European Dividend Stocks To Watch Now

As the pan-European STOXX Europe 600 Index inches closer to record highs amid positive sentiment about future earnings and economic prospects, investors are increasingly focusing on dividend stocks as a potential source of stable income in a fluctuating market. In this context, identifying strong dividend stocks involves looking for companies with solid financials and consistent payout histories, which can offer resilience against economic uncertainties.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.08% | ★★★★★★ |

| Holcim (SWX:HOLN) | 3.99% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.78% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.31% | ★★★★★☆ |

| Evolution (OM:EVO) | 4.81% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.09% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 4.91% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.28% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.18% | ★★★★★★ |

| Afry (OM:AFRY) | 4.00% | ★★★★★☆ |

Click here to see the full list of 191 stocks from our Top European Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

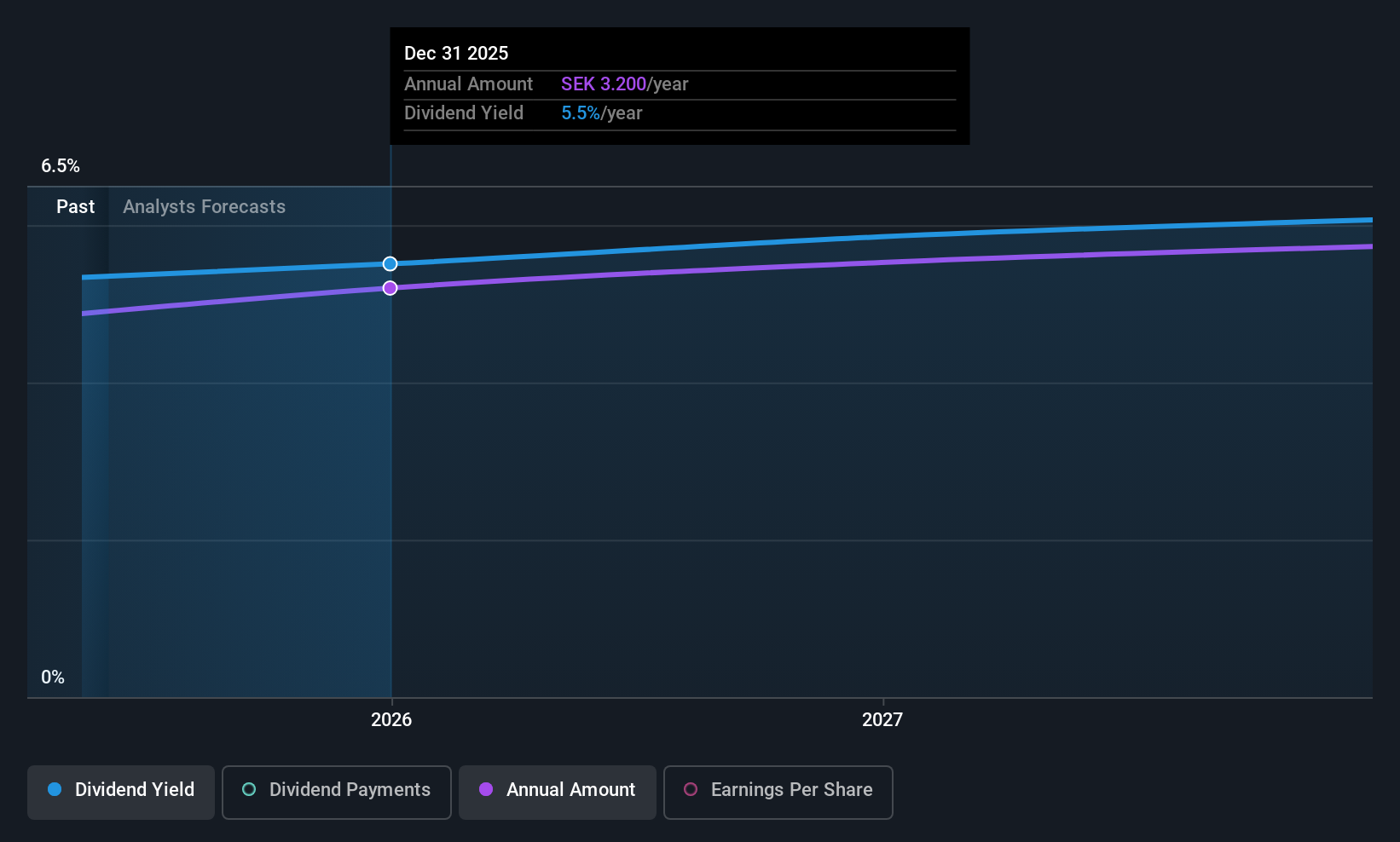

Björn Borg (OM:BORG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Björn Borg AB (publ) and its subsidiaries manufacture, distribute, and sell underwear, sportswear, footwear, bags, and eyewear under the Björn Borg brand with a market cap of SEK1.58 billion.

Operations: Björn Borg AB generates revenue through segments including License (SEK40.08 million), Wholesale (SEK729.72 million), Own Stores (SEK94.11 million), Distributors (SEK716.55 million), and Own E-Commerce (SEK206.67 million).

Dividend Yield: 4.8%

