Etablissements Maurel & Prom And 2 Other Undiscovered Gems With Solid Potential

As the pan-European STOXX Europe 600 Index edges closer to record highs, buoyed by optimism surrounding future earnings and economic conditions, investors are increasingly on the lookout for promising opportunities within this dynamic landscape. In such a market environment, identifying stocks with solid fundamentals and growth potential can be particularly rewarding; Etablissements Maurel & Prom and two other lesser-known European companies exemplify these qualities.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dekpol | 61.42% | 9.03% | 14.54% | ★★★★★★ |

| KABE Group AB (publ.) | 3.82% | 3.46% | 5.42% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Inmocemento | 28.68% | 4.15% | 33.84% | ★★★★★☆ |

| Envirotainer | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Mangold Fondkommission | NA | -6.00% | -42.55% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Etablissements Maurel & Prom (ENXTPA:MAU)

Simply Wall St Value Rating: ★★★★★★

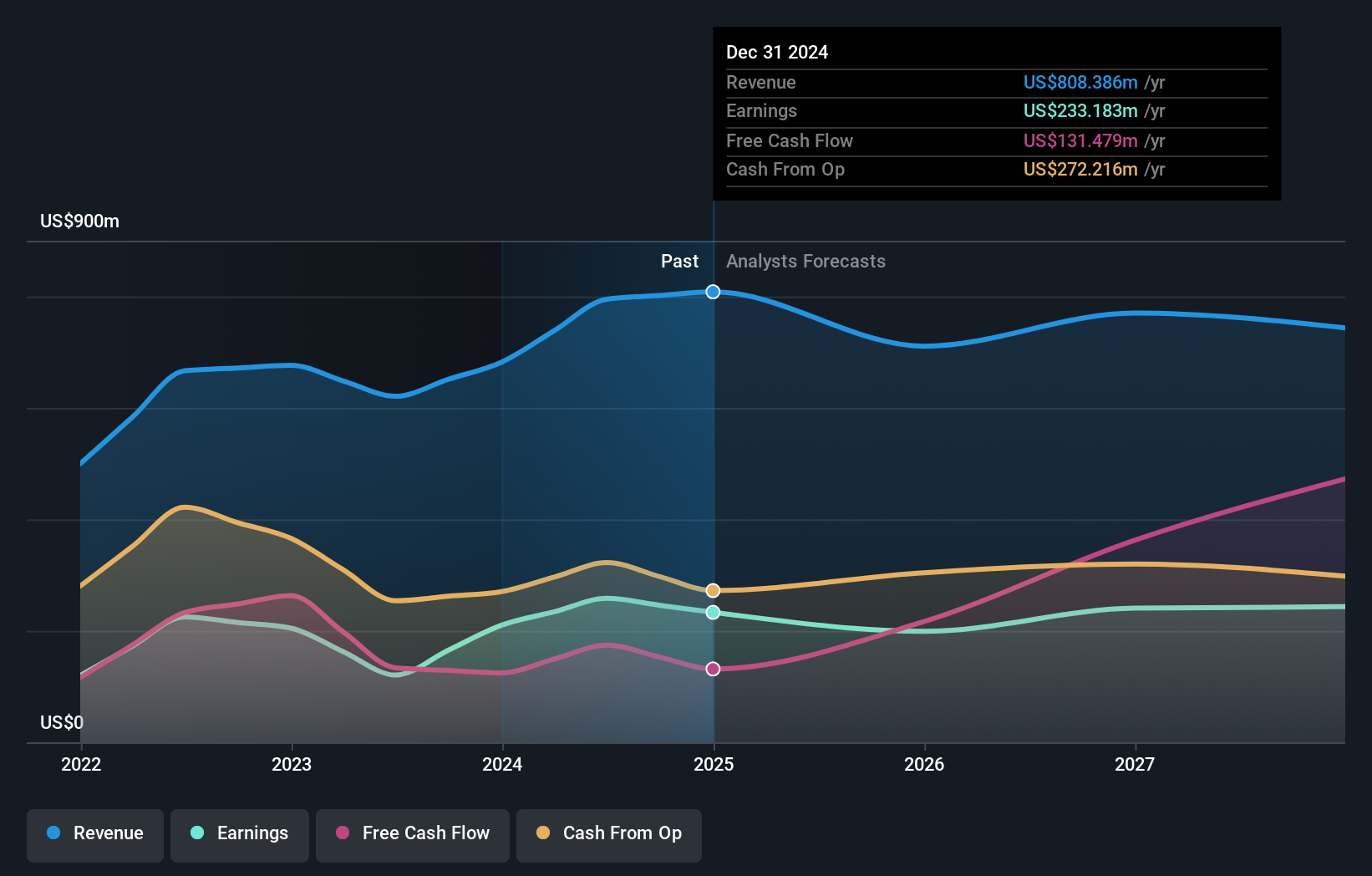

Overview: Etablissements Maurel & Prom S.A. is involved in the exploration and production of oil, gas, and hydrocarbons across Gabon, Tanzania, Angola, and Venezuela with a market capitalization of approximately €1.02 billion.

