3 European Stocks That May Be Trading Below Their Estimated Value

As the pan-European STOXX Europe 600 Index edged slightly higher in a holiday-shortened week, optimism about future earnings and economic conditions has kept investor sentiment buoyant. In this environment, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| YIT Oyj (HLSE:YIT) | €3.122 | €6.09 | 48.7% |

| Unimot (WSE:UNT) | PLN130.00 | PLN257.36 | 49.5% |

| Streamwide (ENXTPA:ALSTW) | €73.20 | €142.58 | 48.7% |

| Sanoma Oyj (HLSE:SANOMA) | €9.50 | €18.45 | 48.5% |

| LINK Mobility Group Holding (OB:LINK) | NOK33.90 | NOK66.21 | 48.8% |

| KB Components (OM:KBC) | SEK41.90 | SEK83.05 | 49.5% |

| Hemnet Group (OM:HEM) | SEK173.20 | SEK337.49 | 48.7% |

| Dynavox Group (OM:DYVOX) | SEK102.00 | SEK202.98 | 49.7% |

| Allegro.eu (WSE:ALE) | PLN31.02 | PLN60.13 | 48.4% |

| Allcore (BIT:CORE) | €1.35 | €2.67 | 49.4% |

Here's a peek at a few of the choices from the screener.

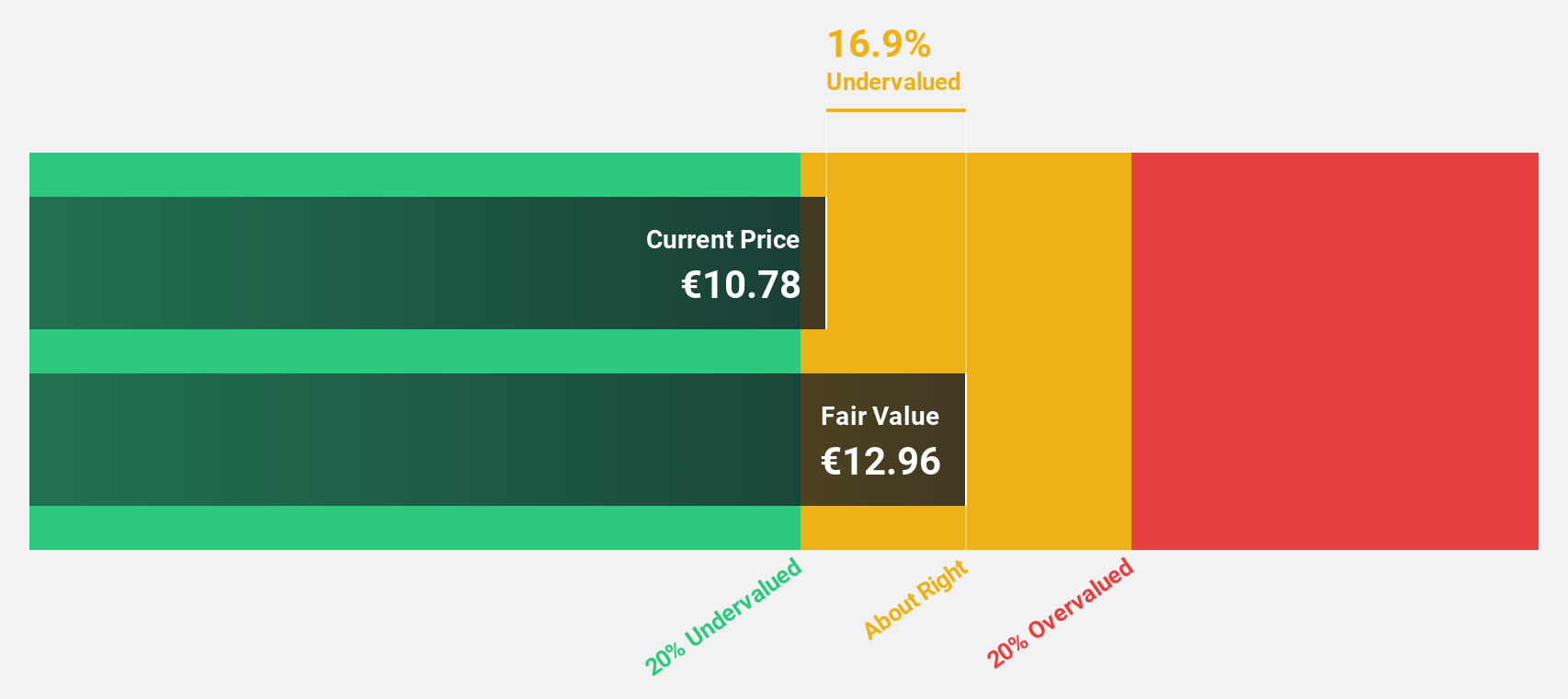

Antin Infrastructure Partners SAS (ENXTPA:ANTIN)

Overview: Antin Infrastructure Partners SAS is a private equity firm that focuses on infrastructure investments, with a market capitalization of approximately €2 billion.

