US Market's Undiscovered Gems With Strong Potential

As the U.S. stock market experiences a slight downturn with major indexes closing lower for the third consecutive session, investors are keeping a close eye on emerging opportunities within small-cap stocks. In this environment, identifying undiscovered gems requires a focus on companies with strong fundamentals and potential for growth despite broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 57.63% | 1.47% | -2.43% | ★★★★★★ |

| Tri-County Financial Group | 102.20% | -2.69% | -15.63% | ★★★★★★ |

| Morris State Bancshares | 1.99% | 2.14% | 1.63% | ★★★★★★ |

| Oakworth Capital | 40.91% | 15.96% | 11.47% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Epsilon Energy | NA | 2.43% | -4.36% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| Seneca Foods | 41.64% | 2.31% | -23.77% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Union Bankshares | 369.65% | 1.12% | -7.45% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Yuanbao (YB)

Simply Wall St Value Rating: ★★★★★★

Overview: Yuanbao Inc., with a market cap of approximately $933.12 million, operates in the People’s Republic of China offering online insurance distribution and services through its subsidiaries.

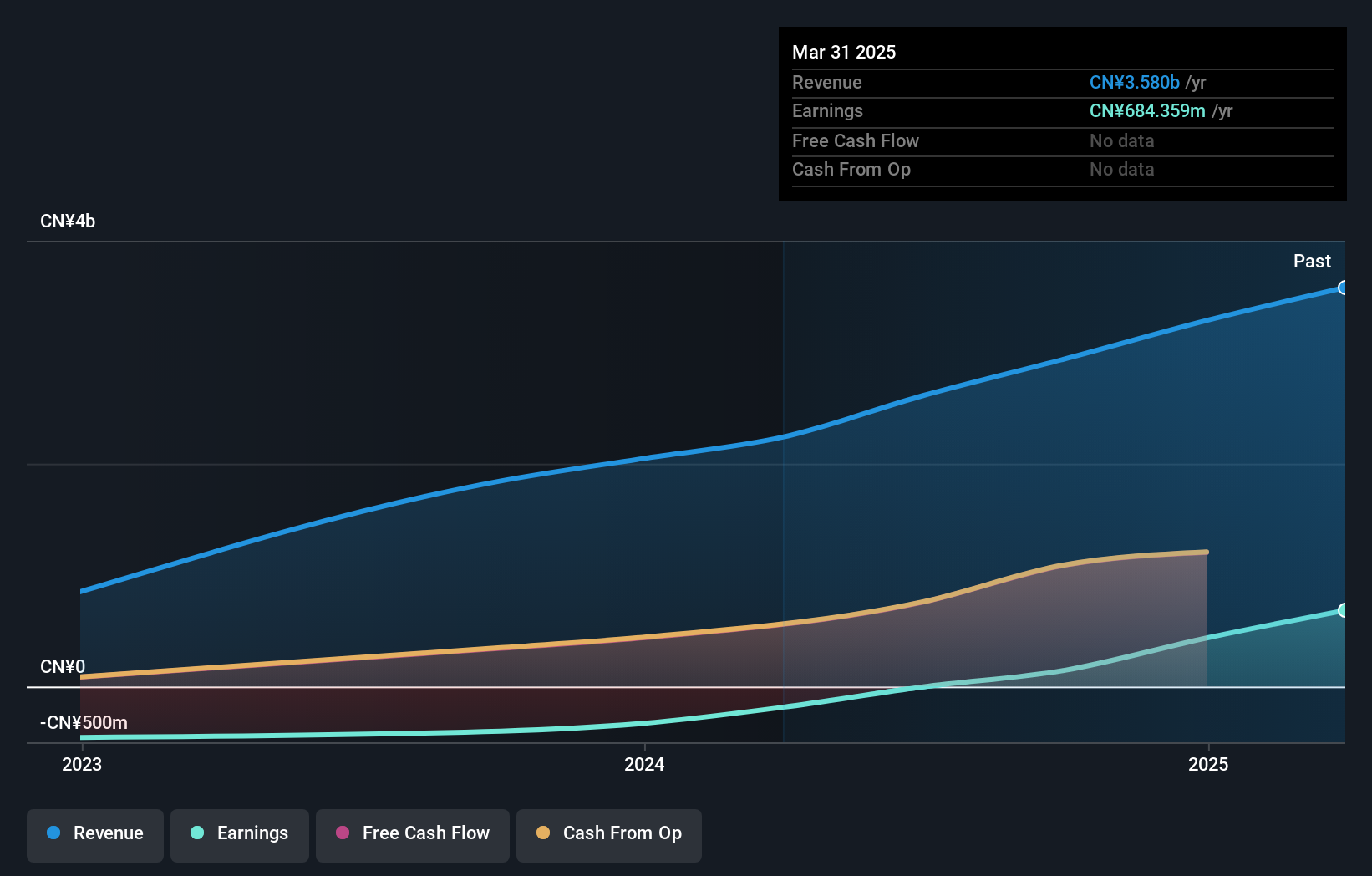

Operations: The primary revenue stream for Yuanbao Inc. is its insurance brokers segment, generating CN¥4.09 billion. The company's net profit margin is not specified in the provided data, so further analysis would be required to assess profitability trends.