Operations: The company's primary revenue stream is from production activities, contributing $554.05 million, while drilling operations add $22.23 million.

Etablissements Maurel & Prom, a notable player in the oil and gas sector, is trading at 80.6% below its estimated fair value, offering an attractive entry point for investors. The company has significantly reduced its debt to equity ratio from 123.8% to 11% over five years while maintaining more cash than total debt, indicating strong financial health. Despite a recent negative earnings growth of -8.6%, production figures have improved with total production reaching 37,973 boepd for Q3 2025 compared to the previous year’s average of 36,288 boepd over nine months.

Wavestone (ENXTPA:WAVE)

Simply Wall St Value Rating: ★★★★★★

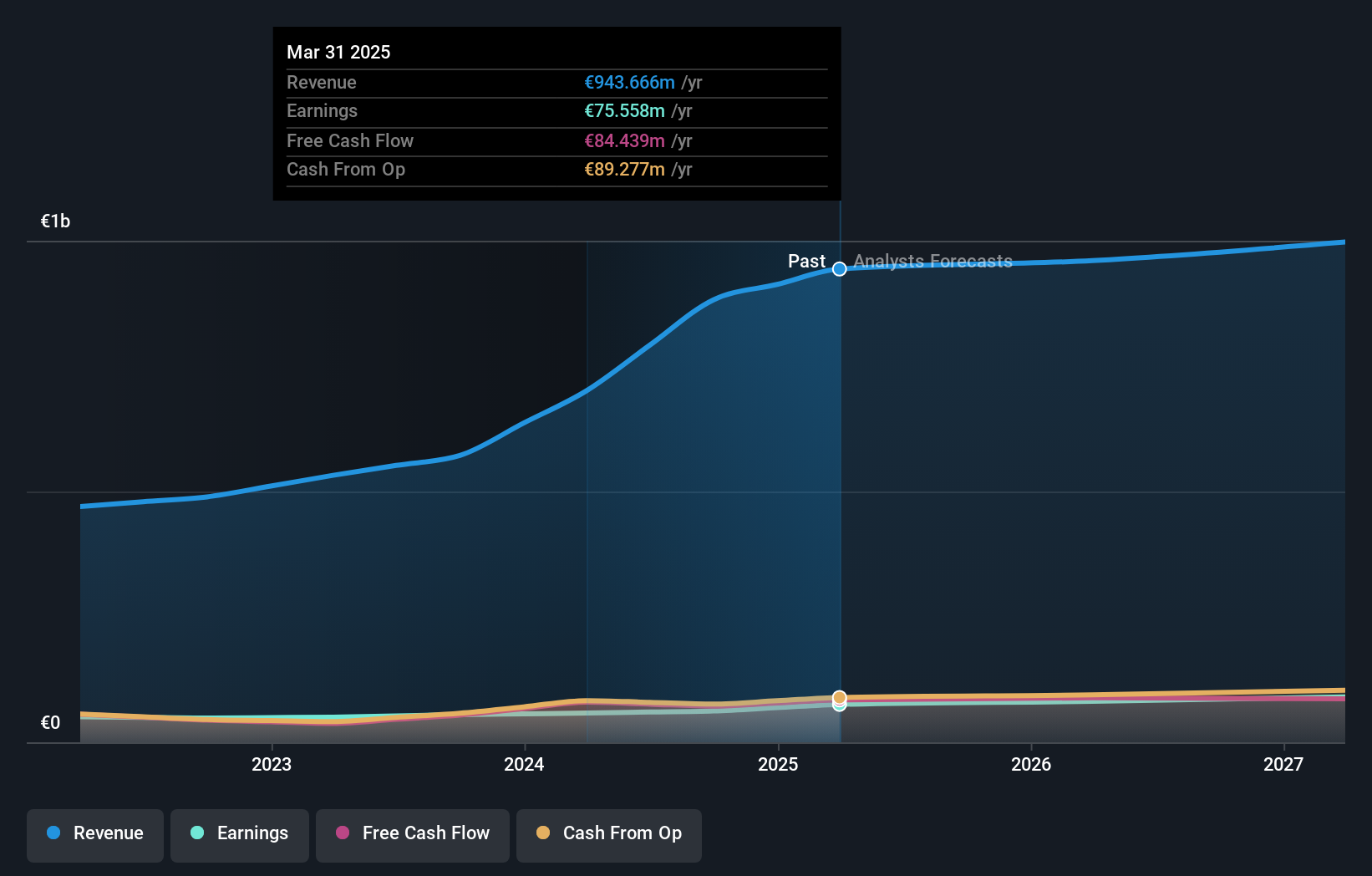

Overview: Wavestone SA is a consulting firm offering management and information system services across France and internationally, with a market capitalization of €1.37 billion.

Operations: Wavestone generates revenue primarily from its management consulting and information system services, totaling €943.94 million. The company's financial performance is reflected in its net profit margin, which stands at 10.5%.

Wavestone's recent performance highlights its potential as a promising investment. The company reported half-year sales of €458.09 million, slightly up from €457.82 million the previous year, while net income rose to €30.32 million from €27.24 million, indicating steady progress despite industry challenges. Earnings per share increased to €1.24 from last year's €1.11, reflecting robust profitability and operational efficiency with interest coverage at 30 times EBIT and a reduced debt-to-equity ratio of 2%. Trading below estimated fair value by 7%, Wavestone's earnings growth outpaces the IT sector average, suggesting strong future prospects in the European market.