Operations: The company's revenue primarily comes from its Asset Management segment, which generated €319.65 million.

Estimated Discount To Fair Value: 13.9%

Antin Infrastructure Partners SAS, trading at €11.18, is undervalued compared to its estimated fair value of €12.99. Despite a dividend yield of 6.35% not being well covered by earnings or free cash flows, the company's earnings are forecast to grow 13.7% annually—outpacing the French market's 12.3%. Revenue growth is projected at 10.8% per year, surpassing the local market's average growth rate of 5.5%. Recent board changes could influence governance positively.

- Our expertly prepared growth report on Antin Infrastructure Partners SAS implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Antin Infrastructure Partners SAS' balance sheet by reading our health report here.

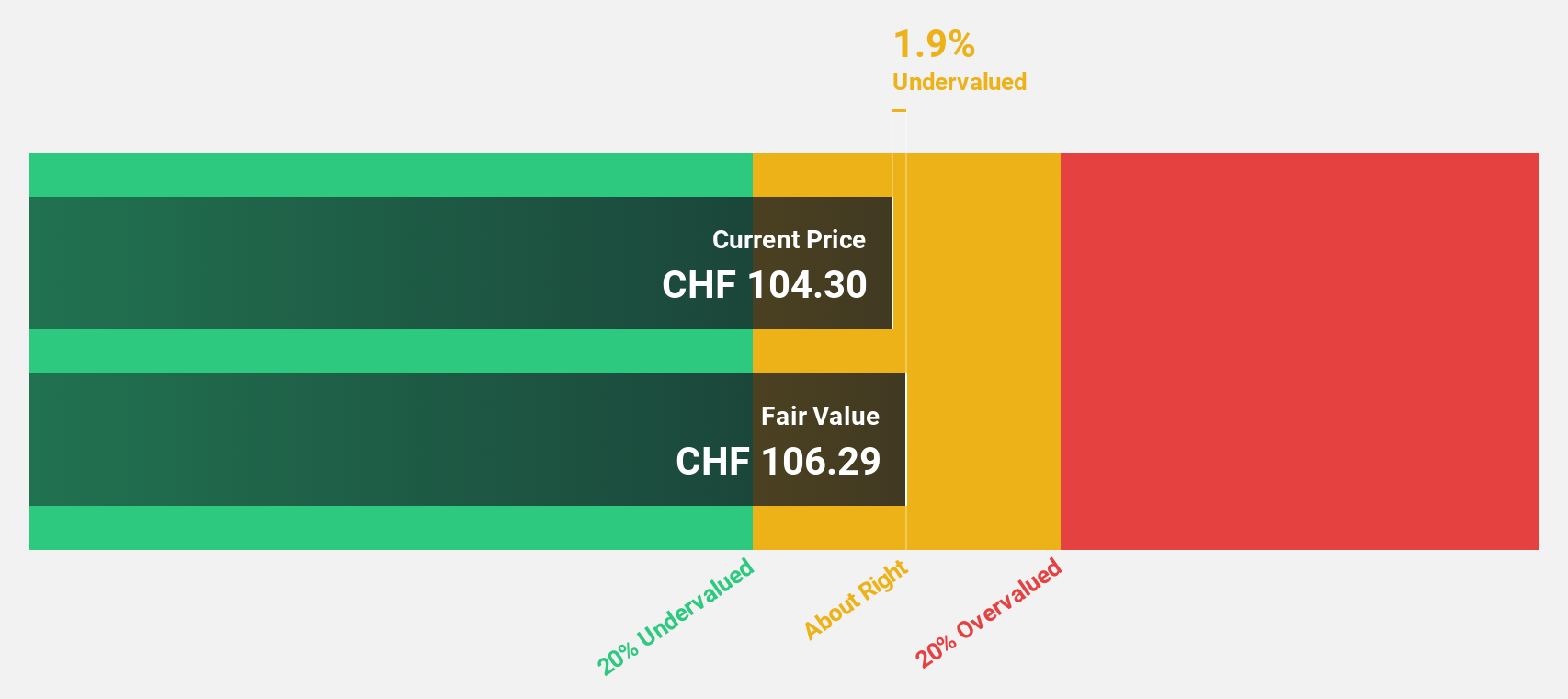

Straumann Holding (SWX:STMN)

Overview: Straumann Holding AG offers tooth replacement and orthodontic solutions globally, with a market cap of CHF14.90 billion.

Operations: The company's revenue segments include Sales in Asia Pacific at CHF655.77 million, North America at CHF783.18 million, Latin America at CHF292.92 million, and Europe, Middle East and Africa at CHF1.14 billion.

Estimated Discount To Fair Value: 36.3%

Straumann Holding, trading at CHF93.46, is significantly undervalued against its estimated fair value of CHF146.65. Earnings are projected to grow 13.8% annually, surpassing the Swiss market's 10.6%. A strategic partnership with Smartee Denti-Technology aims to enhance profitability and innovation in clear aligners, leveraging Straumann’s global reach and Smartee’s technological expertise. This collaboration could bolster Straumann's position in the oral care sector while improving cash flow efficiency and growth prospects.

