China Wantian Holdings And 2 Other Global Penny Stocks To Watch

Global markets have been buoyant, with U.S. stocks reaching record highs amid positive economic data and optimism surrounding artificial intelligence. In this context, investors might find opportunities in penny stocks—an investment area that, despite its somewhat outdated terminology, remains relevant for those seeking growth potential outside the mainstream indices. Penny stocks often represent smaller or newer companies that can offer unique value propositions and growth opportunities when supported by strong financials and solid fundamentals.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.44 | HK$890.67M | ✅ 4 ⚠️ 1 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.28 | £498.41M | ✅ 5 ⚠️ 0 View Analysis > |

| IVE Group (ASX:IGL) | A$3.01 | A$456.46M | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.54 | HK$2.11B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| West African Resources (ASX:WAF) | A$3.00 | A$3.44B | ✅ 4 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.45 | SGD13.58B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.715 | $435.99M | ✅ 3 ⚠️ 2 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.54B | ✅ 5 ⚠️ 0 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.145 | £184.26M | ✅ 6 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,595 stocks from our Global Penny Stocks screener.

Let's review some notable picks from our screened stocks.

China Wantian Holdings (SEHK:1854)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Wantian Holdings Limited operates in the green food supply and catering chain, as well as environmental protection and technology sectors in China and Hong Kong, with a market cap of HK$2.83 billion.

Operations: The company's revenue is primarily derived from its food supply segment, which accounts for HK$1.09 billion, followed by catering services at HK$59.04 million and environmental protection and technology services at HK$0.96 million.