- Take a closer look at Wavestone's potential here in our health report.

Evaluate Wavestone's historical performance by accessing our past performance report.

Idun Industrier (OM:IDUN B)

Simply Wall St Value Rating: ★★★★★☆

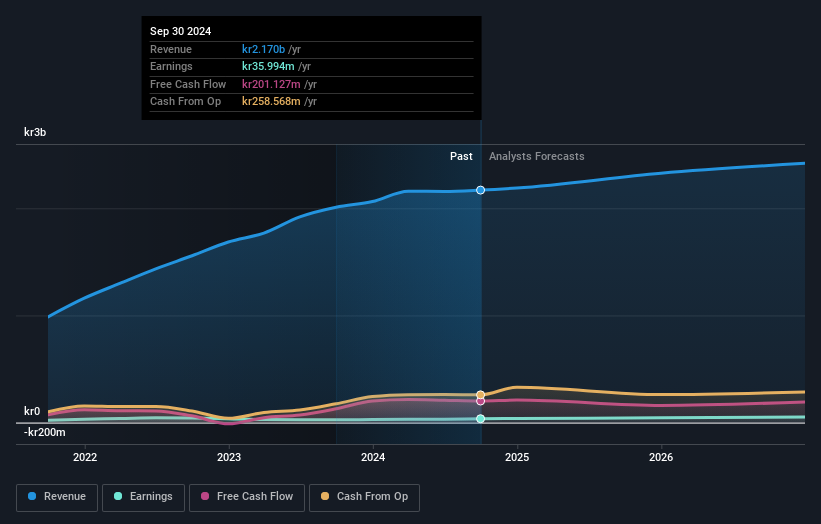

Overview: Idun Industrier AB (publ) is an investment holding company that focuses on developing industrial and service businesses across Sweden, the Nordic region, Europe, and internationally, with a market cap of approximately SEK4.09 billion.

Operations: Idun Industrier generates revenue primarily from its Manufacturing segment, contributing SEK1.40 billion, and its Service & Maintenance segment, which adds SEK845.88 million. The business's net profit margin reflects its financial efficiency at a specific percentage over the evaluated period.

Idun Industrier, a promising player in the industrial sector, has shown impressive financial performance recently. Over the past five years, its debt to equity ratio decreased significantly from 210.8% to 120.8%, indicating improved financial management. The company's earnings growth of 35% last year outpaced the industry average of 18.9%, highlighting its competitive edge. Despite having a high net debt to equity ratio of 84.9%, Idun's interest payments are well covered by EBIT at a multiple of 3.2x, and it trades at an attractive valuation, about 25% below estimated fair value in SEK terms (Swedish Krona).

Summing It All Up

- Discover the full array of 302 European Undiscovered Gems With Strong Fundamentals right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報