Being in deep trouble is a bargaining chip! Boeing (BA.US) may become the next target of the Trump administration's “strategic shareholding”

The Zhitong Finance App learned that since this year, the Trump administration has reached a series of deals to invest in companies critical to national security and supply chains, including chipmaker Intel (INTC.US) and rare earth company MP Materials (MP.US). The Trump administration's plan to “acquire shares in strategic industries” is expected to continue in 2026, and the next target is likely to be aircraft manufacturer Boeing (BA.US).

The Trump administration's acquisition of 9.9% of Intel's shares underscores the importance of America's closest company to a cutting-edge semiconductor manufacturer. Intel has been in trouble for a long time because it lags behind rival TSM.US, which has made it a direct target for the White House. The same logic fully applies to Boeing — one side of the global commercial aircraft duopoly pattern, a huge supplier of military equipment, and the largest single exporter to the US. At the same time, it is struggling with a series of long-term setbacks associated with the fatal failure of its aircraft.

Boeing's current predicament has provided sufficient bargaining chips for the Trump administration to take a stake in this company. The US Federal Aviation Administration has set a cap on the number of Boeing 737 Max aircraft produced and determined its autonomy in carrying out inspections. Furthermore, about one-third of Boeing's revenue comes from its defense, space, and security division, which relies on US government contracts.

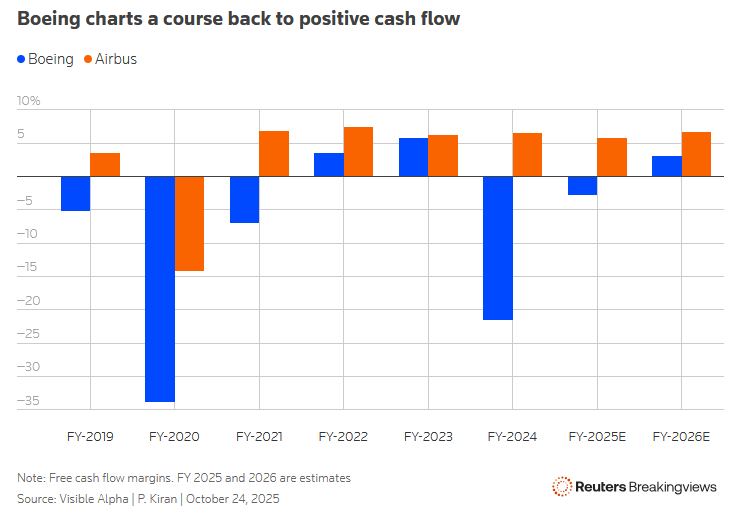

If the White House wants a return on its investment in Boeing to justify its investment, now is an attractive time to act. According to Visible Alpha data at the end of November 2025, Wall Street analysts' predictions for Boeing's target share price for the next 12 months show that the stock price will have room to rise 38%. If this forecast comes true, the company's market value will increase by more than $50 billion. More advantageously, after a round of large-scale investments, the company is expected to resume generating cash flow and possibly pay dividends.

In August of this year, US Secretary of Commerce Lutnick said that the Trump administration is considering buying shares in large defense contractors, including Lockheed Martin (LMT.US). This news has boosted the stock prices of Lockheed Martin, Boeing, and other defense companies.

However, it is worth mentioning that Boeing executives said in early December that the Trump administration's plan to “acquire shares in strategic industries” does not apply to large defense companies. Steve Parker, CEO of Boeing's Defense, Space and Security Division, said at the time: “The plan actually only applies to the supply chain sector, especially for small businesses.” “I don't think this plan is for the 'main contractor'.” The “main contractors” he refers to are large defense contractors with a long history, such as Boeing, Lockheed Martin, Raytheon Technology (RTX.US), and Northrop Grumman (NOC.US).

Nasdaq

Nasdaq 華爾街日報

華爾街日報