthen corporate finance strategies amid global expansion efforts. Upcoming showcases at CES 2026 highlight advancements in AI-powered humanoid robots, potentially enhancing market visibility and investor interest.

- Click to explore a detailed breakdown of our findings in Realbotix's financial health report.

- Assess Realbotix's future earnings estimates with our detailed growth reports.

Where To Now?

- Access the full spectrum of 341 US Penny Stocks by clicking on this link.

- Looking For Alternative Opportunities? These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報