3 Asian Growth Companies With Up To 39% Insider Ownership

As Asian markets experience a wave of optimism, particularly driven by technological advancements and economic resilience in regions like Japan and China, investors are increasingly focusing on companies with strong growth potential. In this environment, stocks with high insider ownership can be attractive as they often indicate confidence from those closest to the company’s operations and strategy.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| UTI (KOSDAQ:A179900) | 25% | 120.7% |

| Streamax Technology (SZSE:002970) | 32.5% | 33.1% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 78.8% |

| Novoray (SHSE:688300) | 23.6% | 31.4% |

| Loadstar Capital K.K (TSE:3482) | 31% | 23.6% |

| Laopu Gold (SEHK:6181) | 34.8% | 34.3% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 31.6% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 37.2% |

| Fulin Precision (SZSE:300432) | 10.6% | 55.2% |

| FRONTEO (TSE:2158) | 17.9% | 46.9% |

Underneath we present a selection of stocks filtered out by our screen.

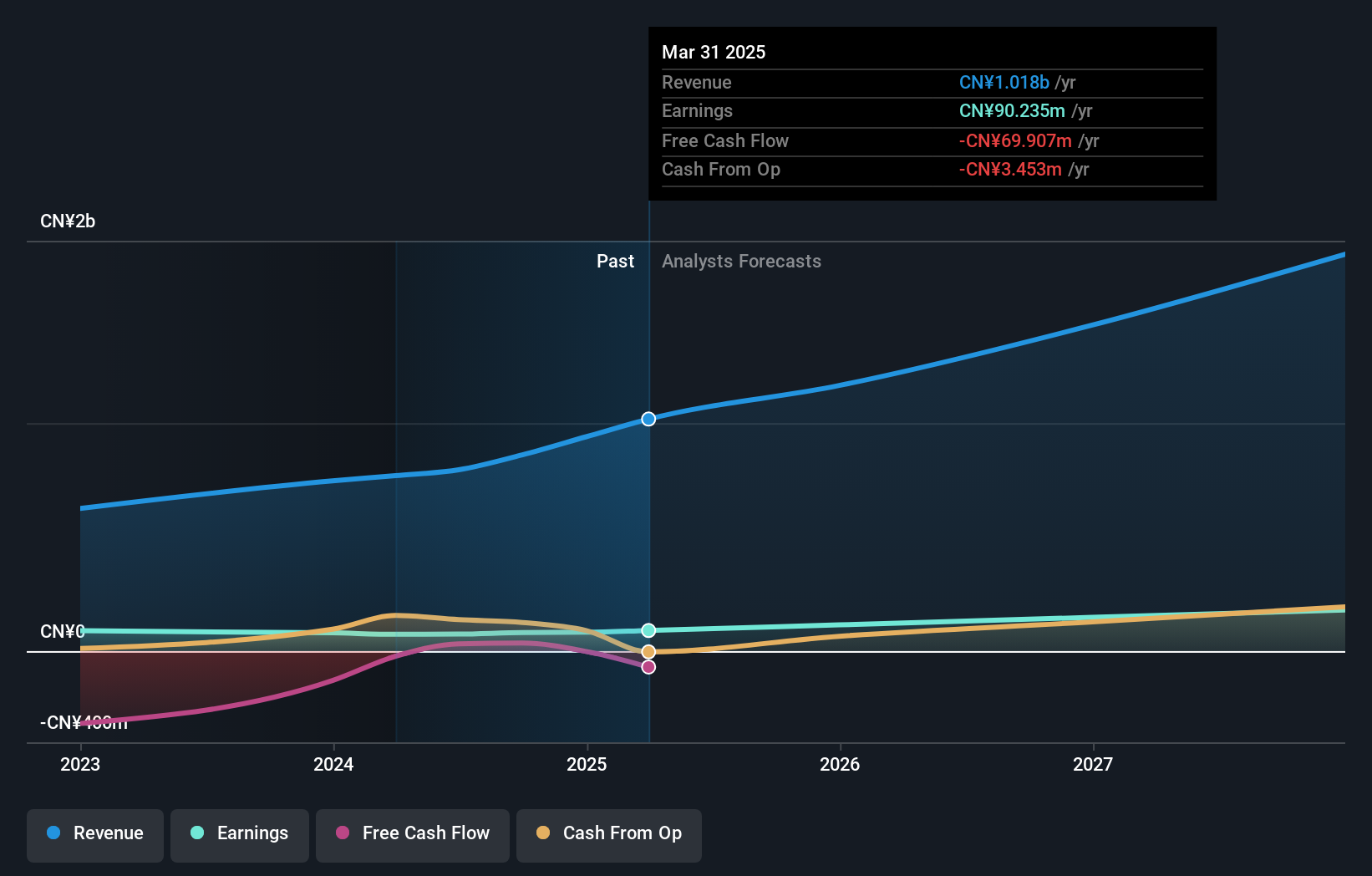

InnoScience (Suzhou) Technology Holding (SEHK:2577)

