Bonterra Energy And 2 Other TSX Penny Stocks With Promising Prospects

As the Canadian market navigates a landscape of strategic sector weightings and global diversification, investors are reminded of the importance of balancing their portfolios across various industries. Penny stocks, while sometimes considered niche, still offer intriguing growth opportunities when backed by solid financial health. These smaller or newer companies can present a unique blend of value and growth potential, making them worthy considerations for those looking to explore promising prospects within the Canadian market.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.16 | CA$54.6M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.75 | CA$21.97M | ✅ 2 ⚠️ 2 View Analysis > |

| Sailfish Royalty (TSXV:FISH) | CA$3.35 | CA$255.45M | ✅ 1 ⚠️ 4 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$1.25 | CA$125.99M | ✅ 4 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.41 | CA$3.43M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.35 | CA$52.48M | ✅ 3 ⚠️ 1 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.31 | CA$871.54M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.24 | CA$24.58M | ✅ 2 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$3.29 | CA$166.88M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.95 | CA$184.52M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 388 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Bonterra Energy (TSX:BNE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bonterra Energy Corp. is a conventional oil and gas company focused on the development and production of oil and natural gas in Canada, with a market cap of CA$171.17 million.

Operations: The company generates revenue primarily from its development and production activities in the oil and natural gas sector, amounting to CA$225.09 million.

Market Cap: CA$171.17M

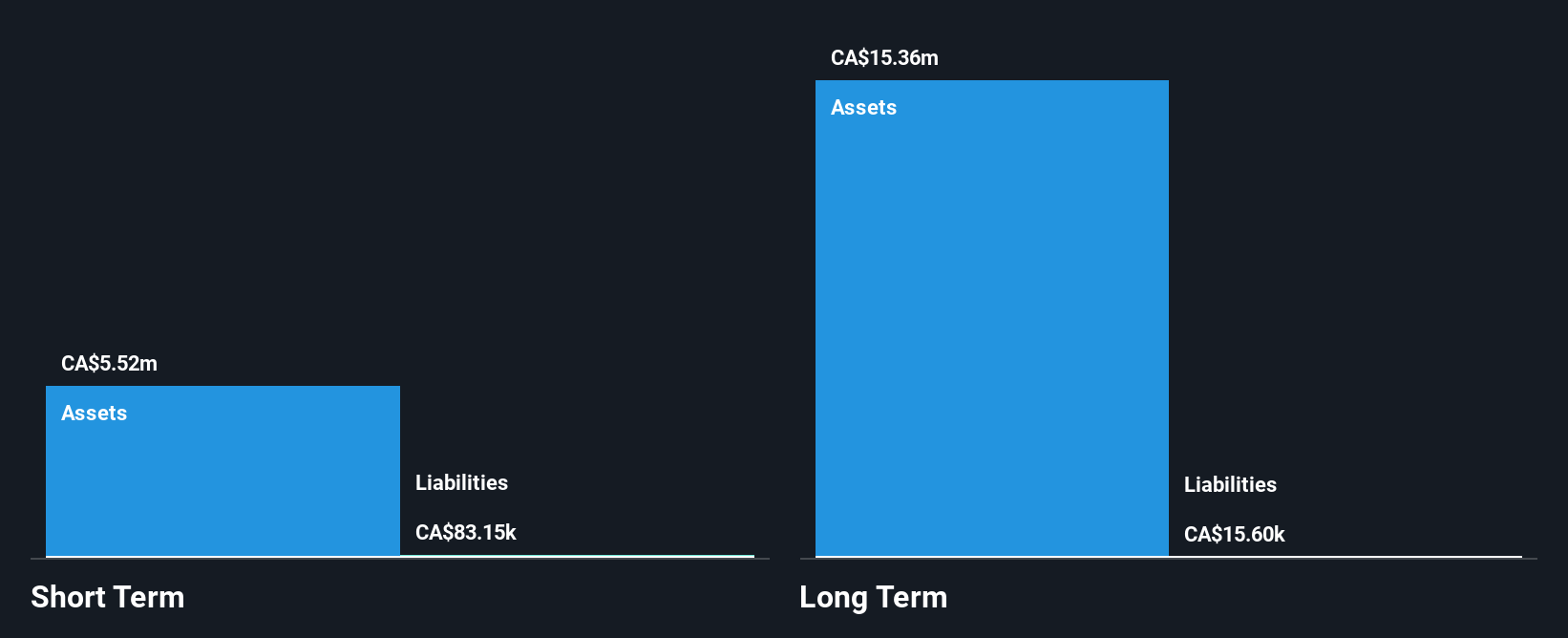

Bonterra Energy, with a market cap of CA$171.17 million, remains unprofitable but has shown resilience by reducing its debt-to-equity ratio from 141.6% to 30% over five years and maintaining positive free cash flow with a runway exceeding three years. Recent strategic moves include acquiring assets in the Greater Bonanza Area for $15.7 million, enhancing production capabilities and land holdings by 36%. Despite facing a net loss in recent quarters, Bonterra's expansion initiatives at Charlie Lake show promising early results, potentially strengthening its position in the oil and gas sector amidst volatile market conditions.

- Get an in-depth perspective on Bonterra Energy's performance by reading our balance sheet health report here.

- Assess Bonterra Energy's future earnings estimates with our detailed growth reports.

