Undervalued Small Caps With Insider Interest Across Regions In December 2025

As 2025 draws to a close, the U.S. market has experienced a slight downturn with major indexes closing lower for three consecutive sessions, while precious metals like gold and silver have rebounded. In this environment of fluctuating indices and economic uncertainty, identifying small-cap stocks that are perceived as undervalued can offer potential opportunities for investors looking to diversify their portfolios.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Wolverine World Wide | 16.9x | 0.8x | 38.08% | ★★★★★☆ |

| First United | 9.9x | 3.0x | 44.63% | ★★★★★☆ |

| MVB Financial | 10.4x | 2.0x | 21.71% | ★★★★★☆ |

| Angel Oak Mortgage REIT | 12.4x | 6.2x | 43.87% | ★★★★★☆ |

| Metropolitan Bank Holding | 12.4x | 3.0x | 31.61% | ★★★★☆☆ |

| Union Bankshares | 9.5x | 2.1x | 22.07% | ★★★★☆☆ |

| S&T Bancorp | 11.3x | 3.9x | 37.37% | ★★★★☆☆ |

| Farmland Partners | 6.3x | 7.8x | -86.92% | ★★★★☆☆ |

| Stock Yards Bancorp | 14.3x | 5.1x | 35.41% | ★★★☆☆☆ |

| Infinity Natural Resources | NA | 0.8x | -13.60% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Armada Hoffler Properties (AHH)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Armada Hoffler Properties operates as a real estate investment trust focusing on office, retail, and multifamily properties, with additional services in general contracting and real estate financing, and has a market capitalization of approximately $1.02 billion.

Operations: Armada Hoffler Properties generates revenue primarily from General Contracting and Real Estate Services, Retail Real Estate, and Office Real Estate. The company's cost of goods sold has a significant impact on its gross profit margin, which was 42.64% as of September 30, 2025. Operating expenses are a notable portion of the cost structure, with depreciation and amortization being substantial components.

PE: 35.5x

Armada Hoffler Properties, a dynamic player in real estate, recently announced a quarterly dividend of US$0.14 per common share, reflecting steady cash flow despite challenges. The company's Q3 2025 earnings report showed sales at US$68.72 million and a net loss of US$0.688 million, indicating financial headwinds but also resilience with strategic leasing moves like Atlantic Union Bank's new lease at Town Center. Insider confidence is evident as leadership transitions continue smoothly with Shawn J. Tibbetts' appointment as Chairman effective January 2026, promising continuity and potential growth in their mixed-use developments portfolio amidst evolving market conditions.

Brandywine Realty Trust (BDN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Brandywine Realty Trust is a real estate investment trust that primarily focuses on the ownership, management, and development of office properties in key markets such as Philadelphia and Austin, with a market capitalization of approximately $1.01 billion.

Operations: Brandywine Realty Trust generates revenue primarily from its operations in Philadelphia CBD and Pennsylvania Suburbs, with significant contributions also coming from Austin, Texas. The company's cost of goods sold (COGS) consistently impacts its gross profit, which has shown fluctuations over the periods reviewed. The net income margin has experienced variability, with notable negative values in recent periods.

PE: -2.8x

Brandywine Realty Trust, a smaller player in the real estate sector, recently saw insider confidence with Gerard Sweeney purchasing 88,500 shares for approximately US$298,882. Despite a challenging year with revised earnings guidance and increased losses per share to US$1.05 - $1.03 for 2025, the company maintained its quarterly dividend of US$0.08 per share. The retirement of their long-serving Executive VP signals upcoming leadership changes while they navigate external borrowing challenges without customer deposits as funding sources.

- Delve into the full analysis valuation report here for a deeper understanding of Brandywine Realty Trust.

Gain insights into Brandywine Realty Trust's past trends and performance with our Past report.