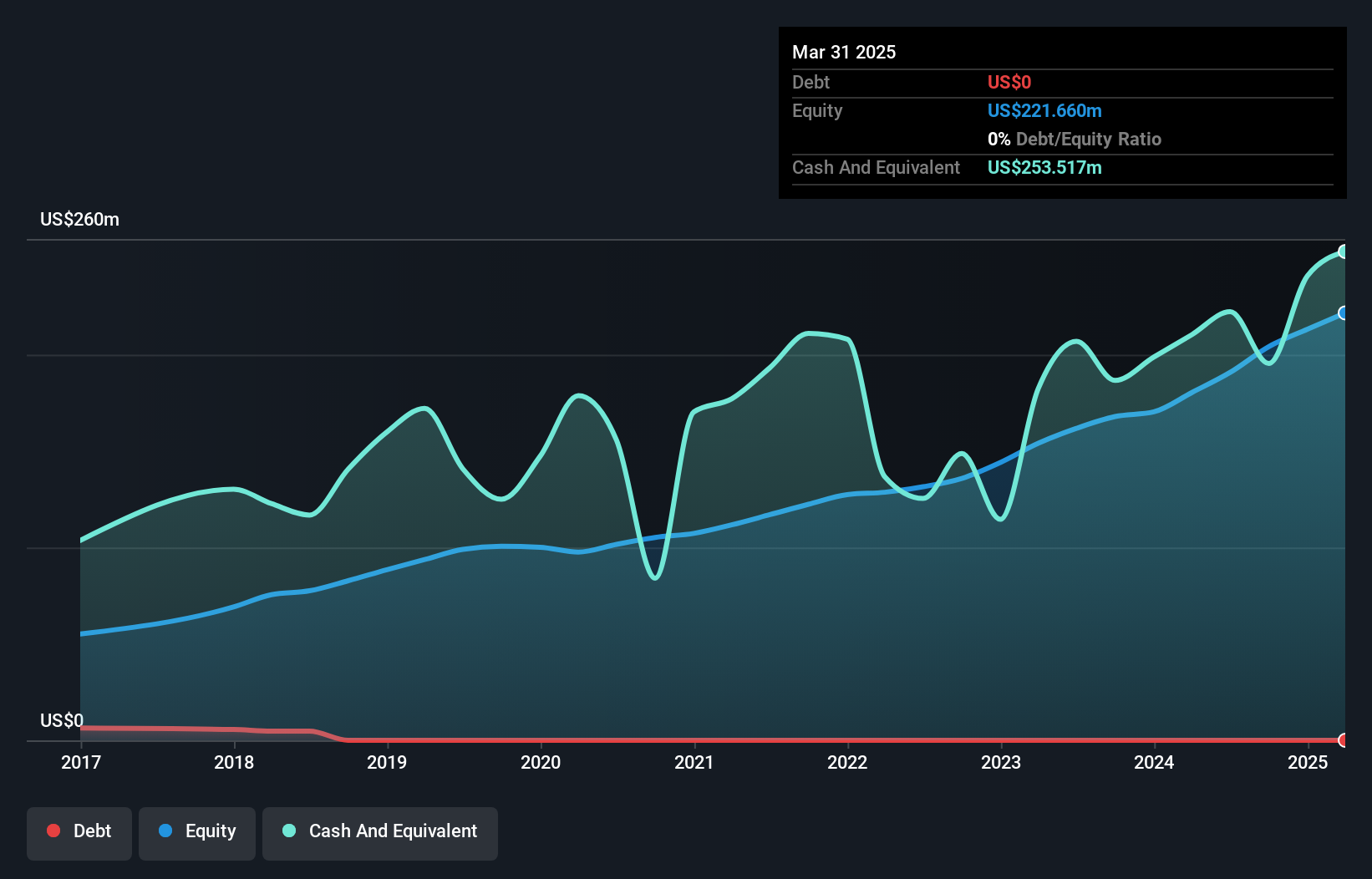

Yuanbao, a nimble player in its sector, has demonstrated impressive growth with earnings surging by 1176.5% over the past year, outpacing the industry average of 11.6%. This performance is underscored by high-quality earnings and a debt-free balance sheet, eliminating concerns about interest payments. Trading at 79% below estimated fair value suggests potential undervaluation. Recent results show sales climbing to CNY 1.16 billion from CNY 866.78 million year-on-year for Q3, while net income rose to CNY 370.36 million from CNY 244.84 million, indicating robust financial health and promising future prospects in the market landscape.

- Delve into the full analysis health report here for a deeper understanding of Yuanbao.

Evaluate Yuanbao's historical performance by accessing our past performance report.

Bank7 (BSVN)

Simply Wall St Value Rating: ★★★★★★

Overview: Bank7 Corp. is a bank holding company for Bank7, offering banking and financial services to both individual and corporate customers, with a market cap of $388.16 million.

Operations: Bank7 generates revenue primarily through its banking segment, which amounts to $95.71 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

With total assets of US$1.9 billion and equity at US$241.7 million, Bank7 showcases a robust financial position in the banking landscape. Total deposits stand at US$1.6 billion, closely matched by loans totaling US$1.5 billion, reflecting a well-balanced approach to lending and funding operations. The bank's net interest margin is an impressive 5%, while its allowance for bad loans is maintained at 0.3% of total