Colonial Coal International (TSXV:CAD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Colonial Coal International Corp. focuses on acquiring, exploring, and developing coal properties in Canada with a market cap of CA$494.65 million.

Operations: The company has not reported any revenue segments.

Market Cap: CA$494.65M

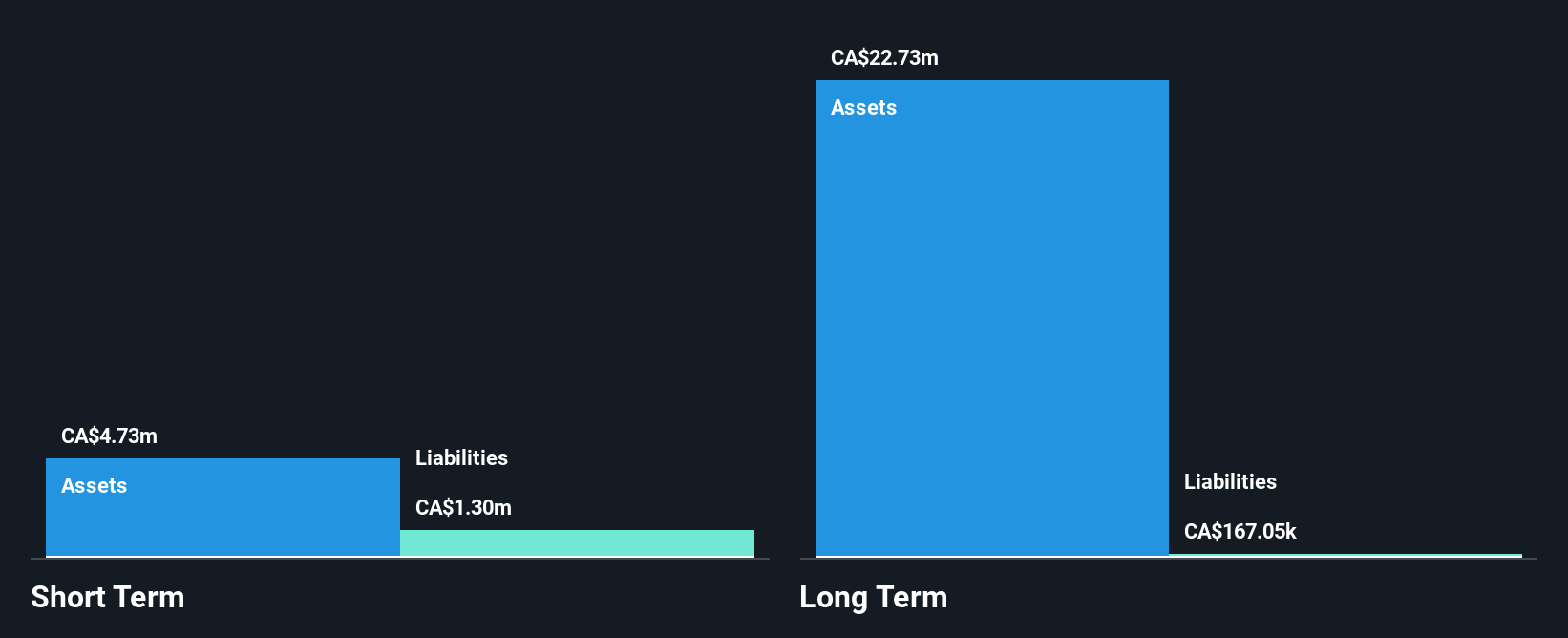

Colonial Coal International Corp., with a market cap of CA$494.65 million, remains pre-revenue and unprofitable, reporting a net loss of CA$7.12 million for the year ended July 31, 2025. Despite this, the company benefits from an experienced management team averaging 15.2 years in tenure and no long-term liabilities or debt. Its short-term assets significantly cover its short-term liabilities (CA$4.4 million vs. CA$106,400), providing financial stability amidst losses that have increased at a rate of 15.1% annually over five years. The firm maintains a cash runway exceeding one year based on current free cash flow trends.

- Take a closer look at Colonial Coal International's potential here in our financial health report.

- Understand Colonial Coal International's track record by examining our performance history report.

Doubleview Gold (TSXV:DBG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Doubleview Gold Corp. is involved in the acquisition, exploration, and development of mineral resource properties in Canada with a market cap of CA$217.75 million.

Operations: Doubleview Gold Corp. does not report any specific revenue segments.

Market Cap: CA$217.75M

Doubleview Gold Corp., with a market cap of CA$217.75 million, is pre-revenue and unprofitable, though it has an experienced management team averaging 7.7 years in tenure. The company recently announced significant drilling results from its Hat Polymetallic Deposit in British Columbia, highlighting expanded mineralization and potential for scandium recovery—a critical metal with growing demand. Despite short-term financial constraints, evidenced by a cash runway of five months as of August 2025, Doubleview has raised additional capital through private placements to support ongoing exploration efforts and the advancement of its Preliminary Economic Assessment.

- Navigate through the intricacies of Doubleview Gold with our comprehensive balance sheet health report here.

- Examine Doubleview Gold's past performance report to understand how it has performed in prior years.

Next Steps

- Reveal the 388 hidden gems among our TSX Penny Stocks screener with a single click here.

- Ready To Venture Into Other Investment Styles? Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報