- The analysis detailed in our Straumann Holding growth report hints at robust future financial performance.

- Navigate through the intricacies of Straumann Holding with our comprehensive financial health report here.

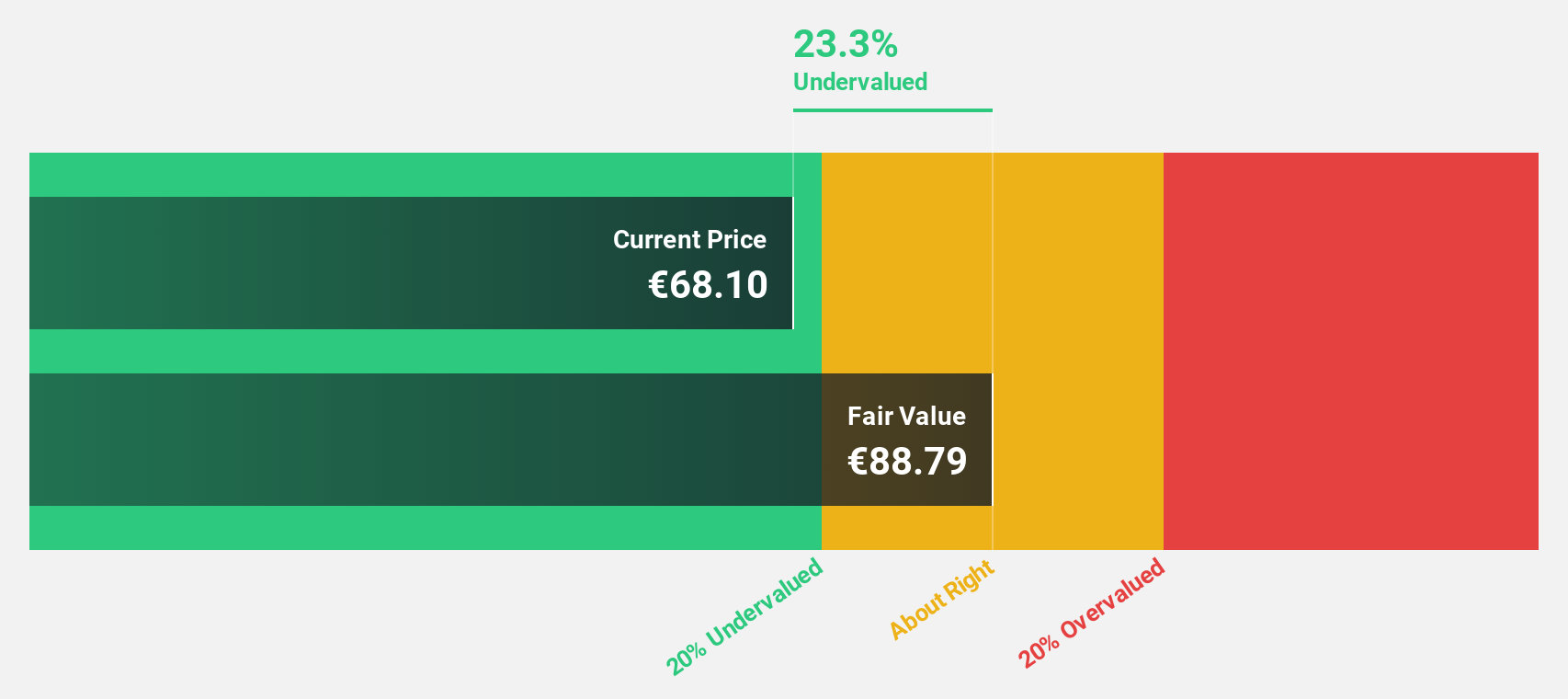

RENK Group (XTRA:R3NK)

Overview: RENK Group AG specializes in the design, engineering, production, testing, and servicing of customized drive systems both in Germany and internationally with a market cap of €5.36 billion.

Operations: The company's revenue is primarily derived from Vehicle Mobility Solutions (€813.93 million), Marine & Industry (€365.83 million), and Slide Bearings (€124.68 million).

Estimated Discount To Fair Value: 33.6%

RENK Group, trading at €53.62, is undervalued relative to its fair value estimate of €80.81. Forecasted revenue growth of 15.6% annually outpaces the German market's 6.3%, with earnings expected to grow significantly at 26.2% per year, exceeding market averages. Despite high debt levels, RENK's strategic focus on M&A opportunities and confirmed revenue guidance over €1.3 billion for 2025 highlight potential for enhanced cash flow and valuation improvement.

- Upon reviewing our latest growth report, RENK Group's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of RENK Group.

Turning Ideas Into Actions

- Explore the 191 names from our Undervalued European Stocks Based On Cash Flows screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報