Market Cap: HK$2.83B

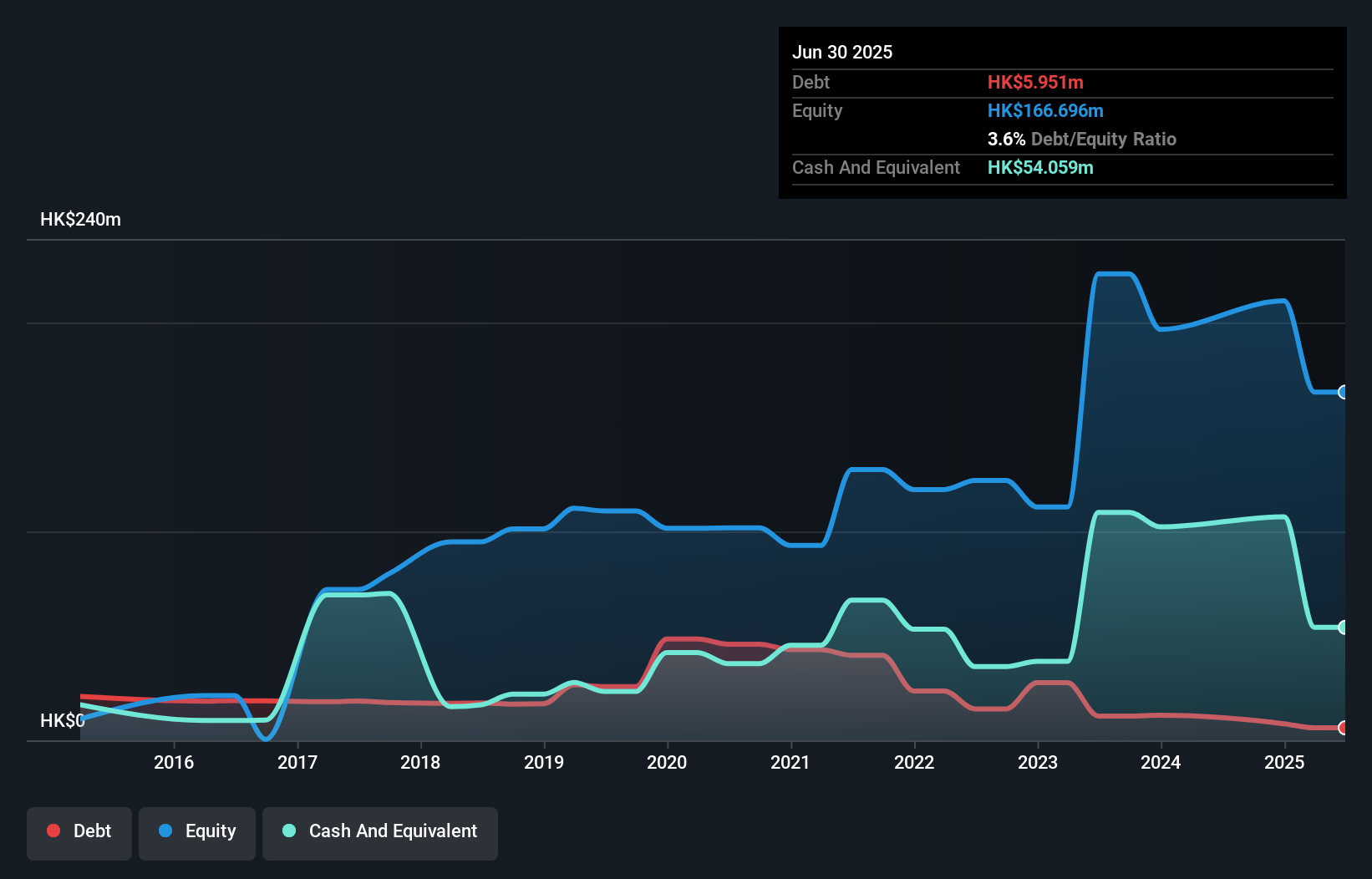

China Wantian Holdings, with a market cap of HK$2.83 billion, focuses on green food supply and catering services, generating HK$1.09 billion and HK$59.04 million in revenue respectively. Despite its substantial market presence, the company remains unprofitable with increasing losses over five years at 51.9% annually and less than a year of cash runway based on current free cash flow trends. Recent board changes include the appointment of Ms. Chan Sze Man and Mr. Hui Chun Kin Norman as independent non-executive directors, potentially bringing fresh perspectives to address financial challenges amidst stable weekly volatility at 8%.

- Navigate through the intricacies of China Wantian Holdings with our comprehensive balance sheet health report here.

- Gain insights into China Wantian Holdings' past trends and performance with our report on the company's historical track record.

Zhewen Pictures Groupltd (SHSE:601599)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Zhewen Pictures Group Co., Ltd operates in China, focusing on the production and sale of yarns, with a market capitalization of approximately CN¥4.49 billion.

Operations: Zhewen Pictures Group Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥4.49B

