European Growth Companies With Strong Insider Ownership

In recent weeks, the European market has shown resilience, with the pan-European STOXX Europe 600 Index ending slightly higher in a holiday-shortened week, reflecting positive sentiment about future earnings and economic conditions. Amid this backdrop, growth companies with high insider ownership can be particularly appealing to investors seeking alignment between management and shareholder interests, as insiders often have a vested interest in driving long-term value.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Warimpex Finanz- und Beteiligungs (WBAG:WXF) | 25.9% | 100.6% |

| S.M.A.I.O (ENXTPA:ALSMA) | 16.1% | 72.8% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| Guard Therapeutics International (OM:GUARD) | 13.1% | 103.3% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 66.1% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 49.7% |

Let's dive into some prime choices out of the screener.

EnergyVision (ENXTBR:ENRGY)

Simply Wall St Growth Rating: ★★★★★☆

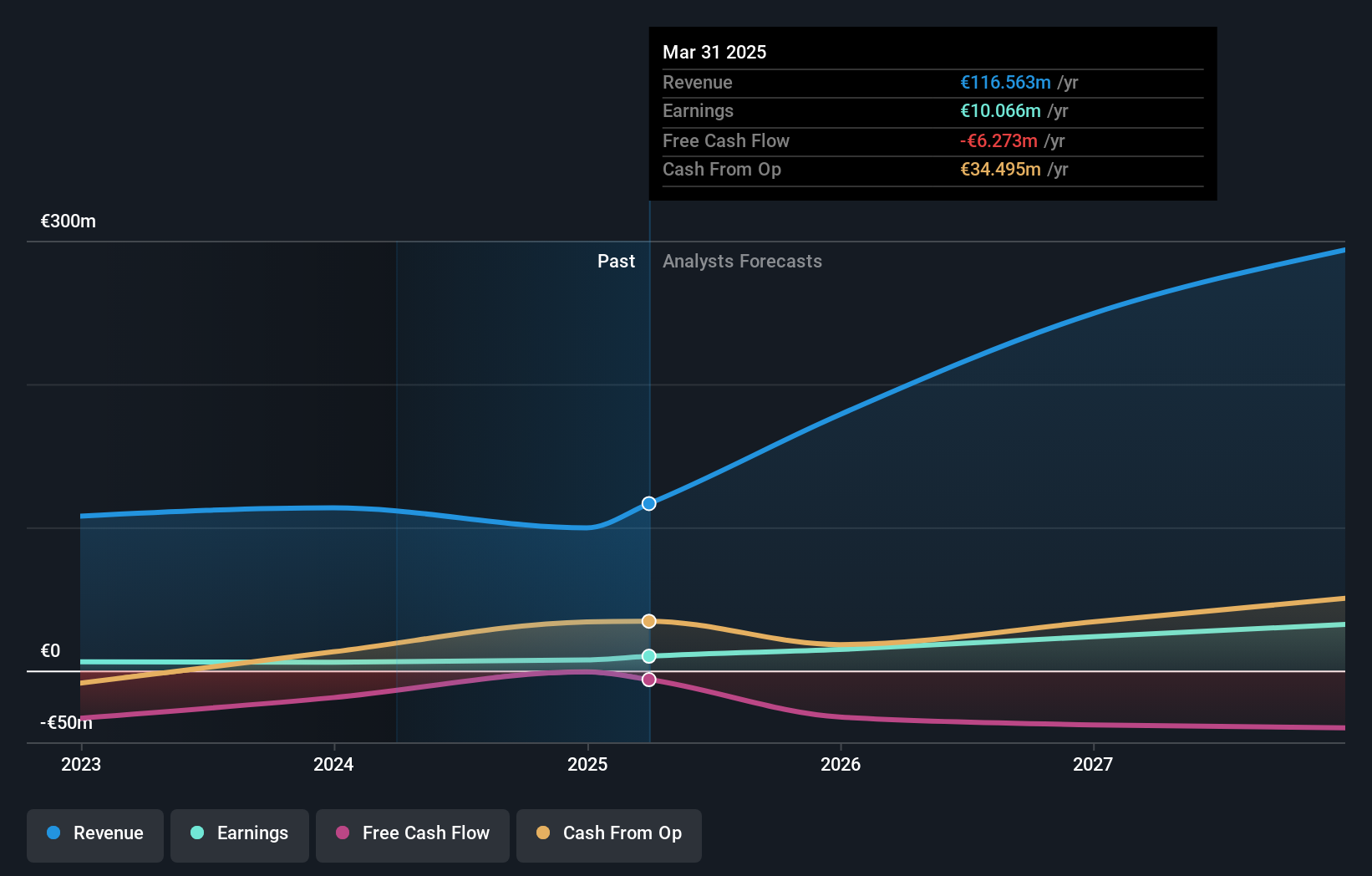

Overview: EnergyVision NV is a Belgian company offering solar energy and mobility-as-a-service solutions to both corporate and residential clients, with a market cap of €621.60 million.

Operations: EnergyVision NV generates revenue through its EPC Activity (€66.65 million), Asset-Based Energy (€18.88 million), Asset-Based Mobility (€6.11 million), and Non-Asset-Based Energy (€34.29 million) segments.

Insider Ownership: 10.1%

Revenue Growth Forecast: 20.9% p.a.

