Investors Still Aren't Entirely Convinced By Hydreight Technologies Inc.'s (CVE:NURS) Revenues Despite 25% Price Jump

Hydreight Technologies Inc. (CVE:NURS) shareholders would be excited to see that the share price has had a great month, posting a 25% gain and recovering from prior weakness. The annual gain comes to 110% following the latest surge, making investors sit up and take notice.

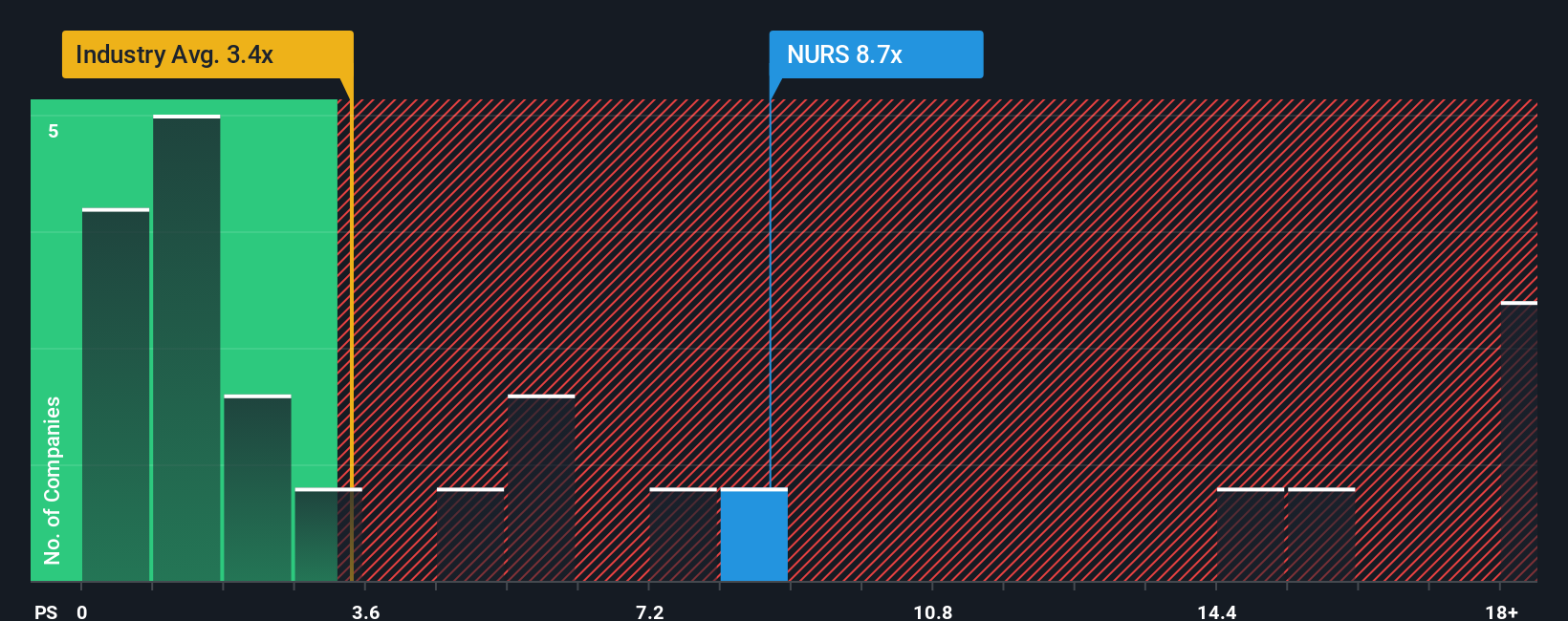

Although its price has surged higher, you could still be forgiven for feeling indifferent about Hydreight Technologies' P/S ratio of 8.7x, since the median price-to-sales (or "P/S") ratio for the Healthcare Services industry in Canada is about the same. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Hydreight Technologies

How Has Hydreight Technologies Performed Recently?

Recent revenue growth for Hydreight Technologies has been in line with the industry. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Hydreight Technologies will help you uncover what's on the horizon.How Is Hydreight Technologies' Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Hydreight Technologies' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 59%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 259% during the coming year according to the two analysts following the company. With the industry only predicted to deliver 13%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Hydreight Technologies' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Hydreight Technologies' P/S?

Its shares have lifted substantially and now Hydreight Technologies' P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, Hydreight Technologies' P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Hydreight Technologies, and understanding them should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq 華爾街日報

華爾街日報