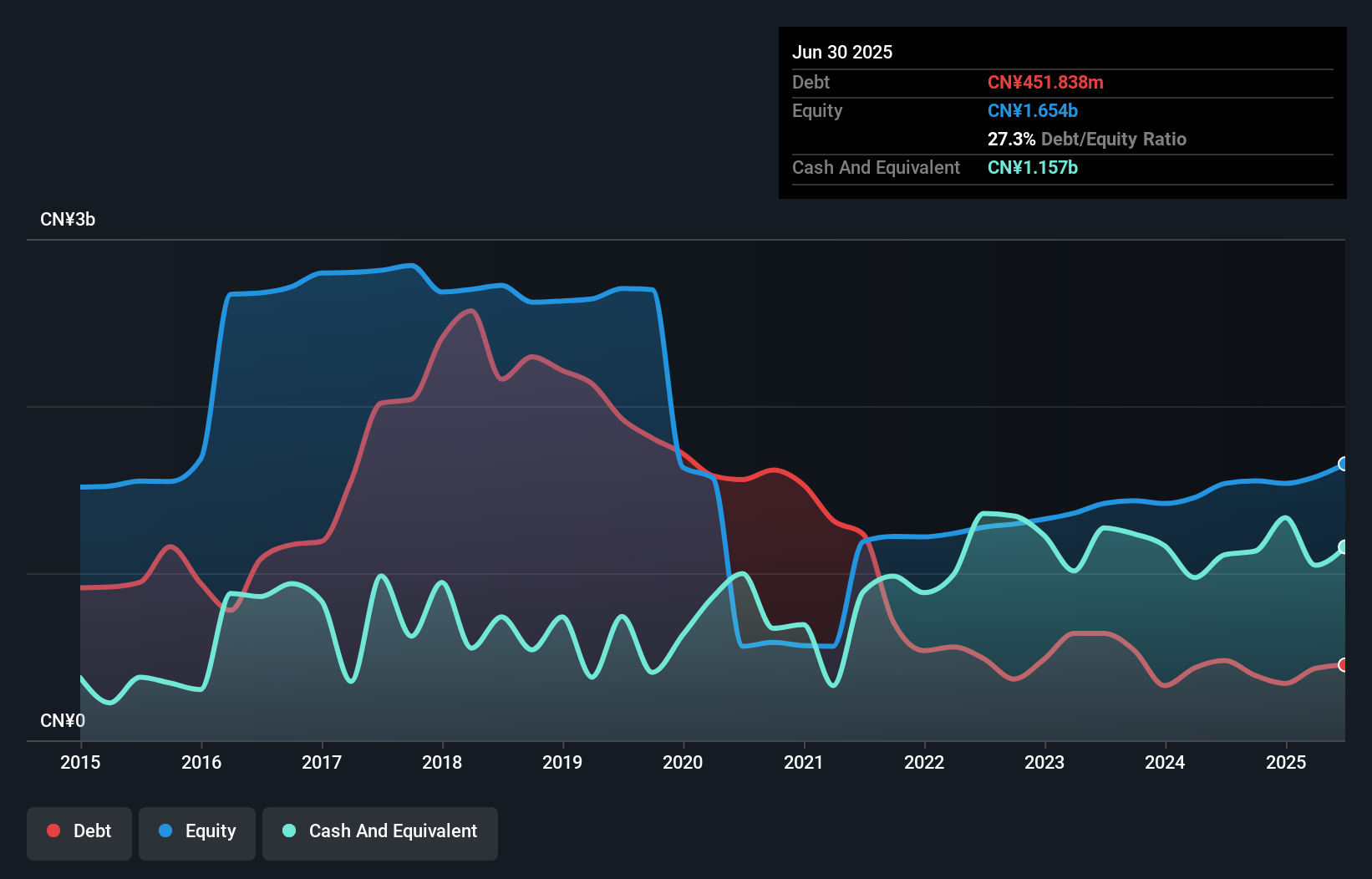

Zhewen Pictures Group Co., Ltd, with a market cap of CN¥4.49 billion, has shown modest earnings growth of 1% over the past year, surpassing the luxury industry's contraction. The company maintains a strong financial position with short-term assets of CN¥2.9 billion exceeding both short and long-term liabilities. Its price-to-earnings ratio is favorable compared to the broader Chinese market, and it has successfully reduced its debt-to-equity ratio significantly over five years while covering interest payments comfortably with profits. However, management's inexperience may pose challenges despite stable weekly volatility at 3%.

- Click to explore a detailed breakdown of our findings in Zhewen Pictures Groupltd's financial health report.

- Understand Zhewen Pictures Groupltd's track record by examining our performance history report.

Hangzhou Century (SZSE:300078)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Hangzhou Century Co., Ltd. offers electronic article surveillance (EAS) and radio frequency identification system (RFID) solutions both in China and internationally, with a market cap of CN¥4.74 billion.

Operations: The company has not reported any specific revenue segments.