EnergyVision demonstrates strong growth potential with earnings forecasted to grow 43.2% annually, outpacing the Belgian market's 15.3%. Revenue is expected to rise at a robust 20.9% per year, surpassing both the market and significant growth benchmarks. Despite high debt levels and a projected low return on equity of 12.8%, analysts anticipate a stock price increase of 32%. No recent insider trading activity has been reported within the past three months.

- Click here and access our complete growth analysis report to understand the dynamics of EnergyVision.

- The valuation report we've compiled suggests that EnergyVision's current price could be inflated.

Canatu Oyj (HLSE:CANATU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Canatu Oyj specializes in developing and selling carbon nanotubes (CNTs) for the semiconductor, automotive, and medical diagnostics industries across Finland, the United States, Japan, and Taiwan with a market cap of €284.45 million.

Operations: Canatu Oyj generates revenue by providing carbon nanotube solutions to the semiconductor, automotive, and medical diagnostics sectors in Finland, the United States, Japan, and Taiwan.

Insider Ownership: 12.5%

Revenue Growth Forecast: 41.6% p.a.

Canatu Oyj is poised for substantial growth, with revenue expected to increase by 41.6% annually, significantly outpacing the Finnish market's average. Recent developments include a commercial production license agreement with FINE SEMITECH CORPORATION, potentially creating new revenue streams through consumables sales and royalties. Despite being undervalued at 55% below fair value estimates and trading below analyst price targets by 27.8%, Canatu's return on equity remains low at a forecasted 7.6%.

- Navigate through the intricacies of Canatu Oyj with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Canatu Oyj's current price could be quite moderate.