loans, indicating prudent risk management practices. Despite forecasts suggesting a slight earnings dip over the next few years, Bank7 trades significantly below estimated fair value, presenting potential opportunities for investors seeking undervalued assets in the sector.

- Navigate through the intricacies of Bank7 with our comprehensive health report here.

Gain insights into Bank7's historical performance by reviewing our past performance report.

Genie Energy (GNE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Genie Energy Ltd. operates through its subsidiaries to provide energy services both in the United States and internationally, with a market cap of $366.96 million.

Operations: Genie Energy generates revenue primarily from its Genie Retail Energy segment, which accounts for $462.20 million, while Genie Renewables contributes $21.09 million.

Genie Energy, a smaller player in the energy market, has seen its earnings grow by 118.9% over the past year, outpacing the Electric Utilities industry average of 9.2%. Despite a debt to equity ratio increase from 1.6% to 4.7% over five years, it holds more cash than total debt and remains free cash flow positive. Recent financials show net income at US$6.74 million for Q3 2025 compared to US$10.2 million last year, with sales rising from US$105.75 million to US$132.37 million in the same period this year; however, significant insider selling raises concerns about future stability amidst market volatility and regulatory challenges.

Summing It All Up

- Investigate our full lineup of 298 US Undiscovered Gems With Strong Fundamentals right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報