Simply Wall St Growth Rating: ★★★★★★

Overview: InnoScience (Suzhou) Technology Holding Co., Ltd. operates in the technology sector, focusing on semiconductor solutions, with a market capitalization of approximately HK$71.47 billion.

Operations: The company's revenue primarily comes from the sales of GaN Power Semiconductor Products, totaling CN¥996 million.

Insider Ownership: 12.5%

InnoScience (Suzhou) Technology Holding is positioned for robust growth with significant insider ownership, driven by strategic alliances and technological advancements. Recent collaborations with onsemi and NVIDIA highlight its leadership in GaN technology, expected to generate substantial revenue from sectors like AI and new energy vehicles. Despite a volatile share price, the company's forecasted revenue growth of 40.5% annually surpasses market averages, supported by strong profit projections and a favorable legal outcome enhancing its intellectual property status.

- Click here to discover the nuances of InnoScience (Suzhou) Technology Holding with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that InnoScience (Suzhou) Technology Holding is trading beyond its estimated value.

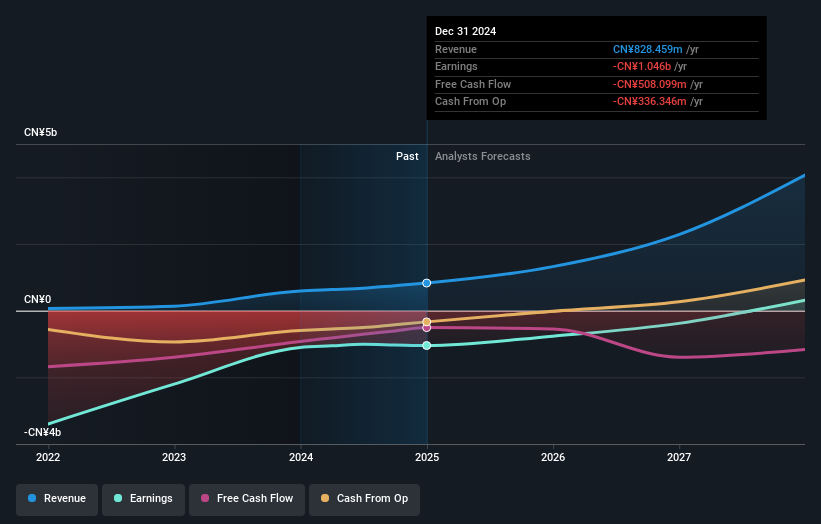

Smartsens Technology (Shanghai) (SHSE:688213)

Simply Wall St Growth Rating: ★★★★★★

Overview: Smartsens Technology (Shanghai) Co., Ltd. operates in the semiconductor industry, focusing on the development and production of CMOS image sensors, with a market cap of CN¥38.48 billion.

Operations: The company's revenue primarily comes from its Semiconductor Integrated Circuit Chips segment, generating CN¥8.08 billion.

Insider Ownership: 23.4%

Smartsens Technology (Shanghai) demonstrates strong growth potential with substantial insider ownership, evidenced by a 132% earnings increase over the past year and forecasted revenue growth of 22.6% annually, surpassing market averages. Despite high non-cash earnings and operating cash flow challenges covering debt, its price-to-earnings ratio of 47x remains attractive compared to industry peers. Recent financials show significant sales and net income increases, reflecting robust operational performance amidst ongoing shareholder meetings.

- Take a closer look at Smartsens Technology (Shanghai)'s potential here in our earnings growth report.

- Our valuation report here indicates Smartsens Technology (Shanghai) may be undervalued.

