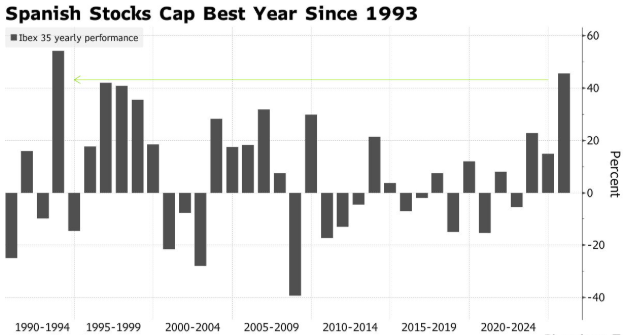

The Spanish stock market ushered in the best performance in 32 years: an annual increase of 50%, leading the main European market

The Zhitong Finance App learned that the Spanish stock market is expected to have the best performance since the early 90s of the last century. Strategists predict that there will be more gains in the future due to increasingly clear profit prospects. As of Tuesday's close, Spain's benchmark stock index, the IBEX 35 index, has accumulated a 50% increase this year. This will be the biggest annual increase in 32 years and make it the best-performing major market in Europe. Spanish corporate earnings growth expectations have been raised by more than 15% this year, surpassing the rest of Europe.

The Spanish stock market is currently at an all-time high due to relatively little impact from the US market and Trump's trade tariffs. Low unemployment and moderate inflation also helped Spain win ratings from the top three credit rating agencies this year.

Mabrouk Chetouane, head of global market strategy at Natixis IM Solutions, said in a speech in Madrid on December 11 that the profit outlook makes the Spanish stock market “completely different; it is driven by some fundamentals and solid factors.”

Bank stocks contributed most of the gains. Six of the ten best performing companies are lenders, led by Banco Santander SA (Banco Santander SA), Unicaja Banco SA, and the Spanish Bank of Bilbao (BBVA SA). All three companies have more than doubled their share prices over the past year. Santander and Banco Bilbao are currently the two largest banks by market capitalization in the EU.

Meanwhile, the best performing stocks in the IBEX index are benefiting from strong investor demand for defense companies, as Europe is racing to rearm as the Russian-Ukrainian war continues. Shares of Indra Sistemas SA, which supplies sensors, radars, and other electronic systems for aircraft, ships, and armed vehicles, have surged 185 percent in 2025.

This round of rise has made the valuation of the Spanish stock market no longer seem cheap. Currently, the price-earnings ratio of the benchmark stock index is about 14 times, which is higher than its long-term average valuation level. However, compared to the broader European Stoxx 600 Index, this is still nearly 8% off.

Natixis' Chetouane said that strong demand for credit from businesses and households indicates that the IBEX index still has room to rise in 2026. “The fundamentals are still beneficial,” he said.

Nasdaq

Nasdaq 華爾街日報

華爾街日報