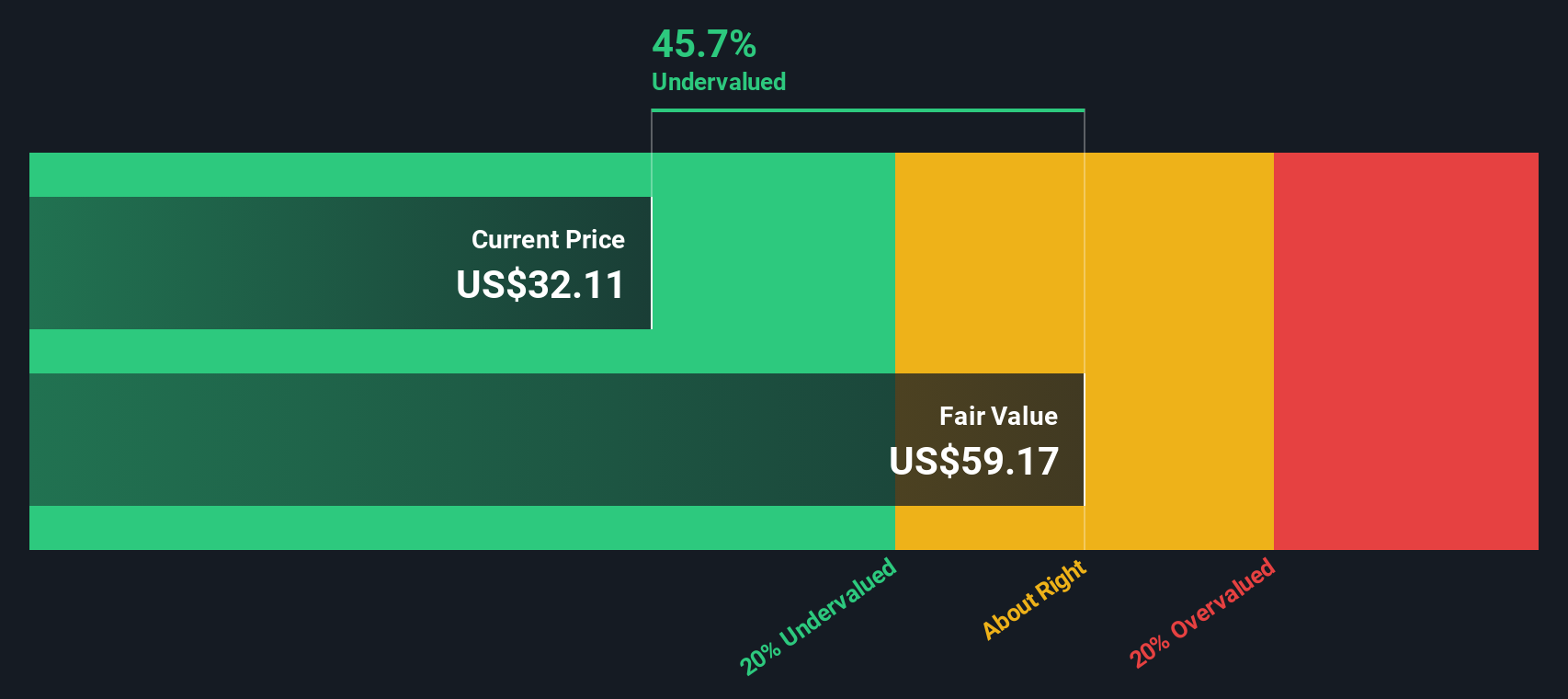

Global Medical REIT (GMRE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Global Medical REIT is a real estate investment trust focused on acquiring and managing healthcare facilities, with a market cap of approximately $0.5 billion.

Operations: The company primarily generates revenue through investments in medical properties, with the latest reported revenue at $144.83 million. Operating expenses and non-operating expenses significantly impact net income, which was reported as -$3.32 million for the most recent period. The gross profit margin has been consistently high, reaching 99.89% in the latest quarter, indicating effective management of direct costs relative to revenue generation.

PE: -136.6x

Global Medical REIT, a smaller company in the healthcare real estate sector, has shown insider confidence with President Mark Decker purchasing 32,000 shares for over US$1 million. Despite recent financial challenges, including a net loss of US$4.55 million in Q3 2025 and reliance on external borrowing as its sole funding source, the company is poised for an earnings growth forecast of 87% annually. Recent dividend affirmations and fixed-income offerings highlight ongoing efforts to maintain shareholder value amid executive changes.

Key Takeaways

- Take a closer look at our Undervalued US Small Caps With Insider Buying list of 82 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報