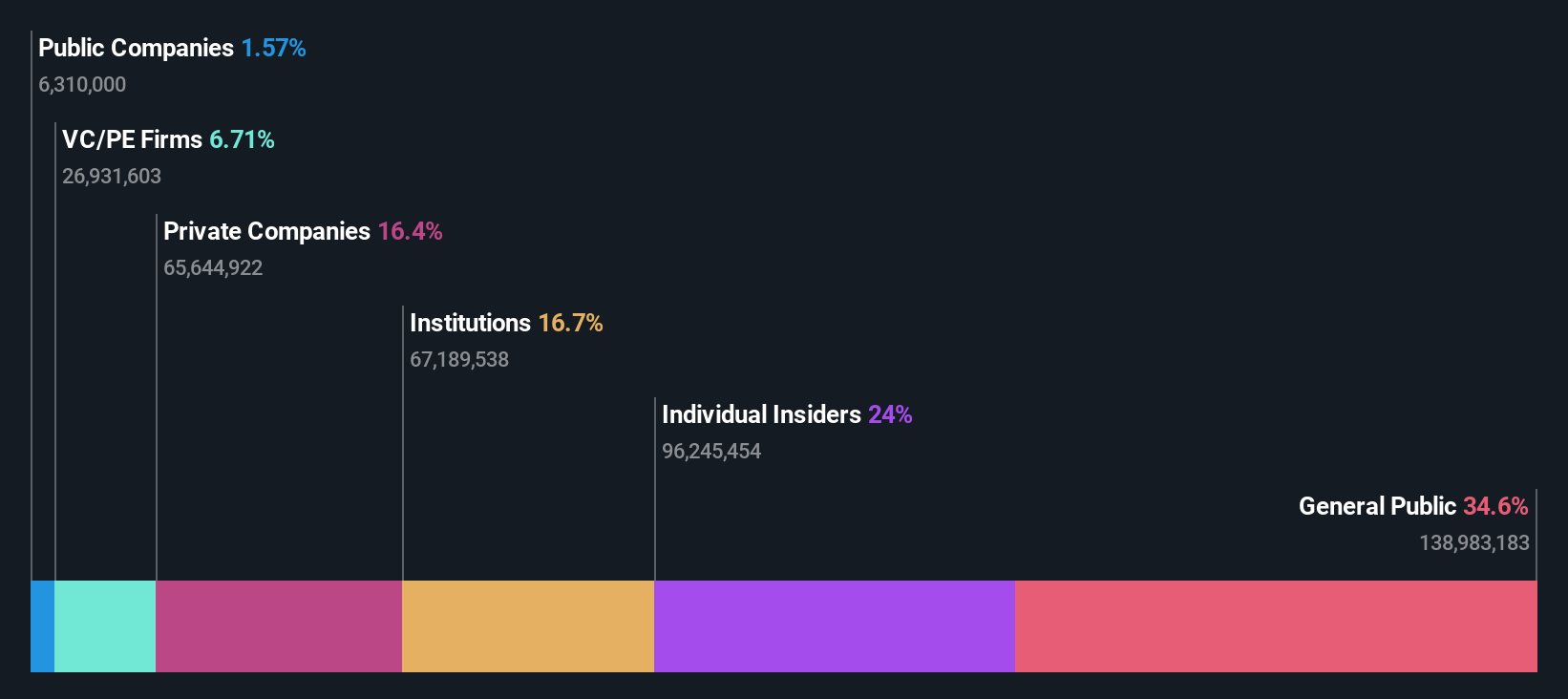

Shenzhen Ampron Technology (SZSE:301413)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Ampron Technology Co., Ltd. focuses on the research, development, manufacture, sale, and service of sensors in China with a market cap of CN¥13.51 billion.

Operations: The company's revenue primarily comes from its Sensitive Components and Sensor Manufacturing segment, which generated CN¥1.14 billion.

Insider Ownership: 39.6%

Shenzhen Ampron Technology showcases promising growth with forecasted annual earnings and revenue increases of 26.54% and 21.5%, respectively, although its Return on Equity is expected to remain low at 10.6%. Recent amendments to corporate governance structures indicate strategic realignments, while sales rose to CNY 862.1 million for the first nine months of 2025, up from CNY 661.79 million in the prior year, despite a volatile share price environment recently.

- Dive into the specifics of Shenzhen Ampron Technology here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Shenzhen Ampron Technology shares in the market.

Key Takeaways

- Investigate our full lineup of 628 Fast Growing Asian Companies With High Insider Ownership right here.

- Searching for a Fresh Perspective? AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq 華爾街日報

華爾街日報