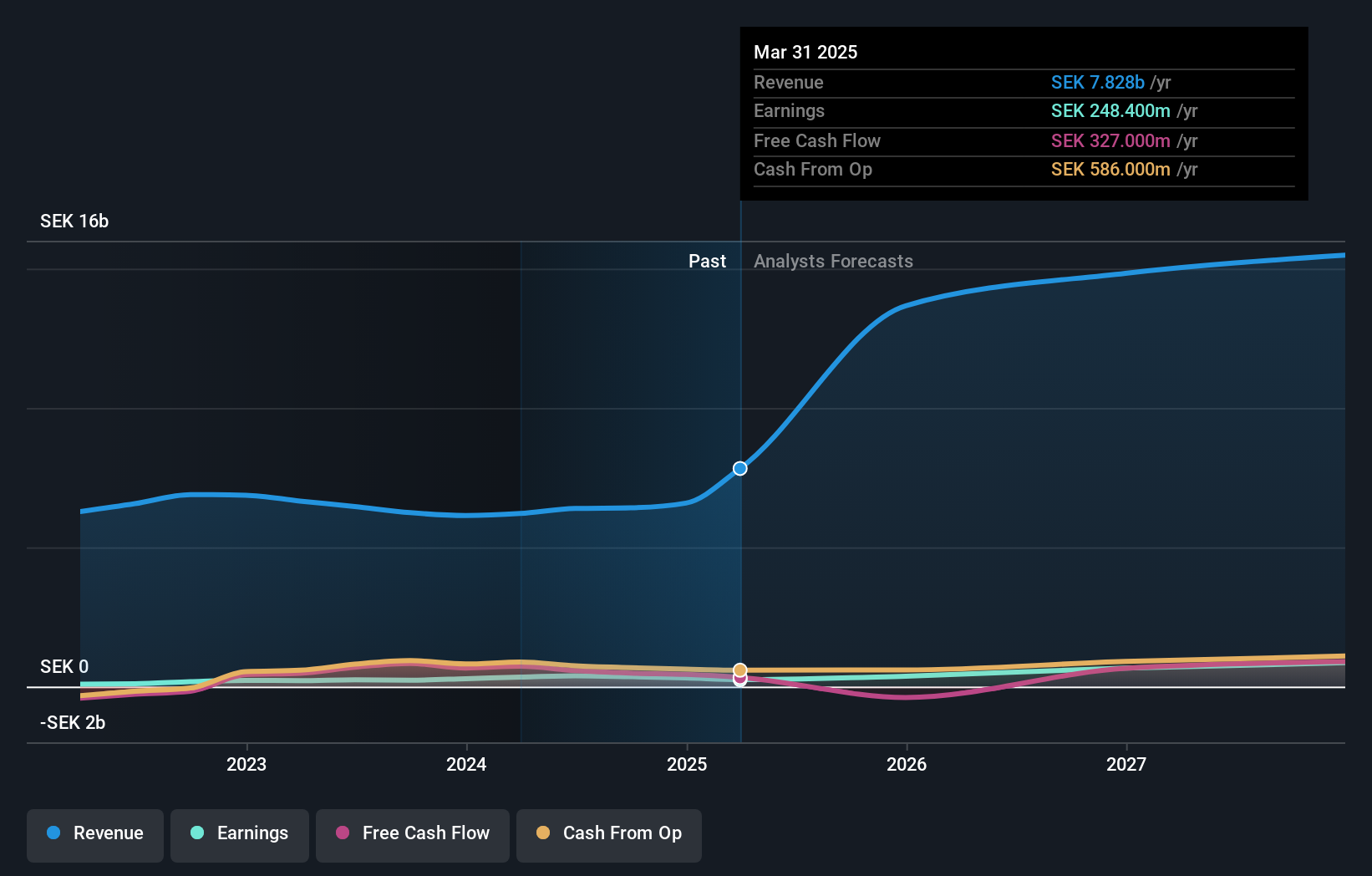

ITAB Shop Concept (OM:ITAB)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: ITAB Shop Concept AB (publ) develops, manufactures, sells, and installs store concepts for retail chain stores with a market cap of SEK4.49 billion.

Operations: The company's revenue is primarily derived from its Furniture & Fixtures segment, which generated SEK11.13 billion.

Insider Ownership: 11.7%

Revenue Growth Forecast: 10.9% p.a.

ITAB Shop Concept is set for significant earnings growth at 56.7% annually, outpacing the Swedish market. Despite trading at 80.9% below fair value estimates, it faces challenges with low profit margins and debt coverage issues. Recent strategic initiatives include a major roll-out of loss prevention solutions in Australia valued at EUR 12 million and a self-checkout project in Europe worth up to EUR 27 million, enhancing its market position amidst leadership transitions.

- Get an in-depth perspective on ITAB Shop Concept's performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, ITAB Shop Concept's share price might be too pessimistic.

Turning Ideas Into Actions

- Delve into our full catalog of 210 Fast Growing European Companies With High Insider Ownership here.

- Ready For A Different Approach? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報