Björn Borg offers a dividend yield of 4.78%, placing it in the top 25% of Swedish dividend payers. However, its dividends have been volatile and are not well covered by free cash flow, with a high cash payout ratio of 133.5%. Despite recent earnings growth—11.7% over the past year—and positive Q3 results, including net income rising to SEK 36.87 million, sustainability concerns remain due to an 87% payout ratio and unreliable historical payments.

- Get an in-depth perspective on Björn Borg's performance by reading our dividend report here.

- Our valuation report here indicates Björn Borg may be overvalued.

IVF Hartmann Holding (SWX:VBSN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: IVF Hartmann Holding AG operates in the medical consumer goods sector, serving both Switzerland and international markets, with a market cap of CHF340.53 million.

Operations: IVF Hartmann Holding AG generates revenue through its key segments: Wound Care (CHF41.36 million), Infection Management (CHF60.39 million), and Incontinence Management (CHF35.49 million).

Dividend Yield: 4.3%

IVF Hartmann Holding's dividend yield of 4.34% ranks it among the top 25% of Swiss dividend payers, yet its dividends have been volatile and not well covered by free cash flow, with a high cash payout ratio of 105%. Despite a reasonable earnings payout ratio of 40.4% and recent earnings growth of 7.8%, the sustainability is questionable due to unreliable historical payments over the past decade. Its P/E ratio stands at a competitive 17.9x against the Swiss market average.

- Click here to discover the nuances of IVF Hartmann Holding with our detailed analytical dividend report.

- The valuation report we've compiled suggests that IVF Hartmann Holding's current price could be inflated.