Market Cap: CN¥4.74B

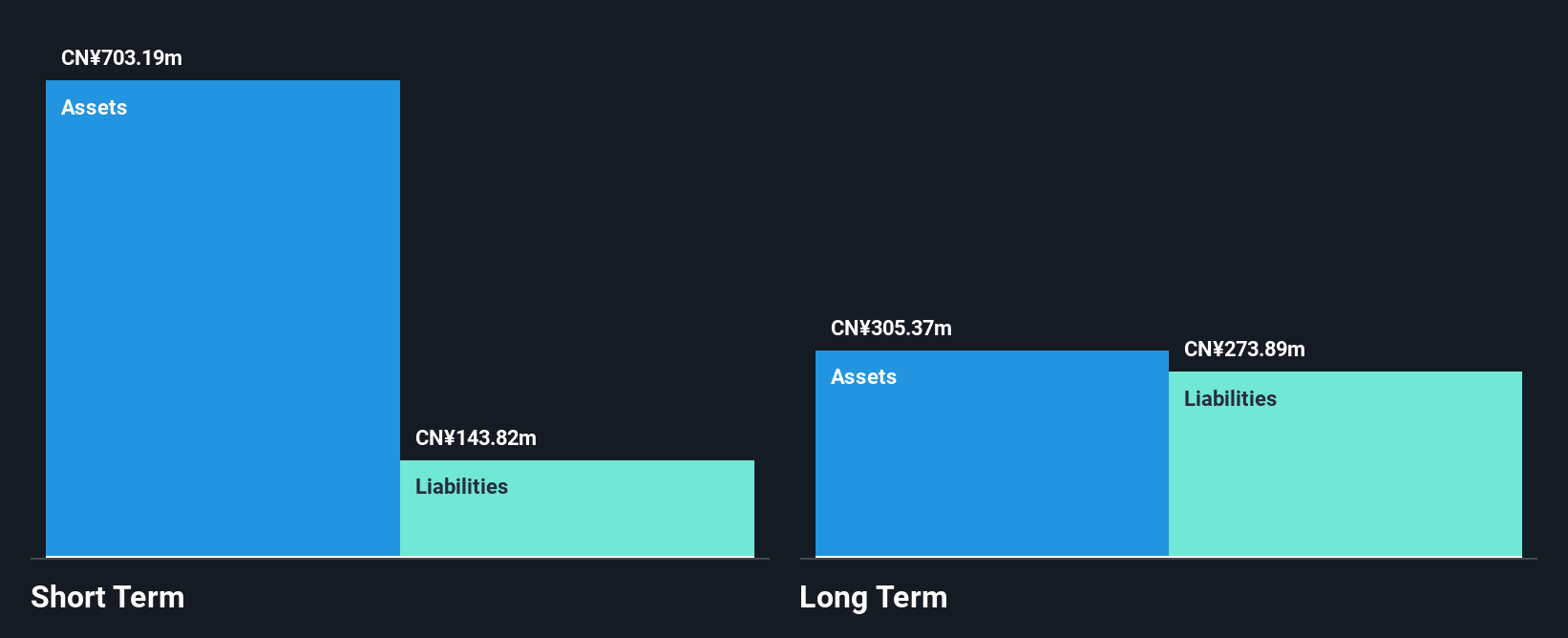

Hangzhou Century Co., Ltd., with a market cap of CN¥4.74 billion, has experienced significant volatility in its share price over the past three months. The company is debt-free and maintains a robust financial position, with short-term assets of CN¥703.2 million covering both short and long-term liabilities comfortably. Despite this stability, it remains unprofitable with earnings declining by 21.6% annually over the past five years, resulting in a negative return on equity of -38.06%. Recent shareholder meetings have focused on amending company bylaws and considering new business scopes to potentially improve future prospects.

- Dive into the specifics of Hangzhou Century here with our thorough balance sheet health report.

- Evaluate Hangzhou Century's historical performance by accessing our past performance report.

Where To Now?

- Unlock our comprehensive list of 3,595 Global Penny Stocks by clicking here.

- Curious About Other Options? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報