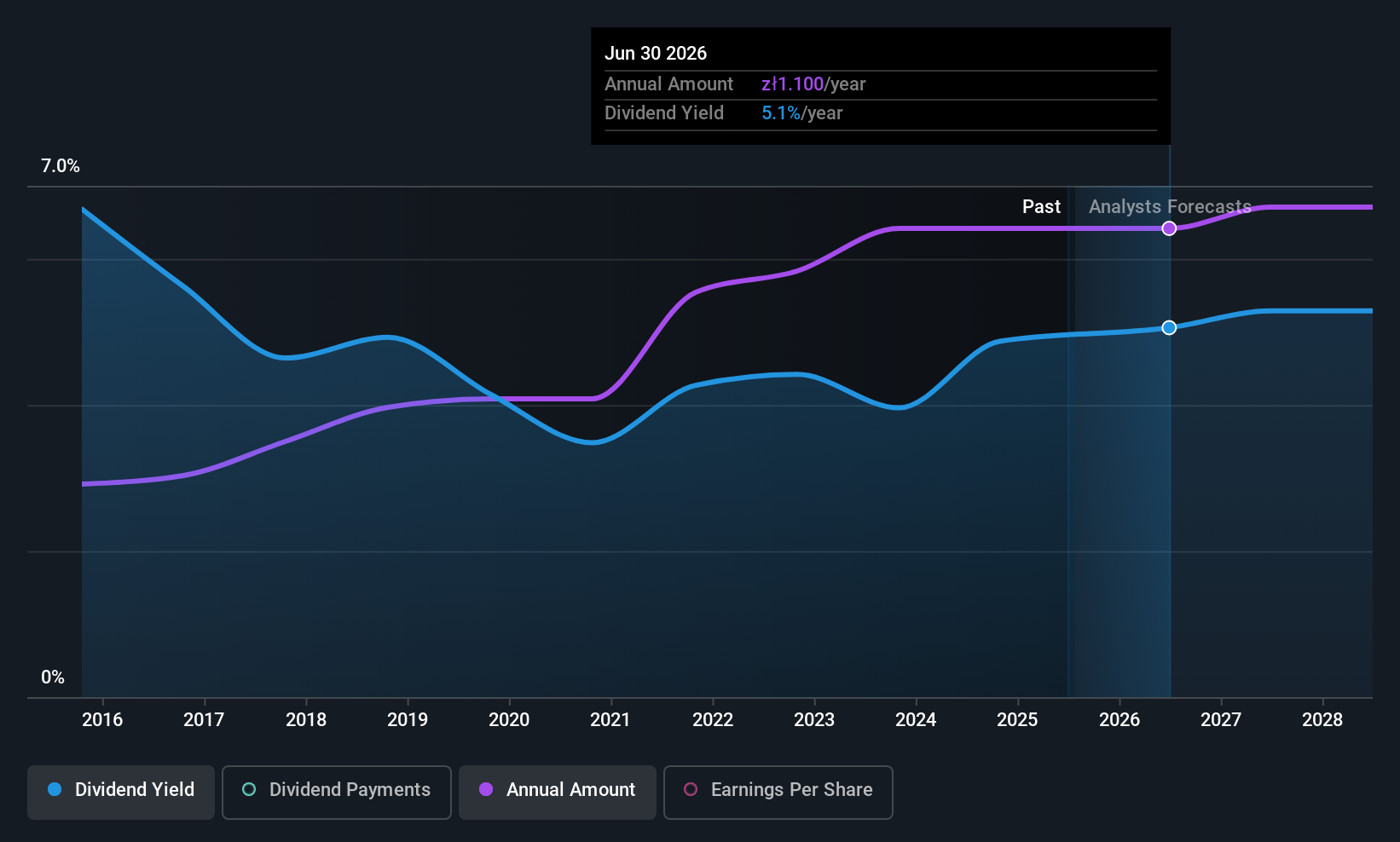

Ambra (WSE:AMB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ambra S.A. is involved in the manufacture, import, and distribution of grape wines across Poland, the Czech Republic, Slovakia, and Romania with a market cap of PLN428.51 million.

Operations: Ambra S.A.'s revenue segments include PLN663.25 million from its core business in Poland, PLN185.20 million from operations in Romania, and PLN80.73 million from activities in the Czech Republic and Slovakia.

Dividend Yield: 6.5%

Ambra S.A. offers a stable dividend profile, supported by a payout ratio of 63.5% and cash payout ratio of 51.1%, indicating dividends are well-covered by earnings and cash flows. Despite trading at 55.5% below estimated fair value, its dividend yield of 6.47% is relatively low compared to top Polish payers but remains reliable with consistent growth over the past decade. Recent earnings showed slight declines in net income but stable sales performance at PLN 194.8 million for Q1 2025.

- Click here and access our complete dividend analysis report to understand the dynamics of Ambra.

- Our comprehensive valuation report raises the possibility that Ambra is priced lower than what may be justified by its financials.

Key Takeaways

- Unlock more gems! Our Top European Dividend Stocks screener has unearthed 188 more companies for you to explore.Click here to unveil our expertly curated list of 191 Top European Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報